Markets like clean narratives. The Federal Reserve cuts rates, financial conditions ease, and risk assets respond accordingly. This time, the story is messier.

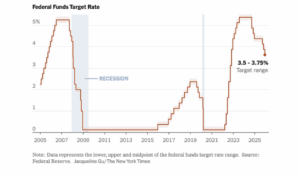

The Federal Reserve cut rates last week, bringing short-term interest rates to their lowest level in years.

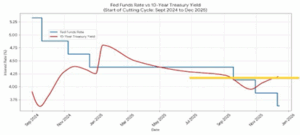

Despite meaningful cuts to short-term rates, the 10-year Treasury yield remains stubbornly high. That’s not a policy mistake. It’s a reminder that the Fed controls the overnight rate — not the entire yield curve.

The bond market is sending a message worth listening to.

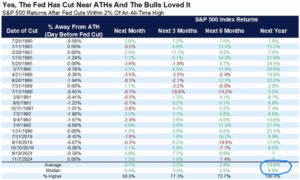

This historical table captures a rare but important setup: periods when the Fed cuts aggressively, yet long-term yields rise or fail to fall.

Two things stand out:

- Equity markets often struggle in the very short term

- Forward returns over 6–12 months have historically been solid

The lesson isn’t “this time is the same.”

It’s that policy easing doesn’t always transmit cleanly through long-term rates — especially early in a cycle. Discomfort is often part of the transition.

The Fed Can Cut Rates — But It Still Has to Run the Plumbing

Part of today’s confusion stems from something most investors don’t spend much time thinking about market plumbing.

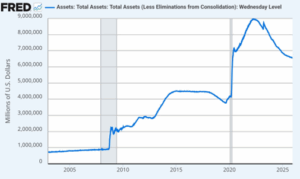

After nearly two years of shrinking its balance sheet through quantitative tightening (QT), the Fed stopped letting assets roll off — and has now begun buying Treasuries again.

This is not a return to 2020-style quantitative easing. It’s a reserve-management operation, aimed squarely at easing money-market strains and keeping short-term rates trading where the Fed wants them.

Even so, it remains a reversal. The motivation wasn’t growth or markets. It was stability. Reserves were tightening. Funding markets were showing stress. The Fed chose function over philosophy. That choice matters.

While the Fed talked about “normalization,” its balance sheet never returned to anything resembling pre-crisis levels. QT reduced assets at the margin — but the structural presence of the Fed remained.

Markets have internalized this and expectations around future intervention now influence how long-term bonds are priced.

It’s important to be precise.

- The Fed is purchasing short-dated Treasury bills, generally with maturities under one year, to inject reserves and stabilize funding markets.

- The U.S. Treasury continues to issue across the curve, including meaningful volumes of notes and bonds at longer maturities. This issuance funds current government spending.

Over the past year, issuance has been heavily skewed toward bills, but long-dated supply has not disappeared.

The result:

- Short-term rates are increasingly influenced by Fed liquidity operations

- Long-term rates are still governed by supply, expectation of inflation, and risk compensation

That split helps explain why long-term yields haven’t followed the Fed lower. The Fed has lost control of the long end. That’s the point.

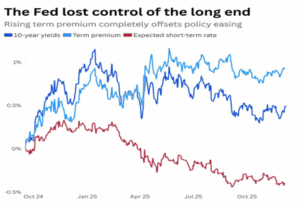

Why has this occurred. This chart explains the disconnect better than any headline.

Short-term rates are expected to fall. But the term premium has risen enough to fully offset policy easing. In plain english, investors want to be paid to lend long-term — for inflation uncertainty, fiscal deficits, and duration risk.

That’s not defiance it’s price discovery.

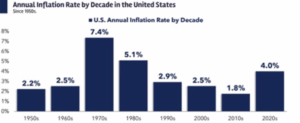

The term premium is largely driven by inflation expectations, an area where the Fed has struggled this decade. The 2010s conditioned investors to believe inflation always fades. The 2020s have reminded markets that inflation regimes can change.

Inflation is lower, but long-term buyers are no longer willing to assume it will stay low indefinitely.

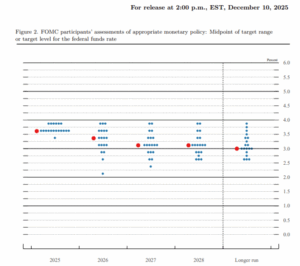

Another reason longer duration rates are stuck has to do with what the Fed is signaling.

The dot plot reinforces that the Fed expects rates to come down, but not rapidly and not back to zero. This is not a return to the post-GFC playbook. It’s a slower, more conditional path, and that nuance matters for long-term yields.

Stocks, Rate Cuts, and All-Time Highs

Historically, when the Fed cuts rates while markets are near all-time highs, forward equity returns have tended to be constructive, particularly over 6–12 months.

This isn’t an emergency cycle, and markets don’t peak simply because rates fall. They peak when earnings, liquidity, and confidence turn together.

We are not there.

Even with rate cuts and renewed bond buying, the 10-year yield is still elevated for several reasons:

- Rising term premium — investors demand compensation for inflation and fiscal risk

- Ongoing long-dated Treasury issuance — supply still needs to be clear

- Inflation credibility has improved, not been restored

- Growth has slowed but not broken

- QT has ended, but QE hasn’t returned — purchases are short-dated and technical

- Global buyers are more price-sensitive than before

The Fed controls the overnight rate. The bond market controls the long story.

Right now, that story says:

- Liquidity matters again

- Inflation risk hasn’t disappeared

- Capital wants to be paid for duration

This isn’t bearish, it’s disciplined. And while it makes the markets noisier, it also makes them more honest. Transitions always feel louder than they are.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.