Is the Recession Over?

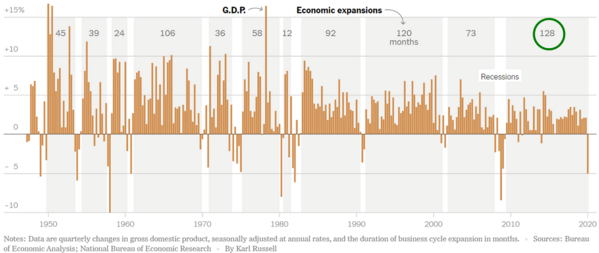

Did we just emerge from the deepest recession since the Great Depression? The definition as to what marks the official end of a recession is a bit murky but, there are two prevailing theories: One is a return to GDP growth after a period of contraction. The other is a return to the GDP growth trend prior to the economy slipping into a recession.

The latter definition is certainly going to be hard to attain this year, however returning to GDP growth might just be at hand. To save lives, we forced a closure of our economy and ended the longest economic expansion in history (128 months). However, we might be in for the shortest recession in history. [i]

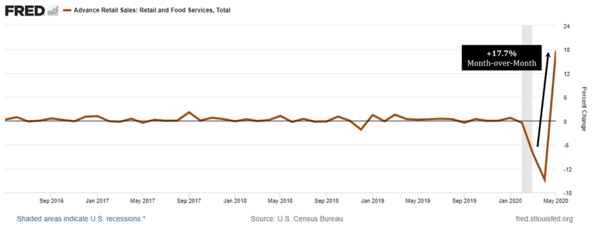

Recent retail sales data suggests the consumer is coming back in a strong way. Instead of continuing to decline, May retail sales jumped 17.7% month-over-month. [ii]

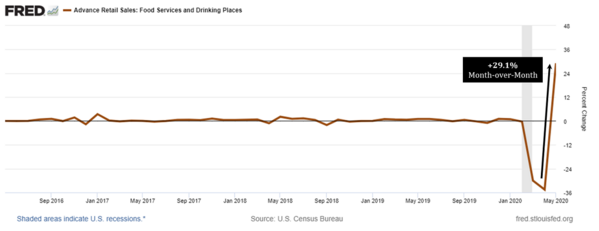

One of the key contributors to retail sales was the food and beverage segment. Retail sales in food and beverage came roaring back from the depths of depression to rise nearly 30%. [iii]

When considering recent survey data on consumer behavior, the gains in retail sales do not come as a big surprise. Consumers have been growing more comfortable with dining out as the virus effects continue to moderate. On a recent road trip, I personally experienced restaurants and bars in Tennessee, Florida, and Louisiana at “full” capacity—as full as their respective state regulations allow. Similarly, the flights I was on were full with middle seats being taken; although we recognize there is ample spare capacity. [iv]

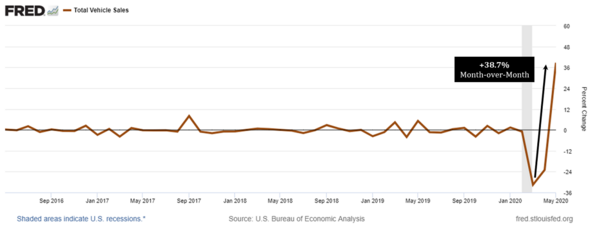

Another contributor to the snap back in May retail sales were vehicle sales, which rose almost 39% off the April lows. The uptick in auto sales points to consumers showing a renewed sense of confidence in making major purchases. [v]

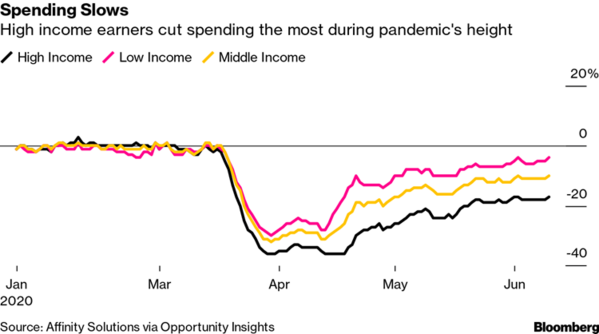

While it’s true high-income earners cut their spending the most during the recession, it is not surprising. With more disposable income and more discretionary spending, making cuts is a little easier. On the flip side, those in the middle-income and lower-income brackets needed to continue spending to cover basic necessities. [vi]

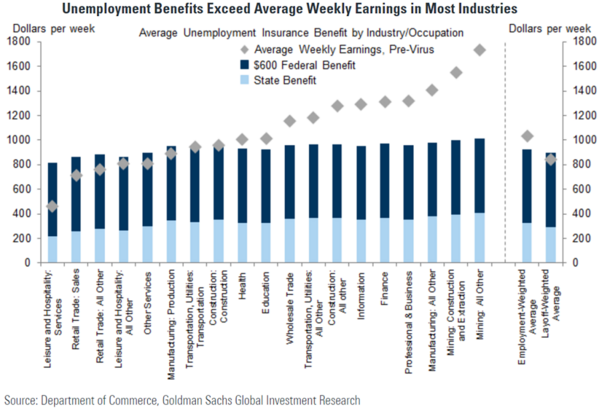

As we have highlighted in the past, much of the stimulus was driven to low-income and middle-income earners through generous unemployment and furlough benefits. According to Goldman Sachs, most displaced workers received benefits that exceeded their normal weekly wages as part of the CARES Act. [vii]

It is not hard to imagine those not working, and making more money than if they were working, wanting to spend that extra cash on dining out, vacations, and retail goods.

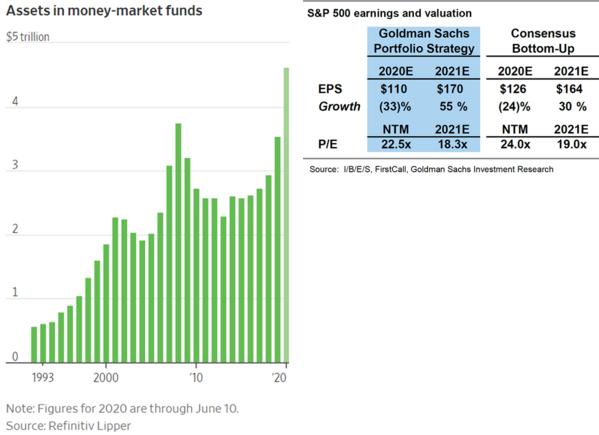

Perhaps that’s why equity prices reflect optimism for the U.S. economy to emerge from this recession quicker than the “smart money” is anticipating. Further, with over $4.5 trillion in cash on the sidelines and a recovery in corporate earnings anticipated in 2021, we may see supportable equity prices and valuations in 2021. [viii] [vii]

If the simplest definition of the end of a recession is a return to growth in consumption and jobs, we might just have seen the quickest recession on record.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.nytimes.com/2020/06/08/business/economy/us-economy-recession-2020.html

ii. https://fred.stlouisfed.org/series/RSAFS

iii. https://fred.stlouisfed.org/series/RSFSDP

iv. https://www.statista.com/chart/22054/readiness-to-return-to-normal-after-coronavirus/

v. https://fred.stlouisfed.org/series/TOTALSA

vi. https://www.bloomberg.com/news/articles/2020-06-18/richest-25-of-americans-cut-spending-the-most-during-pandemic

vii. https://research.gs.com/

viii. https://www.wsj.com/articles/investors-are-sitting-on-the-biggest-pile-of-cash-ever-11592299801