Markets love a captain.

With Kevin Warsh now named as the next Federal Reserve Chair — though still awaiting confirmation — investors have done what they always do when leadership changes loom: they’ve tried to price the person.

The reaction has been familiar. The dollar firmed. Metals sold off. Financial conditions tightened at the margin. Warsh carries a reputation for credibility and discipline, and as a reformer with low tolerance for drifting inflation expectations.

That response isn’t wrong, it’s just incomplete, because while captains matter, they don’t choose the weather.

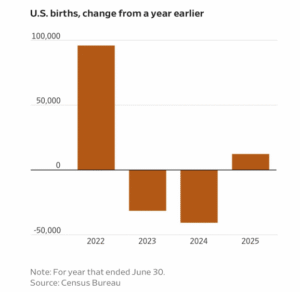

The most telling yet underreported news this week came from the US Census Bureau. After a brief post-pandemic rebound in 2022, births fell sharply in 2023 and again in 2024. The modest uptick in 2025 doesn’t change the direction of travel.

Fewer births today ripple outward — shaping future labor supply, housing demand, consumption, and the economy’s long-term speed limit.

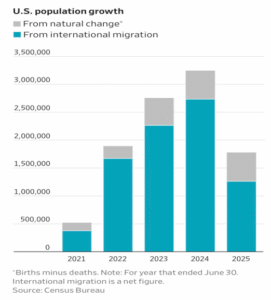

Over the past several years, nearly all U.S. population growth has come from international migration. Births minus deaths — once the primary engine — have faded into the background.

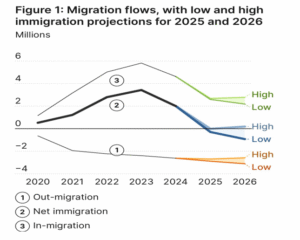

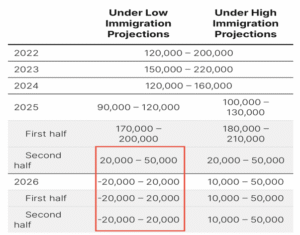

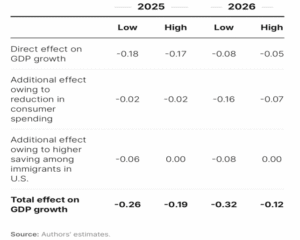

Brookings’ migration data shows that the surge in immigration during 2022–2024 has already peaked. Net immigration declined in 2025 and may approach zero or turn negative in 2026. This isn’t political ideology. It’s math.

One of the least understood effects of slower population growth is how many jobs the economy needs. As immigration and labor force growth decelerate, the “breakeven” pace of job creation falls sharply. Where the U.S. once needed roughly 120,000–150,000 new jobs per month to keep unemployment steady, that number is now far lower — potentially 50,000 or less, and in some scenarios briefly negative. This helps explain why softer payroll growth doesn’t signal recession, but rather a labor market resizing to match a slower-growing population.

Under both low and high immigration scenarios, Brookings estimates a 0.2%–0.3% annual drag on GDP growth from slower labor force expansion, reduced consumption, and higher saving.

Warsh’s reputation is well understood. He has long emphasized credibility, clarity, and the long-term risks of allowing inflation expectations to drift. Markets interpret that as dollar-positive and inflation-hedge-negative — hence the reaction in currencies and metals.

But there’s an important nuance that often gets lost in the shorthand.

Warsh has also been clear that Fed easing is a tool, not a taboo. In moments of genuine stress, liquidity matters. The difference is not whether Fed liquidity exists, but when and why it’s used.

That combination explains both the market’s initial tightening response — and why it won’t be the final word.

Demographics don’t show up at press conferences, but they quietly shape every policy decision.

After World War I, the world focused on debt and central banks — but it was the missing generation from war and pandemic that quietly reshaped growth and labor markets for decades. We saw a version of this again after COVID. Policy responded quickly. Demographics moved slowly. And the slow force won.

Captains change.

Demographics endure.

In a lower-rate world, Warsh’s test as captain is whether he understands the demographic currents beneath the policy surface.

Postscript:

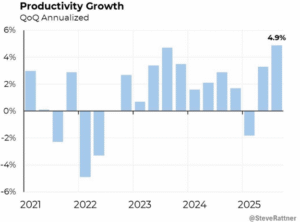

When labor growth slows, productivity is how the economy cheats the math. The recent acceleration suggests we may be learning to do more with fewer workers — easing labor shortages, supporting growth, and giving the economy more room to run than population trends alone would imply. Think AI and innovation.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

Sources & Data Notes

• U.S. Census Bureau – Births and Population Growth Data (Years ending June 30)

• Brookings Institution (January 2026) – “Macroeconomic Implications of Immigration Flows in 2025 and 2026”

• Federal Reserve public speeches and commentary – Kevin Warsh

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.