I should never doubt the US Consumer. If you believed the recent Consumer Confidence Survey, the US Consumer should have been holding onto their pocketbooks this shopping season. Consumer Confidence is incredibly low according to the survey by the University of Michigan. Looking back over a 50-year period, the survey suggested the consumer was pretty downbeat. 1

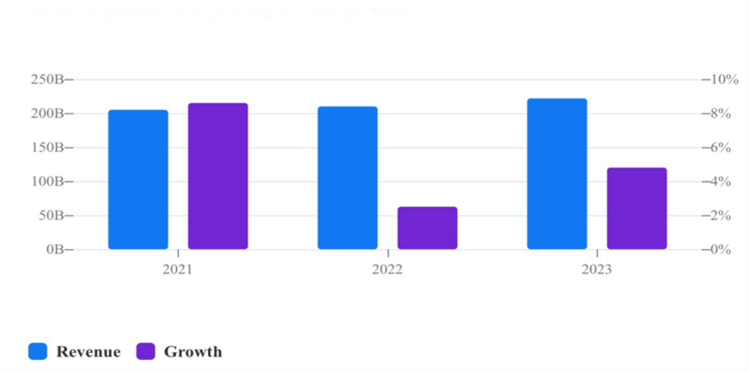

According to Adobe (which has tremendous consumer data), expectations for the US Consumer this holiday season are to spend about 4.8% more than 2022 across the three-day shopping experience.2

According to Deloitte (a leading consultant to major retailers), expectations were much stronger from the merchant standpoint. They expected consumers to spend about 14% more than last year overall.3

The verdict is in, at least for the weekend. The consumer spent solidly at about 5% more online than last year, again from Adobe. 4

Apparently, the consumer is still price/inflation sensitive. Discounting is likely a key motivator for the strong consumer spending this year. 5

It’s clear there is no recession coming in this last quarter of 2023. With the recent Fed’s GDP NowCast at about 2% GDP growth before the strong retail shopping season; an immediate recession is out of the cards. 6

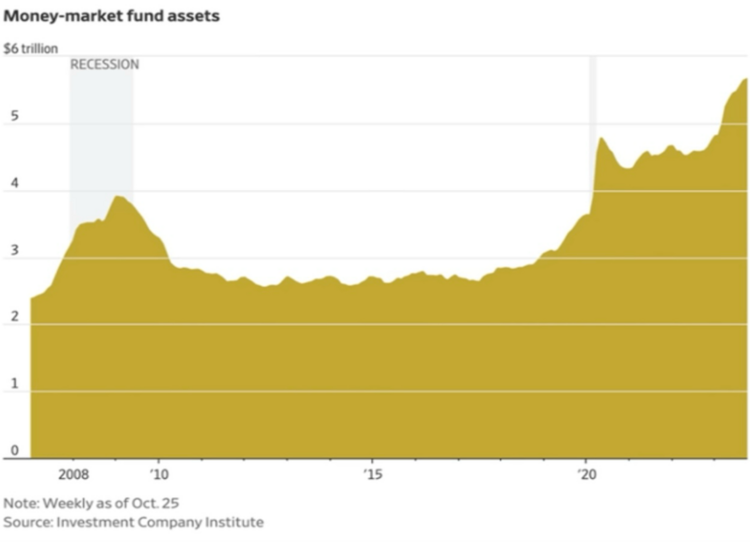

It’s not likely in the cards during Q1 2024 either. The consumer is still sitting on ample levels of cash; even though we’ve spent down $1.42 trillion in post-pandemic savings. There is still over $400 billion to go in stockpiled savings. Considering the inflationary impact on wages, personal consumption remains close to trend. 7

Let’s take this cash thought one step further. Money market accounts are sitting at record levels and those funds will likely be redeployed back into risk assets when rates get cut.8

When we say markets move in brief bursts, this is one of the catalysts. The power of the US consumer should not be discounted. Our desire to consume is only backed by our access to resources like cash and credit. We have piles of both.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://fred.stlouisfed.org/series/UMCSENT

- https://retail-today.com/adobe-forecasts-221-8-billion-u-s-holiday-season-online-cyber-monday-to-top-12-billion/

- https://www2.deloitte.com/content/dam/insights/articles/us176694_cic_holiday-retail-survey/DI_2023-Deloitte-holiday-retail-survey.pdf

- https://business.adobe.com/resources/holiday-shopping-report.html

- https://business.adobe.com/resources/holiday-shopping-report.html

- https://www.atlantafed.org/cqer/research/gdpnow#:~:text=Latest%20estimate%3A%202.1%20percent%20%2D%2D,2.0%20percent%20on%20November%2017.

- https://am.pictet/en/us/institutional

- https://www.ici.org/