If you’ve been anywhere near financial media lately, you’ve heard the phrase “K-shaped economy.” It’s the idea that the economic experience is splitting into two diverging paths—those doing quite well (the upper arm of the K) and those struggling under persistent price pressures and higher borrowing costs (the lower arm).

There’s truth to that narrative. But like most stories that travel fast, there’s also a vibe component—sentiment, headlines, and the emotional residue of the last few years. And then there are the facts: actual earnings, wage data, and commentary from CEOs who see real-time consumer behavior at scale.

Let’s explore the gap between the vibes and the facts, because that gap is now driving markets more than people realize.

The Vibes: A Consumer Who Feels Terrible

If you only looked at sentiment, you’d think we were in the middle of an economic crisis.

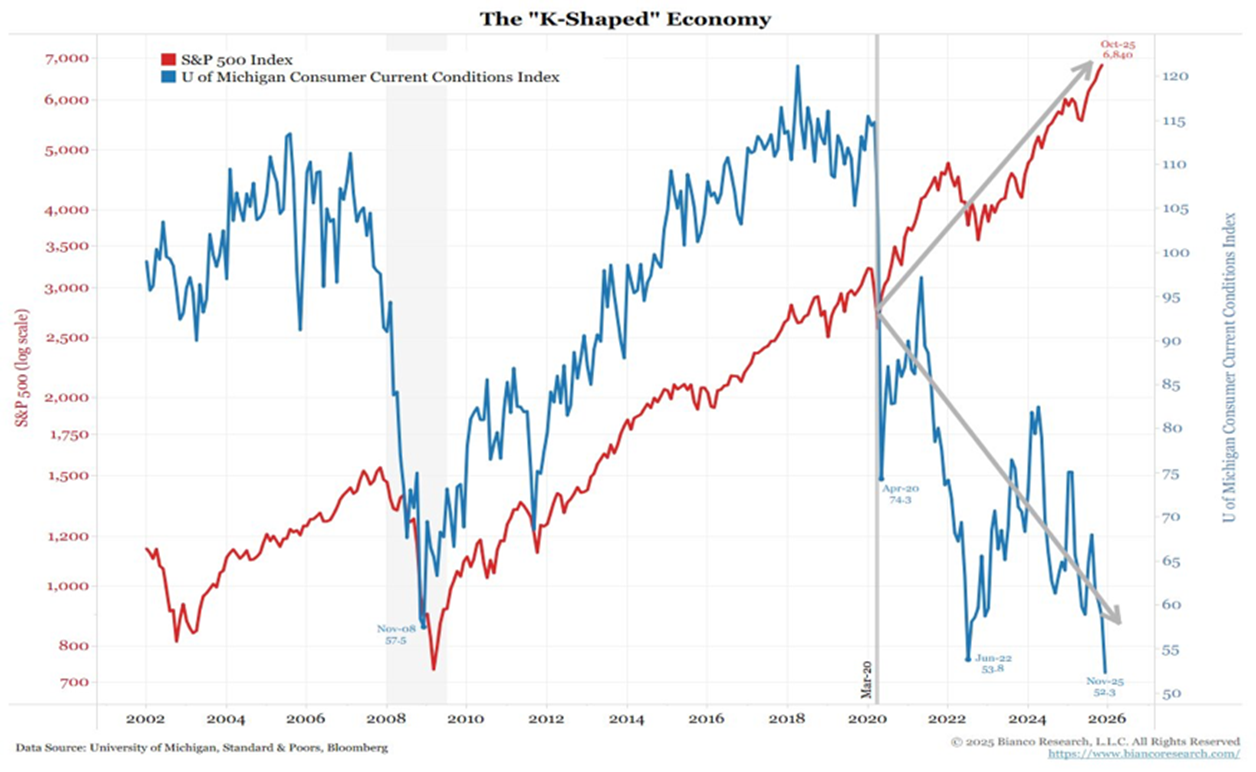

This chart says it all:

- Markets (S&P 500) have surged to new highs.

- Consumer sentiment has slid toward multi-decade lows.

We haven’t seen this level of gloom since the depths of the Great Financial Crisis—even though today’s economic reality looks nothing like 2008.

The Facts: A Consumer Who Is Still Spending—Just More Selectively

But sentiment is not spending. When you step away from the vibes and look at earnings, wages, and CEO commentary, a very different picture emerges.

Below are comments straight from Q3 earnings calls:

Brian Cornell, CEO of Target:

“The consumer is choosing carefully, but they are still choosing. We’re seeing strength in essentials and in categories where value is clear.”

Brian Moynihan, CEO of Bank of America:

“Our customers continue to spend at a healthy pace. Slower than last year, yes, but still growing. We are not seeing signs of broad consumer stress.”

Doug McMillon, CEO of Walmart:

“The lower-income customer is pressured, but the overall consumer is in better shape than sentiment would suggest.”

Jamie Dimon, CEO of JPMorgan:

“Consumer balance sheets remain healthy. Delinquencies are normalizing, not surging.”

These are not the words of executives watching demand fall off a cliff. The consumer has not disappeared—they’ve simply become more discerning.

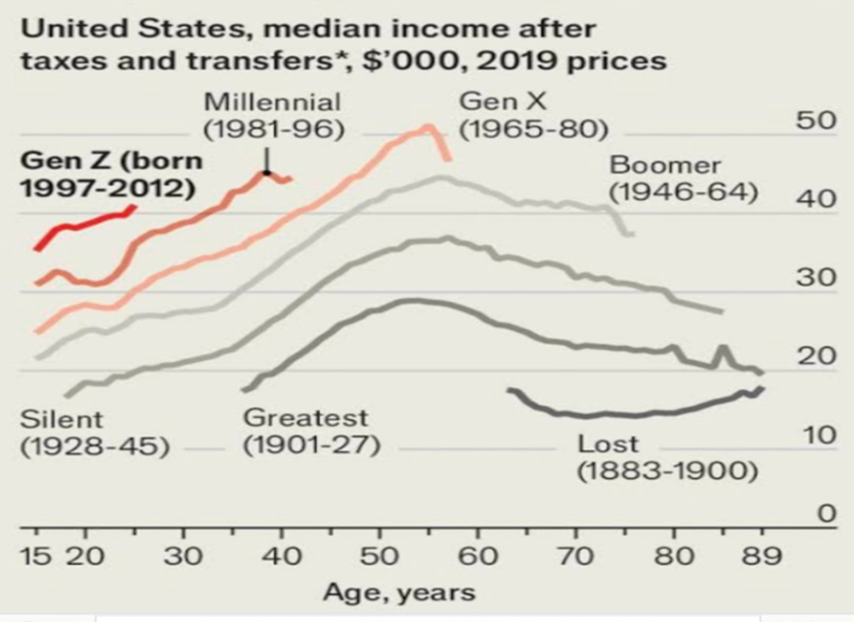

The Wage Side of the K

There is another piece most headlines skip: real wages have been positive for more than a year.

Younger workers—Gen Z and Millennials—continue to see rising median income. And historically, rising real wages translate directly into spending power.

So, we have:

- People earning more

- While feeling worse

A unique feature of the post-pandemic economy.

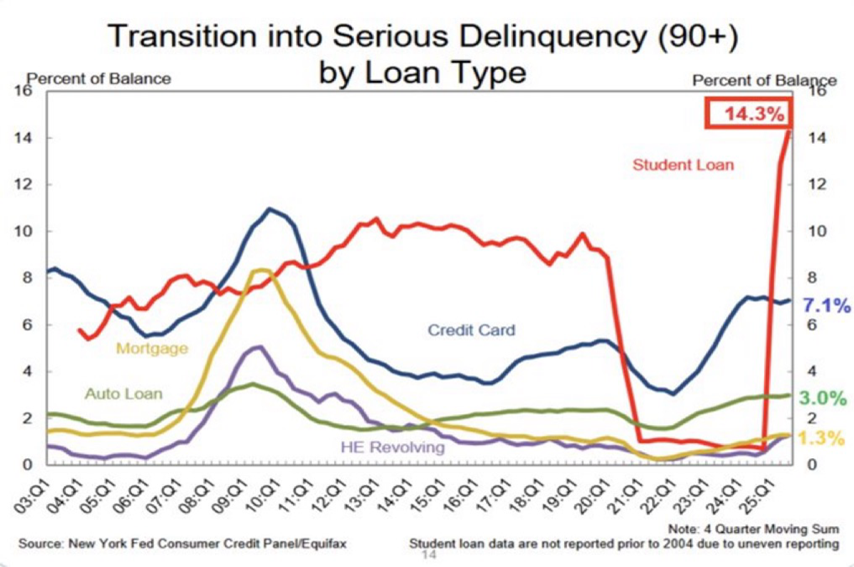

The Debt-Service Side of the K

Now for the other half of the story: there is consumer stress, but it’s concentrated. Some forms of consumer credit are showing modest stress.

- Student loan delinquencies have spiked now that forbearance is over.

- Auto loans are seeing the steepest normalization.

- Credit cards have drifted back toward pre-pandemic norms.

These are important pockets—but they’re not big enough to define the entire consumer landscape. The bottom arm of the K is real, but it’s not the whole story.

Earnings: The Upper Arm of the K Is Built on Fundamentals, Not Vibes

Q3 earnings for the S&P 500 grew over 13% year-over-year, well above expectations. 74% of companies beat earnings estimates, and two-thirds beat on revenue.

Some would characterize this as a boom.

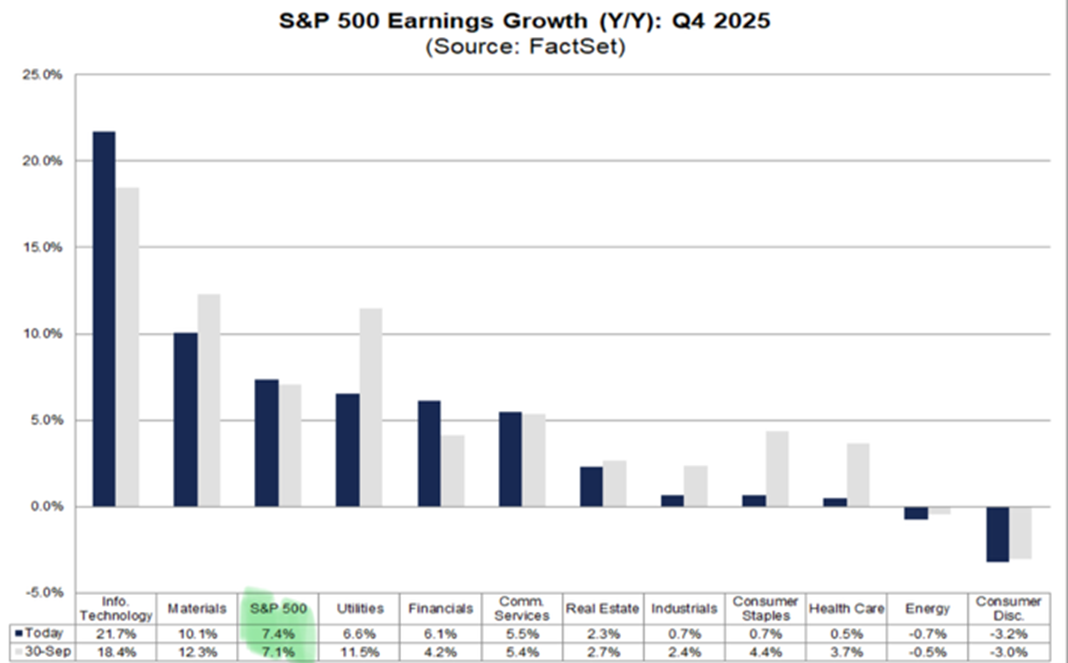

More importantly, Q4 earnings guidance is not flashing red:

- Analysts expect mid-single-digit growth

- Forward earnings revisions have stabilized

- Margins remain resilient

In other words:

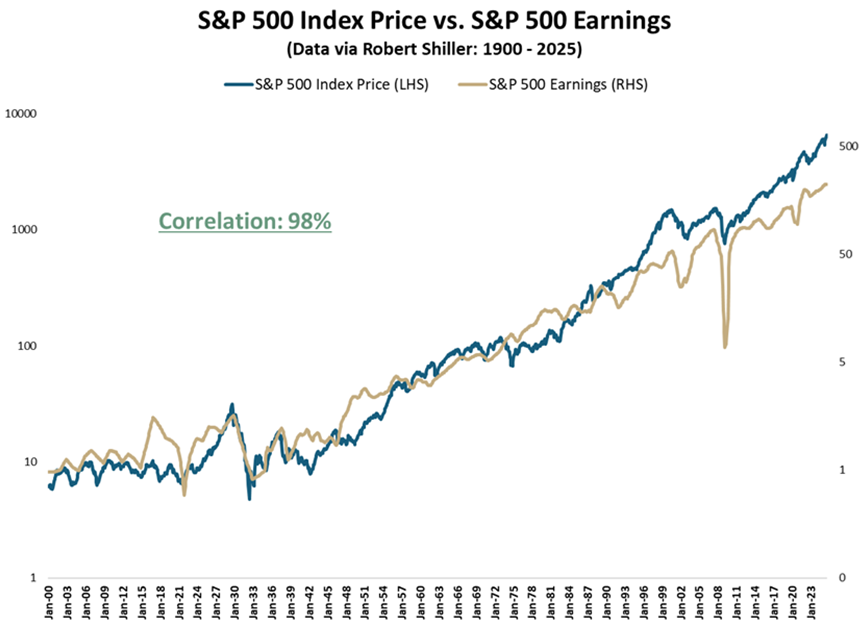

Corporate America is not behaving as if the consumer is collapsing. And that matters because, historically, markets follow earnings, not sentiment.

The 98% long-term correlation between price and earnings is a reminder that fundamentals eventually win. If earnings hold up (and so far, they have), the upper arm of the K—the market—makes sense.

Sentiment may swing wildly week to week, but markets ultimately anchor to cash flows.

Putting It All Together

The modern economy is producing two coexisting truths:

- Some consumers are hurting. Delinquencies are rising. Sentiment is awful.

- Most consumers are still spending. Earnings remain strong. Wages are positive. Corporate commentary is stable.

This isn’t denial. It’s nuance.

We are in a K-shaped economy, yes—but the lower arm is not pulling down the upper arm. Not yet.

And that’s the contrarian point: the vibes are recessionary, but the facts are not. If you only listened to the vibes, you’d assume the consumer has already thrown in the towel. But if you follow the earnings, the wages, and the corporate commentary, you see something different:

- A consumer who is adapting—not collapsing.

- A market that is reacting to real earnings growth—not emotions.

And in a world obsessed with the K-shape, it’s worth remembering that the economy doesn’t move in straight lines. We don’t get to choose the economic narrative, but we can choose which evidence we pay attention to. Beneath the noise, the consumer is adapting, corporate earnings are holding up, and the picture is more balanced than the headlines suggest. That’s enough clarity for now.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.