The recent jobs report should give some reprieve to the Fed’s rapid rate increase cycle. The U.S. economy added 150,000 jobs in October and the unemployment rate rose to 3.9%. On a revised basis, job growth is now averaging 204,000 over the last 3 months compared to the unrevised 266,000 jobs gained in September. 1 2

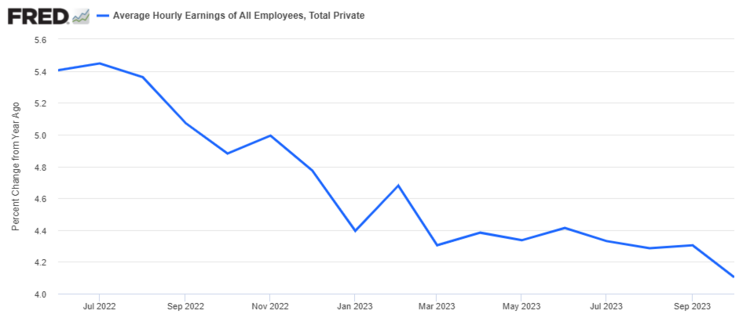

On top of the muted jobs data was a deceleration in average hourly earnings. Wages grew at the slowest rate since June 2021. 3

Rising rates and higher mortgages actually do have an impact on the economy, and the Fed can now rest assured their policy tools work. 4

In his post-meeting press conference last week, Fed Chair Powell indicated that his policy tools are working and left some room for doubt about the next round of rate increases. 5

“Our restrictive stance of monetary policy is putting downward pressure on economic activity and inflation.”

He went on to say:

“Financial conditions have tightened significantly in recent months, driven by higher longer-term bond yields.”

“Reducing inflation is likely to require a period of below-potential growth and some softening of labor market conditions.”

With the rolling three-month average job growth picture weakening over the same period of time rates have been increasing. I’d say mission accomplished. 4

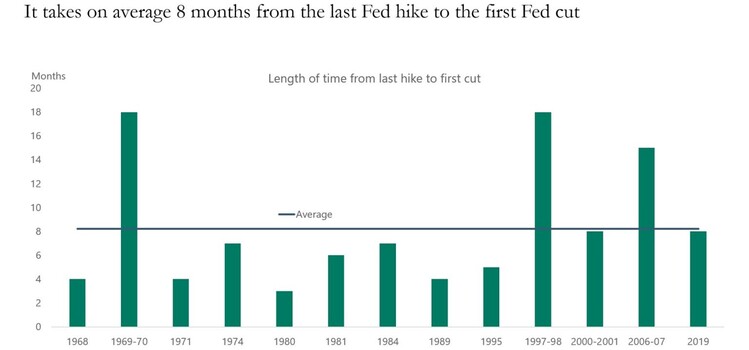

While investors will pre-position for a new risk premium for equities and a neutral Fed Funds rate, the actual rate cuts might still be months away. 6

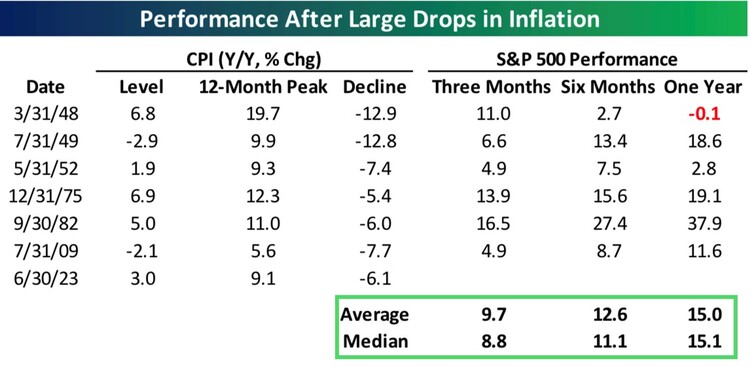

Typically, the Fed will need to see large drops in inflation before cutting rates and that has led to some stellar market performance. 7

When the Fed does pause—as they have now done in two consecutive rate decision periods—markets tend to perform well. Further when it comes to rate cuts, equity markets also outperform. 7

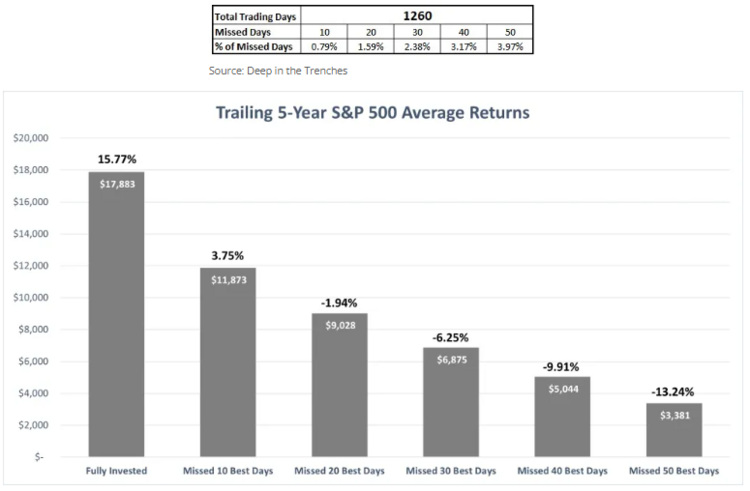

The challenge isn’t really in the macro rate cut call. The challenge is in pre-positioning portfolios ahead of the cut. It’s those periods that foment the most doubt and uncertainty. However, if you don’t do some pre-positioning, you will likely miss the biggest part of the moves. Markets move in brief bursts; if you miss just a few days you lose all the advantage.

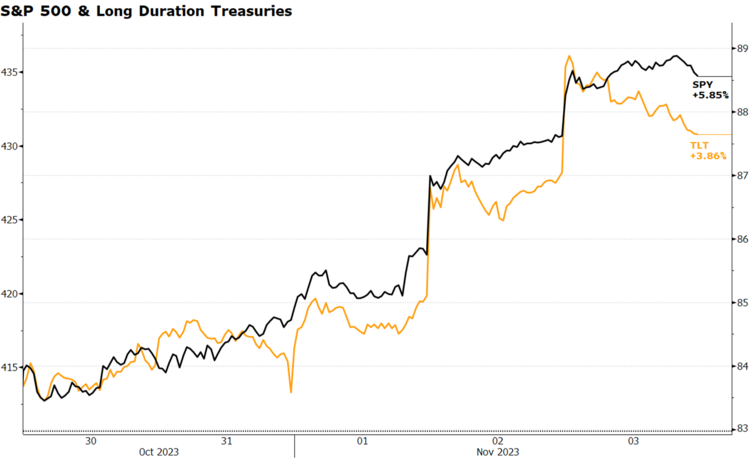

Just look at equities last week and long duration treasury bonds – both had great price gains for the week. 4

We are getting into a soft spot with the economy and owning longer duration equities like Technology and above average duration Treasuries are reasonable pre-positioning.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.nytimes.com/2023/11/03/business/economy/jobs-report-october-2023.html

- https://www.ey.com/en_us/strategy/macroeconomics

- https://fred.stlouisfed.org/graph/?g=1b3aP

- Bloomberg

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20231101.pdf

- https://apolloacademy.com/eight-months-from-last-fed-hike-to-first-fed-cut

- https://www.bespokepremium.com