I was prepared this week to introduce my Q1 2026 Look Ahead—a forward-looking framework grounded in probabilities, earnings durability, and the idea that markets rarely move in straight lines. Then, as often happens, the world reminded us that calendars do not govern capital.

Geopolitical developments often arrive wrapped in strong language and stronger reactions. For investors, the challenge is not avoiding those conversations but reframing them. Markets do not vote, opine, or moralize. They respond to capital flows, incentives, and time horizons.

This piece looks at recent developments through that lens alone, focusing on what history suggests markets tend to price when energy, infrastructure, and nation-building enter the discussion. My intention is to avoid endorsing policy and instead focus on the underlying investment themes.

The geopolitical backdrop shifted—or at least appeared to. Venezuela, energy, great-power influence, and nation-building moved from academic discussion to active market conversation almost overnight. For investors, moments like this create a familiar tension: do we pause the framework and react, or do we test the framework against new information?

In my long experience, the latter tends to be more productive.

Oil in the Ground Is Not Oil in the Market

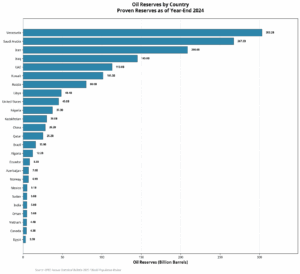

Venezuela sits atop the largest proven oil reserves in the world. On paper, that fact alone fuels dramatic conclusions—trillions in value, instant supply relief, inflation solved.

Markets, however, do not trade paper. They trade barrels delivered, not barrels counted. Venezuelan crude is overwhelmingly heavy oil—expensive to extract, costly to transport, and dependent on specialized refining capacity that has been underinvested in for decades.

This is not U.S. shale. It is not Saudi light sweet crude. It is oil that requires capital, time, and institutional stability before it can meaningfully enter global supply chains.

Reserves vs. Exports: Where Value Is Actually Created

Here’s what is quietly missed in the headlines: Venezuela dominates reserves but barely registers on exports. The United States, with a fraction of the reserves, exports far more crude by dollar value.

Markets reward infrastructure, logistics, and execution—not geology. However, think about one thing: what if the U.S. controlled the Venezuelan reserves and combined that control with our reserves?

That is over 350 billion barrels of reserves, and it would not take much for the U.S. in exports to surpass Saudi Arabia as the global kingpin of oil.

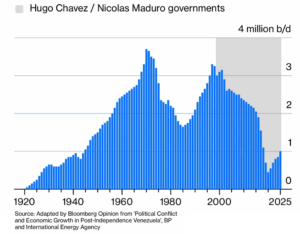

Collapse Is Fast. Rebuilding Is Slow.

Before we get ahead of ourselves, the long arc of Venezuelan oil production is a lesson markets already understand. Systems decay gradually, then fail quickly. Recovery is asymmetrical. It takes longer. The collapse was decades in the making.

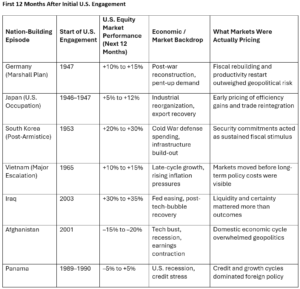

Nation-Building and Markets: What History Suggests

Geopolitical events invite confident predictions. History shows markets tend to respond less to the event itself and more to how uncertainty translates into capital spending, liquidity, and incentives.

Energy Policy, Energy Prices, and an Underappreciated Market Result

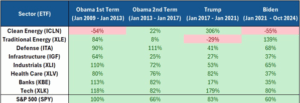

It should not be forgotten that the Trump administration has always been an excess oil supply regime. “Drill Baby Drill” has its consequences, and certainly it is going to make capital allocation to Venezuelan oil infrastructure difficult at current oil spot prices and equity performance.

There might not be enough profit in “oil companies investing billions.”

Markets don’t always reward supply expansion.

China Is Also at Play

China’s engagement across Latin America has been slow, patient, and infrastructure-focused. Control over Venezuelan oil is not just about energy. It is about who sets the rebuild timetable. It is no coincidence that China was in Venezuela one day before the U.S. rendition of Maduro.

What This Means for Investors

Markets rarely wait for certainty. They wait for direction.

The Venezuela conversation—stripped of politics—signals that physical investment, infrastructure, and system repair remain powerful economic forces.

This is exactly why our Q1 2026 Look Ahead emphasizes process over prediction. The goal isn’t to forecast every geopolitical development correctly. It’s to stay anchored to earnings durability, productivity, valuation, and disciplined capital allocation when narratives shift quickly.

In the short run, markets will try to discount the headlines, and in the long run, infrastructure, capital spending, and supply capacity will win out. That calendar is a long way from being defined.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.