It’s understandable if this week feels unsettling as an investor. Headlines are loud, geopolitical risks feel elevated, and policy uncertainty can create the sense that markets are balancing on a knife’s edge. That anxiety is real — and it deserves to be acknowledged.

Headlines will swirl around geopolitics: renewed tension over Greenland, tariff rhetoric aimed at the European Union, and a Supreme Court ruling that adds yet another layer of uncertainty to trade policy.

While geopolitical developments grab attention, corporate earnings quietly do the real work of compounding capital. And the earnings picture heading into this week looks constructive.

A Broad Earnings Cross-Section, Not Just a Tech Story

This week’s earnings slate offers a wide-angle view of the U.S. economy rather than a narrow, tech‑only snapshot.

Consumer and household bellwethers like Procter & Gamble and Abbott give insight into pricing power, input costs, and real consumer behavior.

Industrials and logistics leaders such as Fastenal and Prologis sit close to the pulse of construction, manufacturing, and global trade.

Financials — including Charles Schwab, Capital One, and a range of regional banks — help frame credit quality, deposit trends, and the true cost of capital.

Technology and connectivity platforms like Netflix, Intel, and Ericsson speak to monetization discipline and enterprise spending rather than abstract growth.

This is not an earnings week dominated by one sector or one narrative. It’s a cross‑section of how businesses are adapting to slower growth, normalizing inflation, and a more selective capital environment.

The Long Arc: Earnings Still Belong to Technology — But Not Only Technology

Over the long run, technology earnings have dramatically outpaced those of the broader global market. That structural advantage remains intact. What has changed is the character of that growth.

Today’s technology earnings are increasingly tied to productivity gains, cost efficiency, and embedded infrastructure rather than speculative future promises. Artificial intelligence, automation, logistics software, and data infrastructure are no longer optional — they are showing up directly in margins and cash flows across multiple industries. What’s not priced in is the actual human improvements by tech. It’s simple: your $1,000 iPhone can do what a 30-million-dollar computer could do in the 1980s. That is nowhere in the numbers (GDP, productivity, or inflation).

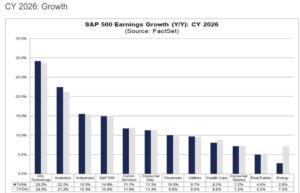

2026 Earnings Expectations: Strong, But More Evenly Distributed

Looking ahead to calendar year 2026, earnings growth expectations remain solid — and notably more balanced.

According to FactSet, Information Technology still leads, but Industrials, Materials, Financials, and select consumer segments are expected to contribute meaningfully. This matters because broader earnings participation reduces market fragility and supports resilience even when macro or political uncertainty rises.

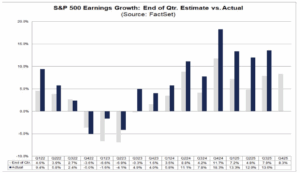

Analysts Are Still Underestimating Earnings

A persistent theme over recent years has been analysts starting cautious — and companies quietly outperforming. Time and again analyst estimates miss the actual mark.

Operational discipline, pricing power, and productivity improvements continue to surprise to the upside. The Wall Street analyst class continues to disappoint and underachieve. Let’s keep betting on great companies to drive growth.

Prices Follow Earnings — Not Headlines

Here’s my final rebuttal to this week’s noise. Over time, stock prices track earnings. Not perfectly. Not in straight lines. But reliably. Geopolitical events, tariff rhetoric, and court rulings create volatility — sometimes sharp, sometimes uncomfortable — but the gravitational force remains forward earnings. (Again, from FactSet)

This week will be noisy. The geopolitical volume will be turned up. Markets may react in the short term. But beneath the headlines, companies will report what ultimately matters: what they sold, what it cost, and what they earned.

For long‑term investors, the discipline remains unchanged: focus less on the noise you can’t control and more on the earnings power you own.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

FactSet

Earnings Whispers

Goldman Sachs Global Investment Research

Datastream/Worldscope

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.