The S&P 500 touched another record high last week, marking the 45th time it has set a record this year. Last week’s blog covered the topic of extreme pessimism. Really smart people can be seduced into pessimistic thinking even when the only logical reaction should be long-term optimism. But investing is frequently counterintuitive. 1

I’m sure investors are asking themselves: When will this bull run end? It’s a natural question with an unknowable answer. Bull markets can last a long time. Investor enthusiasm can outstrip pessimism for much longer than one would think. We are now at a 7x return on the S&P 500 since the Great Financial Crisis but certainly well below the 17x run from 1978-2000. And that run included the worst one-day percentage drop in history – October 19, 1987 (Black Monday). 2

As investors, we should always be mindful of the simple fact that drawdowns are a common part of the cycle. In fact, markets spend around 90% of the time below all-time highs. 3

It is an interesting dichotomy: on one side, we aim to compound wealth, and on the other, we must live with the constant nagging threat of a drawdown.

How do we manage this threat? It takes courage and an ability to constantly look forward. In our current circumstance, we are entering the Q3 earnings reporting season. This week we will see some major companies announce their last quarter results (Johnson & Johnson, Goldman Sachs, and Netflix to name a few). 4

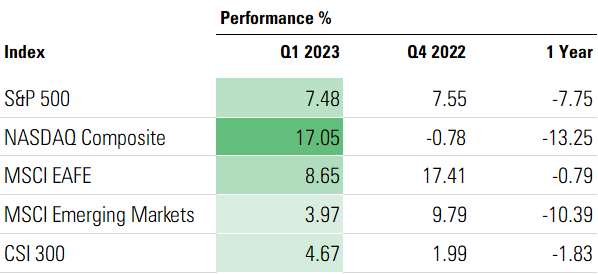

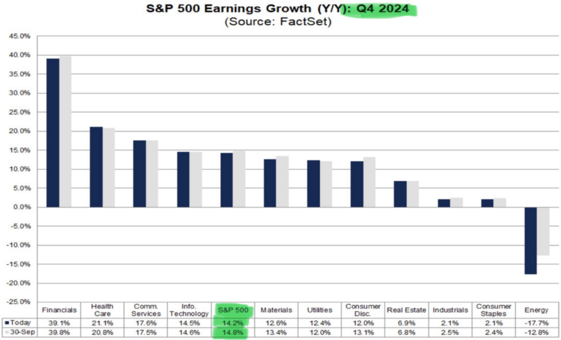

When you look at earnings expectations for Q3, a 4.1% year-over-year growth rate is not that bad although that’s the past. We know investors should be buying the future not the past. 5

Looking ahead to Q4, S&P 500 earnings are expected to grow at a whopping 14.2%. 5

Perhaps that is the underlying catalyst for the recent surge in all-time highs on the S&P 500. Or could it be the upward revisions to U.S. GDP growth? 6

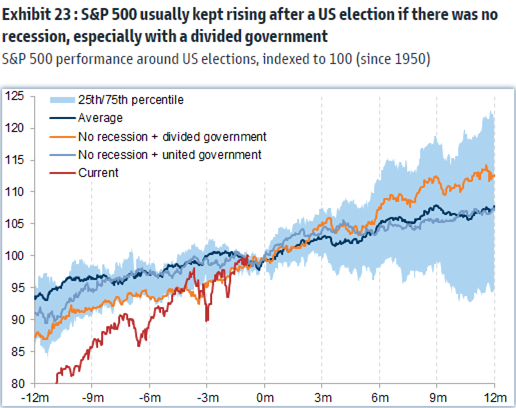

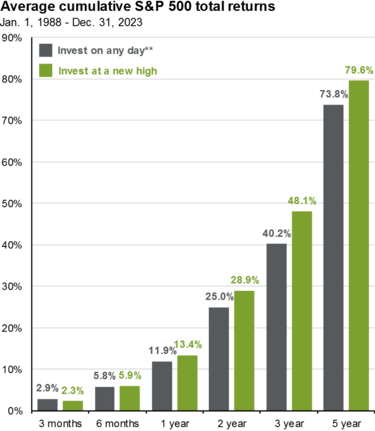

Continuing to invest at all-time highs requires some fearlessness. Or maybe not. Investing at all-time highs has historically generated better returns when you look past six months. 7

It takes courage to look beyond sensational headlines, resist the allure of pessimism, and focus on the long term.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://x.com/charliebilello/status/1844832643403190542

- https://x.com/JeffWeniger/status/1845123510869340448

- https://x.com/charliebilello/status/1845115446766317694

- https://x.com/eWhispers/status/1844739292192469177

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_101124B.pdf

- https://www.atlantafed.org/cqer/research/gdpnow

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/?slideId=investing-principles/gtm-investingalltimehighs

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.