Back to What Matters

Standing at the threshold of one of the most anticipated periods on the financial calendar – corporate earnings season – we find ourselves getting back to what matters most for equity markets. This time of the year, companies from various sectors open their books, unveiling their financial performance for the quarter. It is a moment that holds the potential to sway market sentiment, influence stock prices, and provide a plethora of insights into the broader economic landscape.

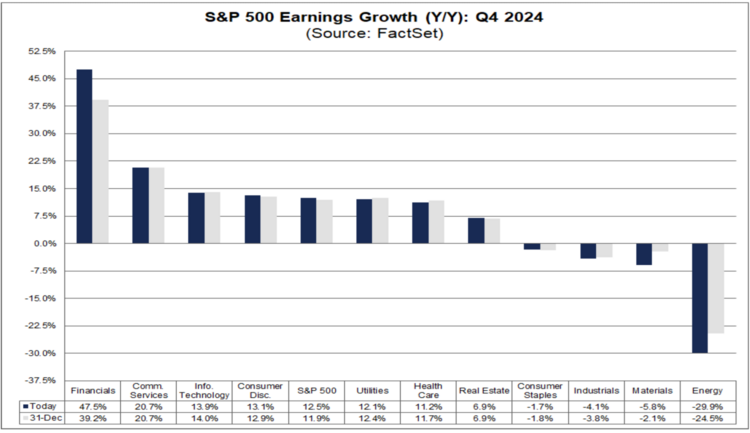

S&P 500 earnings for Q4 2024 are expected to grow at a growth rate above 12%. If that expectation comes to fruition this will be one of the better earnings seasons in a year. 1

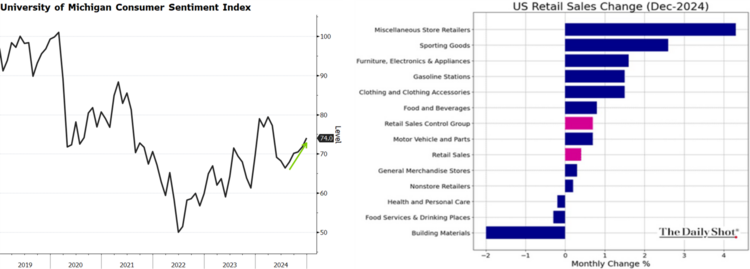

A key driver of this optimistic earnings forecast is the exceptional strength in December retail sales. Despite the myriad challenges that have beset the global economy, consumer spending in the final month of the year has shown robust growth.

The holiday season, traditionally a peak period for retailers, saw a surge in consumer confidence and a corresponding increase in spending across various sectors. This upswing in retail activity not only bolstered the revenues of businesses but also provided much-needed stimulus to the overall economy. 2 3

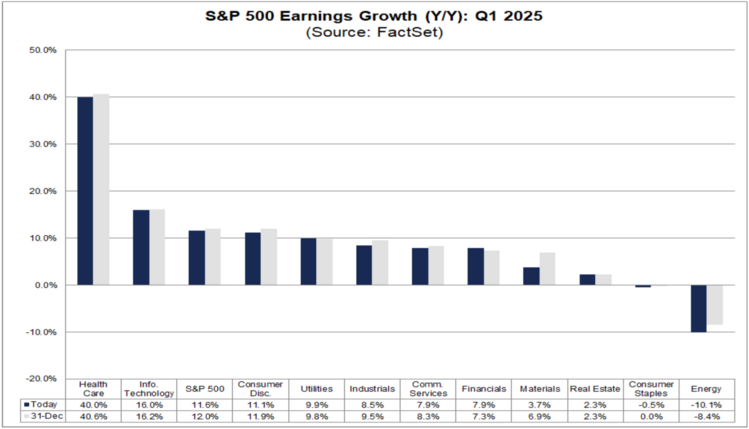

Earnings expectations for Q1 2025 are also promising, with another quarter of nearly 12% growth. 1

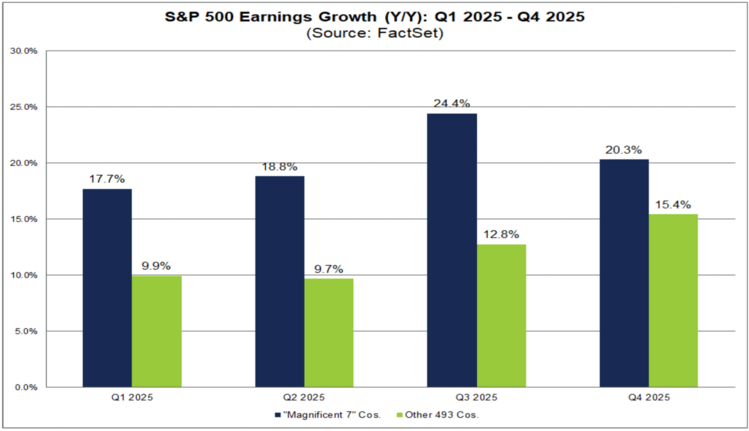

And before we get too bearish on the large tech companies' valuations, you might want to note who is in President Trump’s orbit. The “Tech Bros,” encompassing almost every one of the Magnificent 7 CEOs, were all over the news staking their claim to their fair share of protection for their corporate interests. Not surprisingly, their earnings growth for 2025 is projected to be remarkable as well. 1

When you are paying premium values, you are also expected to get premium earnings growth. That might be one very strong reason supporting these lofty valuations.

U.S. GDP growth for Q4 2024 should reflect the strength of the consumer and the subsequent flow through to S&P 500 companies. A recent upgrade to GDP growth from the Atlanta Fed is proof of that. 4

Getting back to what matters will generate the necessary headlines to support equity prices – provided expectations align with reality.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_011725.pdf

- http://www.sca.isr.umich.edu/

- https://thedailyshot.com/2025/01/17/robust-retail-sales-boost-us-q4-gdp-growth-estimate/

- https://www.atlantafed.org/cqer/research/gdpnow

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.