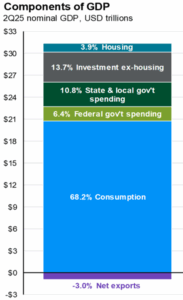

If you want to understand the American economy, you don’t need a macro textbook — just a holiday shopping receipt. Consumption isn’t part of GDP: it is the economy. Roughly 70% of U.S. GDP is driven by consumer spending. And during the holidays, that engine revs at full throttle.

That chart tells the story plainly: consumption fuels ~68% of GDP. Everything else — investment, government spending, net exports — rides on the leftover. If consumption sneezes, the rest of the economy catches a cold.

Which is why holiday spending matters so deeply: it’s the densest burst of consumption all year.

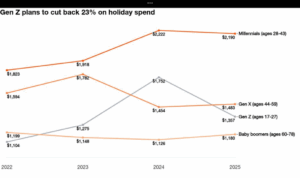

And, as always, not all consumers are equal.

This year’s data, like most data in 2025, is sending us a mixed message of sorts. Before we get to that, we need to know who’s driving US consumption.

- Millennials (ages ~28–43): currently the largest share ~30–32% of total consumption

- Gen X (ages ~44–59): second largest ~27–29%

- Baby Boomers (ages ~60–78): still a major chunk ~20–22%

- Gen Z (ages ~17–27): younger but smaller ~8–10% and growing

Now consider who’s spending more and who’s cutting back this holiday season. Most are spending more except for Gen Z. They look to be cutting spending by a whopping 23%. If Gen Z does pull back, it’s a warning sign for future growth — but it doesn’t yet have the weight to tip the entire engine into stall.

Meanwhile, the backbone of holiday consumption remains firmly with Millennials, Gen X, and Boomers.

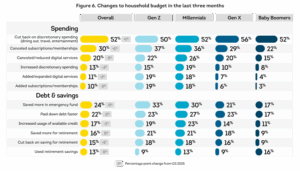

The Consumer Still Looks Healthy — Just More Selective

Recent survey data shows a sensible reallocation, not panic. Across age cohorts:

- Discretionary spending is being cut back — dining, travel, entertainment, subscriptions.

- Many households are paying down debt or building emergency savings.

- Non-essential categories are being pruned; essentials and value-oriented purchases are being prioritized.

This isn’t a consumer collapse. It’s a reset. And for now, the engine is still running, just more efficiently at a lower RPM.

So why the Gen Z pullback?

The latest Beige Book from the Federal Reserve gives us clues.

- As the national summary puts it: “Employment declined slightly … with around half of Districts noting weaker labor demand.”

- Hiring plans are being scaled back. “More districts reported contacts limiting headcounts using hiring freezes, replacement-only hiring, and attrition than through layoffs.”

- In Boston, one region said employment “edged lower amid weakening labor demand.”

- Some firms — especially staffing and retail — say entry-level hiring is soft, and that automation (AI) is substituting for new workers.

- On the spending side: multiple districts reported that consumer spending declined further, especially among middle- and lower-income households. High-end retail held up better, but the broader base is shrinking.

Gen Z Is Not Just Buying Less — They’re Buying Differently

Amid a softer labor-market and tighter budgets, Gen Z isn’t just shrinking their holiday list — they’re reshaping it.

- Trading down: cheaper brands, discount retailers, off-price over premium.

- Prioritizing value and essentials over status or luxury.

- Substituting experiences or low-cost meaningful gifts (digital goods, subscriptions, gift-cards) for big-ticket items.

- Increasing use of flexible payment methods, BNPL, or lower-cost options rather than relying on high-interest credit cards.

This shift matters — not just for their wallets, but for how retailers must adapt, and for what long-term consumption growth will look like.

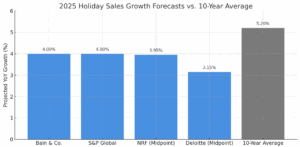

The macro picture is still resilient.

Despite Gen Z’s pullback and a softening labor market, the broader holiday-season outlook remains modestly optimistic:

- Overall holiday spending is still forecast to grow (though at a slower pace).

- The backbone of consumption remains Millennials, Gen X, and Boomers — who have more stable incomes, longer track records, and larger savings buffers.

- Retailers who adapt to value-oriented, discount-seeking, younger consumers may still do well — especially in categories like discount, fast fashion, streaming, services, and experience-based gifts.

So, the economy doesn’t appear to be collapsing. It’s evolving. If the recent Black Friday trends are any indication, the US Economy should post solid growth in Q4.

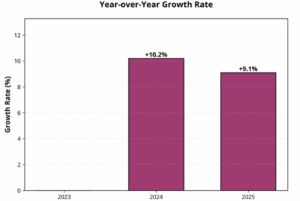

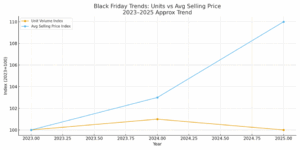

Overall consumption grew by 9% on Friday compared to last year’s growth rate of 10% — well more than the 5.2% growth forecasts.

While actual volume of what sold is down slightly, the overall consumer spend was up. Inflation and tariffs may have had a modest impact on the selling price.

Holiday spending isn’t just consumer excess; it’s the leading indicator for tomorrow’s consumption engine.

Gen Z’s pullback this holiday season isn’t a sign of immediate crisis. It’s a signal. A signal that the next wave of consumption — and by extension, economic growth — may look very different from the last. But that could be 10 years from now.

As for now, the consumer and by design the overall US economy look to be in solid shape. All of which should translate into continued corporate earnings growth and a supportive stock market.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.