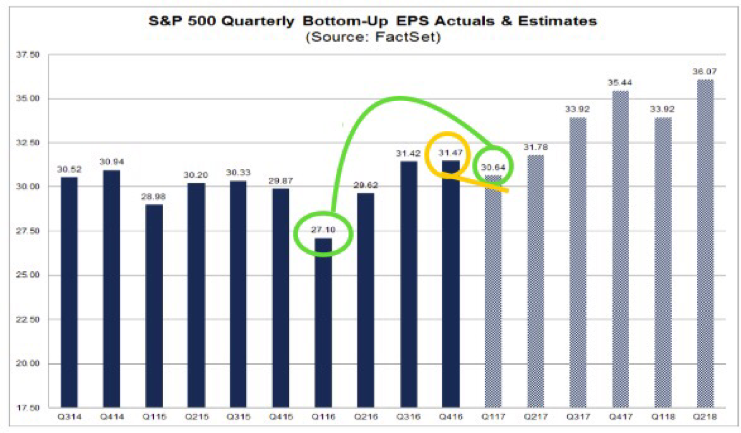

While the ebbs and flows of the news cycle might have investors on edge for an impending crash, those watching corporate earnings might have a different view. Corporate earnings results for the final quarter of 2023 signaled continued corporate strength. Earnings growth was over 4%, compared with expectations for a 1.5% rise on December 31st. 1

Earnings growth expectations for full-year 2024 are around 11%, with Technology and Communications leading the way. 1

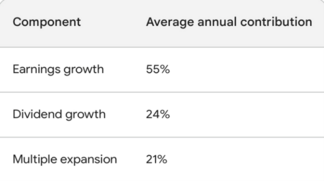

Always remember, earnings matter in the long run. In fact, earnings growth makes up the vast majority of what drives stock prices higher.

While the ability of companies to sustain profit margins despite slowing inflation is one factor in continued corporate earnings growth, macroeconomic demand drivers borne out in recent data releases should also drive a great earnings season in Q1 and perhaps the rest of the year.

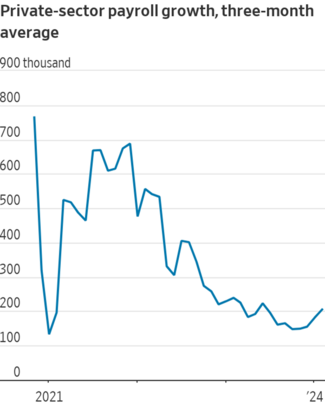

First, the U.S. jobs market in February showed strong job creation of 275,000. This result was above expectations. This is a great number, and the prior period revisions held the 3-month rolling average to around 200k. Just enough to absorb new workers coming into the labor force. This is great news for the economy and consumers. It’s also great news for moderating inflation. 2

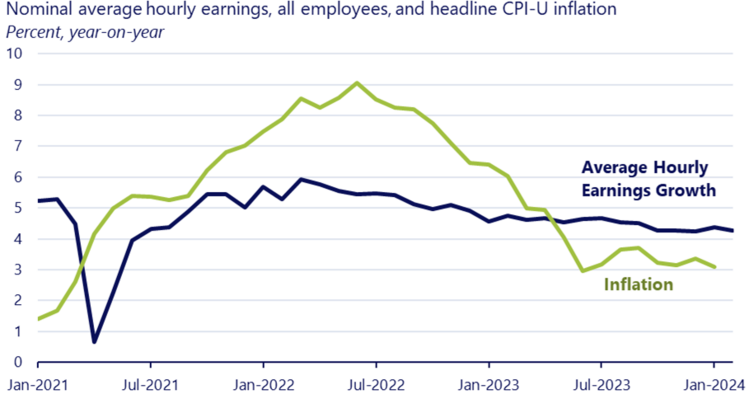

Second, nominal wage growth came in at 4.3% in February. That was below the prior period’s growth of 4.5%. Wage growth continues to outstrip inflation, but is moderating, giving a win to U.S. consumer’s purchasing power while also placating the Federal Reserve’s ongoing fight against inflation. 3

In fact, the Federal Reserve Chair said as much by suggesting interest rate cuts will be made this year. 4

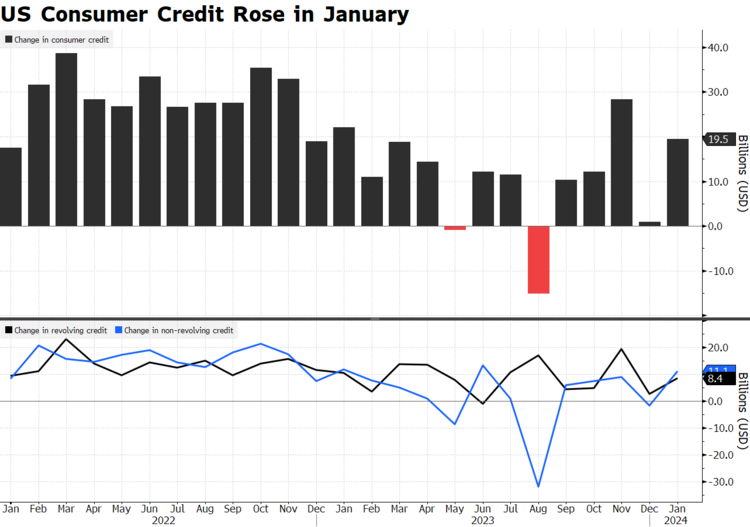

But is the consumer spending? If the recent report on consumer credit is any guide, the answer is yes. The stock of consumer credit outstanding expanded $19.5 billion in January, nearly doubling consensus expectations for a $10 billion addition, with the gain driven by growth in both nonrevolving and revolving credit. 5

With the acceleration in consumer credit mirroring the surprisingly strong labor market and recent real wage gains for the U.S. consumer, Q1 2024 earnings just may surprise to the upside.

As we like to reiterate; earnings matter.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://insight.factset.com/lowest-number-of-sp-500-companies-citing-recession-on-earnings-calls-since-q4-2021

- https://twitter.com/NickTimiraos/status/1766095359594361274

- https://x.com/WhiteHouseCEA/status/1766101590111354983?s=20

- https://www.wsj.com/economy/central-banking/powell-says-fed-on-track-to-cut-rates-this-year-52e5feb3

- https://www.federalreserve.gov/releases/g19/current/