A Short Primer: What GDP Really Measures

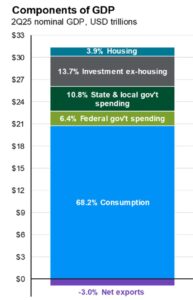

Gross Domestic Product (GDP) is simply the sum of everything the economy produces, but how that growth is generated matters far more than the headline number. Roughly two-thirds of U.S. GDP comes from consumption, with the remainder split among investment, government spending, and net exports.

That composition is why I obsess over the consumer. When household spending holds up, the economy tends to expand rather than break, and earnings and stock valuations tend to follow. When it cracks, recessions usually follow. This context matters as we evaluate recent growth—and where it may lead next.

Q3 2025: Growth That Actually Counts

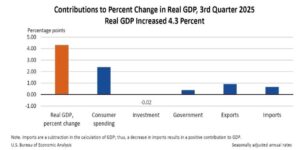

Q3 delivered a 4.3% annualized real GDP growth rate, but the headline alone understates the quality of the expansion. This wasn’t inventory noise or a temporary trade distortion; it was real demand, led decisively by the consumer.

Consumer spending accounted for more than half of total growth, while government, exports, and imports rounded out the picture. Investment had a modest negative contribution, and residential investment remained soft—hardly surprising in a higher-rate world—but neither derailed the broader expansion.

In short, this was growth you can believe in.

The consumer has adjusted, and households continue to spend—just differently. Wage growth has slowed but still outpaces inflation. Job creation has cooled without collapsing. Savings are lower, but not exhausted.

What we’re seeing is adaptive behavior, not retreat. Consumers are prioritizing essentials and experiences over discretionary goods, which helps explain why services inflation remains stickier than goods inflation.

This adaptability is the defining feature of this cycle. The consumer hasn’t disappeared—they’ve recalibrated. Here’s how:

The Healthcare Economy: A Structural Stabilizer

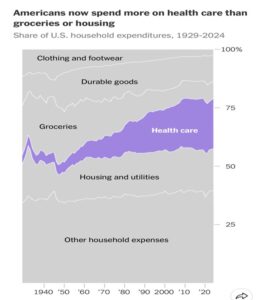

One of the most important—and least discussed—shifts in the U.S. economy is the rise of healthcare as a core growth engine.

Healthcare now represents over 11% of U.S. GDP and has surpassed both housing and groceries as the largest category of household spending. This is not cyclical; it’s structural.

Three forces drive this:

- Demographics: An aging population consumes more care, regardless of economic conditions.

- Labor intensity: Healthcare is service-heavy and wage-driven, making spending stickier on the downside.

- Policy insulation: Insurance coverage, Medicare, and Medicaid act as built-in stabilizers. The current healthcare premium debacle involving the political class will need to be resolved soon.

From a macro standpoint, healthcare has quietly become one of the economy’s most reliable shock absorbers. It doesn’t surge like tech investment, but it doesn’t collapse when confidence fades, either.

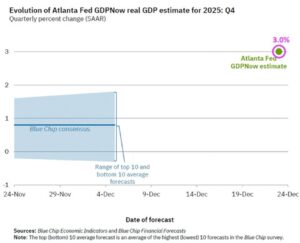

Q4 2025: Growth Is Beating Expectations

As we wrap up Q4, growth expectations have steadily improved. The Atlanta Fed’s GDPNow estimate has climbed toward 3%, well above earlier consensus forecasts that hovered closer to stall speed.

This matters because it reflects real-time economic data, not backward-looking optimism. Consumption remains firm, government spending continues to contribute, and trade has been less of a drag than feared.

2026: The Fiscal Bridge

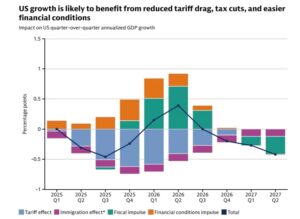

As we look toward 2026, the baton begins to pass from monetary restraint to fiscal support.

Infrastructure spending, industrial policy, defense outlays, and healthcare funding (pending a solution to premium support) all carry long implementation lags. Those lags are now turning into measurable economic contributions, particularly in early 2026.

Importantly, this isn’t a return to pandemic-era stimulus. It’s more targeted, slower-burning, and far less inflationary—but it still provides a floor under growth as private investment adjusts to higher long-term rates.

The Market’s View: Wall Street Still Believes

Wall Street forecasts deserve skepticism—but they’re still instructive. Major banks project continued equity market upside through 2026 and 2027, even after accounting for tariffs, rate normalization, and slower nominal growth.

Wall Street’s 2026 S&P 500 forecasts imply returns ranging from roughly +5% to +18%, suggesting expectations of continued—but more measured—upside rather than a speculative surge.

Markets are signaling that earnings growth, consumer resilience, and fiscal support are likely to matter more than macro-anxiety headlines.

Yes—the consumer remains the economic backbone, adjusting rather than retreating as growth normalizes. At present, there appears to be no break in consumer behavior.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.