Comprehensive Retirement Plan Solutions for Every Business

No matter the size of your organization, we can design a comprehensive, competitive benefit plan tailored to your needs. We’ll help you select the best options for your company, enroll participants, and provide employee education that encourages active participation and long-term retirement readiness. Working with us means having a plan that reduces administrative costs, improves program performance, encourages greater employee participation, and creates better outcomes for your employees and your business.

The Department of Labor often expects you to know too much when managing your 401(k). That’s why we’re here to walk you through the fine print, ensure you have proper documentation, and make sure you understand every relevant option available to you. In short, we take care of what we do best, so you can focus on what you do best.

Employers

How do I protect against fiduciary risk while providing the greatest amount of benefit to my employees?

Our mission is to improve the lives of those we serve, and we provide synergetic strategies that benefit your employees while helping you manage costs.

Retirement plan services:

- One-on-one Employee Meetings

- Fiduciary Training and Support

- Plan Vendor Search

- Investment Policy Statement Development

- Fund Menu Design

- Investment Monitoring

- Fee Benchmarking

Participants

As retirement approaches, will you be financially ready?

The education and engagement we offer our participants includes the following:

- Investor Education: Develop and strengthen your knowledge of mutual funds, exchange traded funds, stocks, and bonds, while showing you how to allocate them throughout your lifetime.

- Risk Tolerance Profile: Ensure you to take the right amount of risk today and as your needs change in the future.

- Retirement Calculator: We work with you to determine the deferral amount and required rate of return needed to meet your specific goals.

- Meeting Rhythm: Establish a predictable meeting pattern and providing the information that is important to you.

- Economic Commentary: Our assessment on what the economy is doing, why it is happening, and how it may be affecting your investments.

- Reporting: Direct and transparent communication about your account's performance in good times and bad so you know where you stand and where you are headed.

- Recommendations: We provide you with a recommended allocation to achieve your targeted return rate using our capital markets expectation tool.

Watch our Webinar on How to

Supercharge Your 401(k)!

Supercharge Your 401(k)!

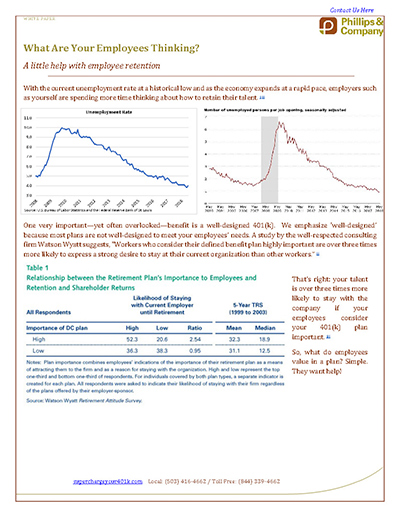

What Are Your Employees Thinking?

Smart 401(k) Management

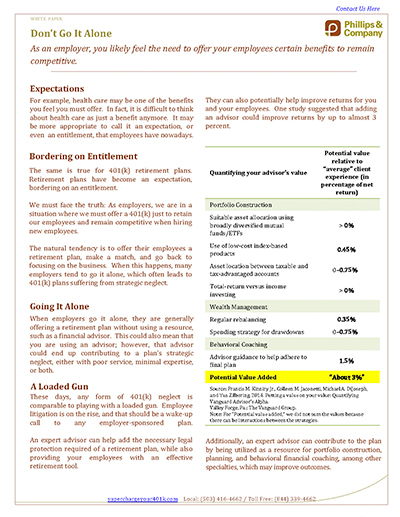

Don’t Go It Alone – Supercharge Your 401(k)

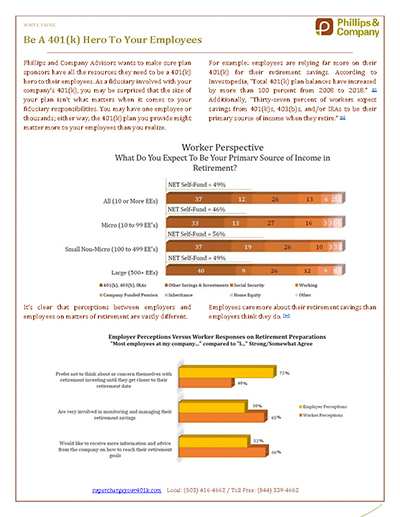

Be A 401(k) Hero To Your Employees

Amazing 401(k) Ideas

3 Reasons Your 401(k) is a Ticking Time Bomb

Is Your 401(k) Advisor Earning Their Keep?

The 5 Basic Rules Equity Investors Need to Know

Contact Us for a Complimentary Plan Review

As a fiduciary or plan sponsor, there are certain questions that you should revisit to ensure your plan is performing well in a way to meet your employees’ retirement goals.

- Are you getting the best performance from your 401(k), 403(b), or other retirement plan?

- Are your plan’s fees increasing your fiduciary liability?

- Is your plan aligned with your company’s retirement goals?

- Is your plan’s investment advisor a retirement specialist?

- Do you know what your share class means?

- Should you consider automatic features for your plan?

- Are your employees properly allocated?

Our advisors can provide a no-obligation, complimentary review of your plan to determine whether you have the best fund performance, lowest costs, and even compare share-classes of funds. Additionally, we can provide you with options to Supercharge Your 401(k), as well as benchmark your plan’s fees against other plans of your size based on assets and the number of the participants.