There are moments in economic cycles when the headlines miss the real story. This is one of them.

Much of today’s debate centers on slowing job growth, softer wage momentum, and whether the economy is finally losing altitude. Those concerns aren’t wrong—but they are incomplete. Beneath the surface, productivity is accelerating, and that matters more than most investors appreciate.

This is shaping up to be a cycle in which the economy grows faster than payrolls, corporate profits expand faster than wages, and output rises without reigniting inflation. That mix is unusual—and powerful.

Job Growth Is Slowing—But for the Right Reasons

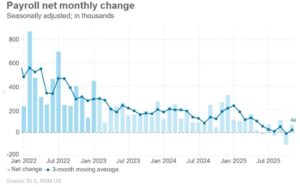

Hiring has clearly cooled. Monthly payroll gains have decelerated meaningfully from the post-pandemic surge, drifting toward levels that historically would raise recession concerns.

But context matters. This slowdown isn’t being driven by collapsing demand or financial stress. It’s being driven by efficiency. Firms are producing more without adding incremental workers. That’s a very different signal than cyclical weakness.

2025 Job Growth Is Historically Soft—Outside Recessions

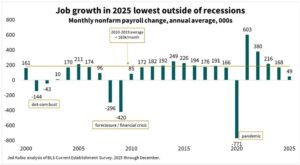

On an annual basis, job growth in 2025 ranks among the weakest non-recessionary years in decades. That statistic is striking—but it doesn’t stand alone.

In past cycles, weak job growth typically reflected falling output. This time, output is holding up—and even accelerating. That tells us productivity is doing the heavy lifting.

Growth Is Re-Accelerating Even as Hiring Cools

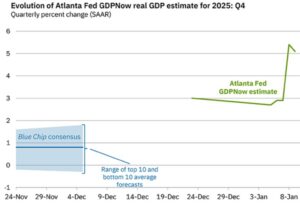

Despite slower payroll growth, real GDP expectations have moved higher. The Atlanta Fed’s GDPNow estimate for Q4 has climbed well above consensus, pointing to an economy that is gaining momentum—not losing it.

When growth rises without a commensurate increase in labor input, productivity must fill the gap. And it is.

Productivity Gains Are Translating into Lower Labor Costs

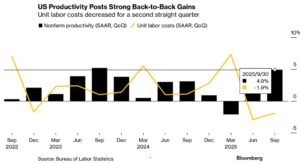

Nonfarm productivity has posted strong back-to-back gains, while unit labor costs have declined for consecutive quarters. That combination is rare—and historically favorable for corporate profit margins.

Higher productivity means lower cost per unit of output, less wage pressure relative to revenue, and greater operating leverage as growth scales.

Earnings Are Already Reflecting the Shift

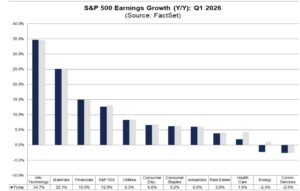

FactSet data for Q1 2026 shows double-digit earnings growth for the S&P 500, led by technology, materials, and financials—sectors most exposed to automation, scale, and productivity gains.

Even as job growth cools, corporate profitability remains resilient. This is exactly what a productivity-led expansion looks like.

This Pattern Has Precedent—But the Pace Is Faster

Every major productivity wave—PCs, the internet, mobile, cloud—followed a similar arc: temporary labor dislocation, durable gains in output per worker, and rising profitability.

The difference today is speed. AI, automation, and software-driven efficiencies are spreading across industries far faster than prior technological shifts.

The Trade-Off: Profits Over Payrolls

A productivity-driven expansion supports growth and profits, but it can suppress headline job gains and moderate wage growth. That tension helps explain why sentiment surveys feel weaker than GDP and earnings data suggest.

People experience the economy through jobs and wages. Markets experience it through cash flows and margins.

Bottom Line

The economy isn’t stalling—it’s evolving.

Productivity is quietly replacing hiring as the primary engine of growth. That shift may feel disorienting in the labor data, but historically it’s been associated with durable expansions and strong corporate profitability.

The real risk for investors isn’t slower job growth. It’s missing what’s taking its place.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.