False Start?

In a recent blog, we noted that the stock market is near all-time highs with valuations at long-term historic levels, so earnings must deliver. We followed up with a mid-earnings-season data review that observed signs of economic strength, including 4% Q2 GDP growth, but left us with questions about consumer spending going forward and whether improving economic growth would translate into earnings growth and drive equity returns.

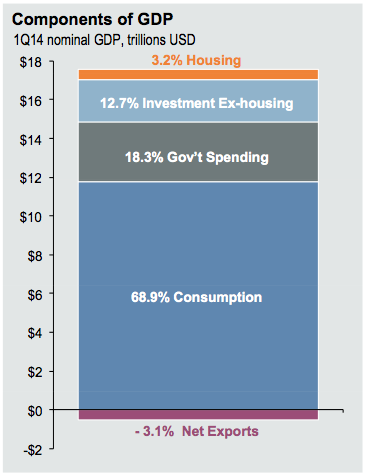

We remain in a low interest rate, low inflation, and improving employment environment. However, recent consumer confidence, retail sales, and mortgage data show signs of hesitation by consumers. With about 70% of GDP being driven by consumption, perhaps the rosy economic growth forecasts were a false start.[i] Let’s review the data and see if we can make a call.

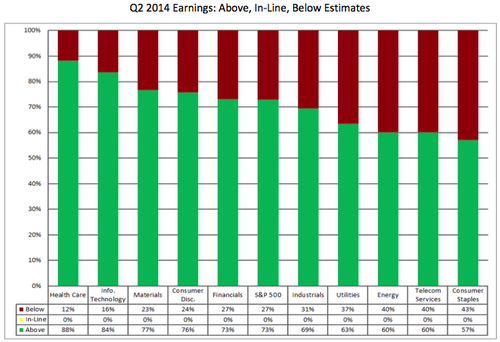

With 469 of the S&P 500 companies reporting, 73% had Q2 earnings above estimates and all sectors had over 50% of companies beating expectations.[ii]

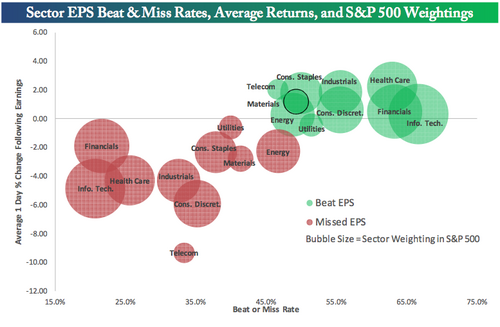

In a sign that the market has priced in high expectations, our friends at Bespoke showed that companies with earnings misses had larger magnitude price changes than companies that beat earnings estimates.[iii]

This suggests volatility if earnings or economic growth fall short of expectations. Recent consumer data show potential causes for concern.

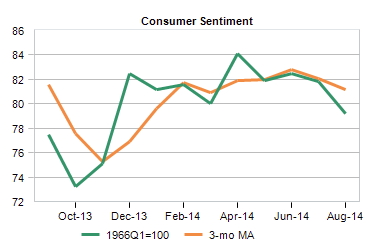

Against expectations, the University of Michigan Consumer Sentiment index fell further in August, to its lowest level since April and its lowest level for 2014.[iv]

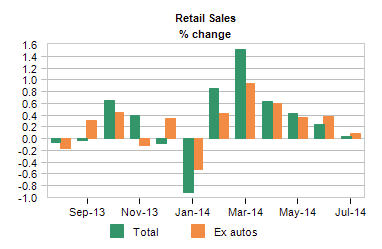

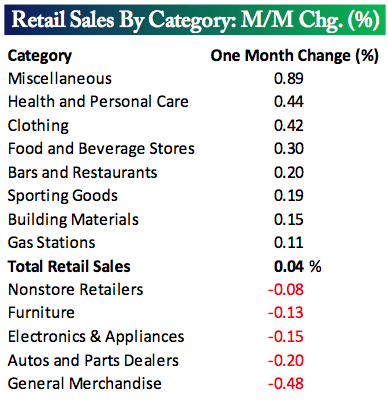

Looking at the index components, consumers felt very confident about their present condition (99.6%), but expectations for the economy for the next year reached their lowest level since October 2013 (66.2%).[v] When consumers are worried about the future, it can impact their current spending, and sure enough, the retail sales data reflect this. Retail sales growth was unexpectedly flat in July and there has been a declining trend since March.[vi]

While some sectors showed positive sales growth, two notable groups that lagged were autos and general merchandise.[vii]

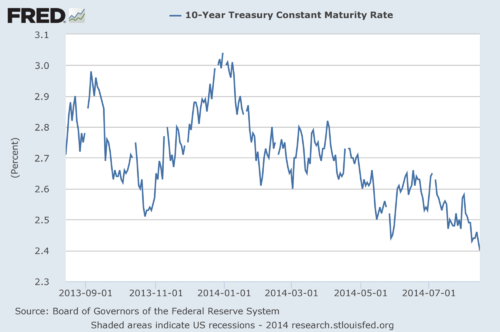

In addition to retail sales weakness, consumers are reluctant to spend on housing. Mortgage borrowing is at a 14-year low and mortgage applications are at a 6-month low, despite interest rates falling to their lowest level in a year.[viii,ix]

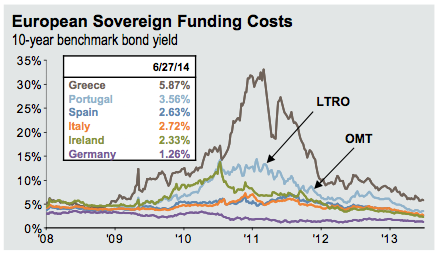

While the Fed continues to taper its bond purchases, interest rates have declined due in part to even lower rates in European countries, which make US Treasuries relatively attractive.[x]

European rates could decline even more, as European Central Bank president Mario Draghi recently acknowledged that European economic momentum had slowed and new geopolitical tensions would only do more harm.[xi] Slower European economic growth impacts US economic growth.

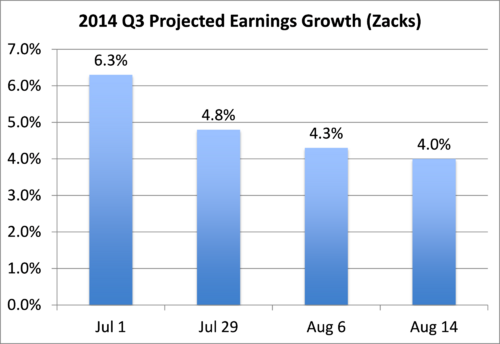

As we might expect, with all of these signs of concern, Q3 earnings forecasts have declined. Zacks reports that current Q3 earnings growth is projected at +4.0%, compared to +6.3% at the start of the quarter.[xii,xiii]

So were the original forecasts for strong US economic growth in the second half a false start, or can the US economy meet the expectations? The stock market appears to have high earnings expectations priced in, yet Q3 earnings growth estimates keep declining along with consumer confidence. An economic slowdown in Europe and heightened geopolitical tensions will only make matters more challenging. If current trends continue, the stock market may need to adjust its expectations downward. Data releases are on tap that may provide more color on consumer spending.

This week, several retailers report earnings including Target, TJX, Gap, and Dollar Tree. We will also learn more about the housing market from the housing starts and existing home sales reports, as well as earnings reports from Lowe’s and Home Depot.

We will continue to monitor Q3 earnings projections and data releases, and provide further review. Be prepared for increased volatility as more data come out, particularly if the data indicate slower growth.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Jeff Paul, Senior Investment Analyst – Phillips & Company

Tim Phillips, CEO – Phillips & Company (Editor)

References

[i] JP Morgan Asset Management. (Jun 30, 2014). 3Q 2014 Guide to the Markets. p 17.

[ii] Butters, J. (Aug 15, 2014). Earnings Insights. FactSet. p 2.

[iii] Bespoke Investment Group. (Aug 15, 2014). The Bespoke Report: Earnings Season Ends. p 8.

[iv] Kelley, N. (Aug 15, 2014). United States: University of Michigan Consumer Sentiment Survey. Moody’s Analytics.

[v] Ibid.

[vi] Hoyt, S. (Aug 13, 2014). United States: Retail Sales. Moody’s Analytics.

[vii] Bespoke Investment Group. (Aug 15, 2014). The Bespoke Report: Earnings Season Ends. p 14.

[viii] Hughes, D. (Aug 16, 2014). Scaredy-cat consumers, housing stalls, Yellen in Jackson Hold: The week ahead. Yahoo Finance.

[ix] Federal Reserve Economic Data. (Aug 18, 2014).

[x] JP Morgan Asset Management. (Jun 30, 2014). 3Q 2014 Guide to the Markets. p 48.

[xi] Hughes, D. (Aug 16, 2014). Scaredy-cat consumers, housing stalls, Yellen in Jackson Hold: The week ahead. Yahoo Finance.

[xii] Mian, S. (Aug 14, 2014). Zacks Earnings Trends. Zacks. p 3.

[xiii] Mian, S. (Aug 6, 2014). Zacks Earnings Trends. Zacks. p 2.