Wall Street loves a neat narrative: “Inflation is solved, cue the soft landing, cut the rates.” The data is moving in the right direction. But voters don’t live inside a CPI spreadsheet—they live inside monthly payments.

That’s the real tension heading into 2026: headline inflation can cool while the most visible household costs—housing, healthcare, and utilities—still feel like they’re grinding higher. That gap between reported progress and lived reality is where elections get decided.

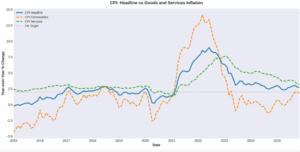

CPI is closer to target, but services still run hotter than goods.

The inflation split screen: goods (orange line) are fine, but services (green line) are still elevated.

- Headline CPI is ~2.7%—down dramatically from the peak and within striking distance of “normal.”

- Goods/commodities inflation is ~1.8%—basically back to target behavior.

- Services inflation is still ~3%+—moderating, but not “done.”

That’s why the public mood can stay frustrated even as the macro crowd celebrates: the stuff people notice most often is still sticky.

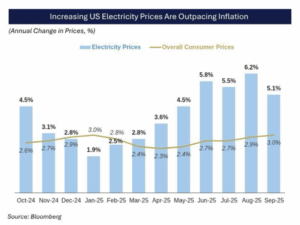

Power is becoming its own inflation lane

If you want one “kitchen table” line item that hits nearly everyone, it’s electricity. It’s not optional. You can economize at the grocery store. You can delay a car purchase. You can’t “unsubscribe” from keeping the lights on.

BLS’s latest CPI detail shows electricity up ~6.9% year-over-year (November 2025).

That matters for two reasons:

It bleeds into everything (housing operating costs, local services, small business overhead).

It’s colliding with a structural demand story: electrification + grid investment + AI-driven data center load growth. Even if your personal usage is flat, the system is getting more expensive to run and expand.

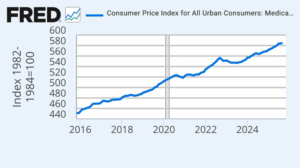

Healthcare: the slow burn that still wins elections

Healthcare inflation doesn’t always spike like energy—but it rarely goes away. In the CPI detail, medical care services are still running hot (~3–4% YoY), and hospital services are higher (~5%+ YoY) in the latest read.

That’s exactly the kind of category that voters interpret as: “I’m paying more and getting less.” It’s also why inflation as a political issue doesn’t disappear just because headline CPI improves. In fact, it is about to get super-hot if the political class can’t come up with a solution and fast.

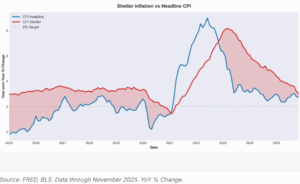

Shelter inflation is improving at around 3.0% and converging toward headline CPI—a big improvement from the 2023 peak.

That’s the good news.

The nuance is the CPI for shelter doesn’t capture today’s real-time market clearing the way people assume it does. National homebuilders have been “cutting prices” without cutting the sticker price through:

- rate buydowns,

- closing-cost credits,

- design-center upgrades,

- lot premiums waived,

- and incentives that function like a price cut.

Those discounts reduce the true cost of shelter for the marginal buyer, but they don’t always show up cleanly or quickly in reported shelter inflation. So, we end up with a familiar mismatch: the market is adjusting in real time, and the inflation gauges confirm it later.

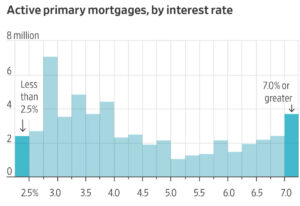

The “rate lock” economy is why housing stays tight even when rates are moving slightly lower. That’s the reason shelter stays complicated; it’s the millions of households that are sitting on ultra-low mortgage rates. That “rate lock” reduces forced selling and keeps resale inventory tight, which props up prices and pushes buyers toward new construction (where incentives are doing the heavy lifting).

Most homeowners aren’t feeling today’s rates—buyers are. That’s why the housing story is uneven and politically combustible.

So, what will voters care about in 2026?

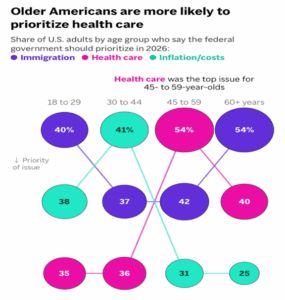

One reason inflation remains politically potent—even as the data improves—is that voters don’t experience inflation evenly. What matters most shifts with age, income, and stage of life.

The chart makes three things clear:

- Younger voters (18–29) lean toward immigration and inflation/costs—rent, food, gas, and day-to-day affordability.

- Middle-aged voters (45–59) overwhelmingly prioritize health care (54%), reflecting peak exposure to insurance premiums, dependent care, and aging parents.

- Older voters (60+) split between health care and immigration, but inflation doesn’t disappear—it just shows up differently, through fixed incomes and rising non-discretionary costs.

What’s striking is that inflation doesn’t need to be the “top issue” to still dominate behavior. It’s embedded inside health care costs, electricity bills, insurance premiums, and housing affordability.

In other words, inflation hasn’t left the conversation—it’s just changed disguises.

The inflation voters feel isn’t the inflation economists celebrate

This is where policy messaging often misses the mark. Headline CPI can cool, but voters anchor to:

- Healthcare premiums and out-of-pocket costs that rarely move down.

- Utility bills, especially electricity, that rise steadily and feel unavoidable.

- Housing costs that remain elevated, even when reported shelter inflation lags what’s happening in the market.

For older voters in particular, health care is inflation. For younger voters, housing is inflation. For nearly everyone, power costs are inflation. The upcoming health premium increase will add another layer of complexity to the uneven way inflation is being felt.

That’s why 2026 won’t hinge on whether CPI prints 2.4% or 2.8%. It will hinge on whether households feel any relief in the categories they can’t opt out of.

Inflation is cooling, but the costs people vote on are not cooling evenly.

And until electricity, health care, and housing feel better—not just measure better—inflation will remain a central political force, even when it no longer dominates the headline.

The 2026 voter check list will look something like this:

- Monthly payment inflation (rent, utilities, insurance, childcare).

- Healthcare costs (premiums, copays, “surprise” bills).

- Housing affordability (rates + prices + “why does everything still cost so much?”).

- Trust gap: “Are we being told inflation is fixed while our bills say otherwise?”

That’s the political overlay: headline inflation can improve, but if electricity and medical costs are still climbing, voters don’t feel the win.

Postscript (for investors):

The same categories that keep inflation politically alive also define where pricing power and cash-flow durability still exist as headline inflation cools.

- Power, utilities, and grid infrastructure: Structural demand growth—electrification, grid hardening, and AI-driven load—combined with regulated cost-recovery frameworks means returns are driven by capital recovery and rate base expansion, not discretionary demand.

- Health care services and managed care: Aging demographics and voter prioritization support durable utilization, while pricing opacity and reimbursement complexity allow margins to hold even as policymakers declare inflation “solved.”

- Housing supply and adjacencies (not speculation): Rate lock keeps existing inventory constrained, pushing demand toward new construction, rentals, and housing services that adjust through incentives and fees rather than outright price declines.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.