2021: The Perfect Sunrise

While it is too early to close the books on 2020, it is pretty easy to conclude that 2020 was a dark period in our history. There are likely more dark days ahead as COVID-19 spreads uncontrolled and cities and states resort to rolling lock downs in some sectors.

On the other hand—from what I can tell based on early indicators—2021 is shaping up to be a terrific year. Perhaps this blog will provide you a greater context to enjoy a healthy, safe, and joyous Thanksgiving with your people.

My view on 2021, and for that matter any year, resides in the strength of the U.S. Consumer driving GDP growth and corporate profits.

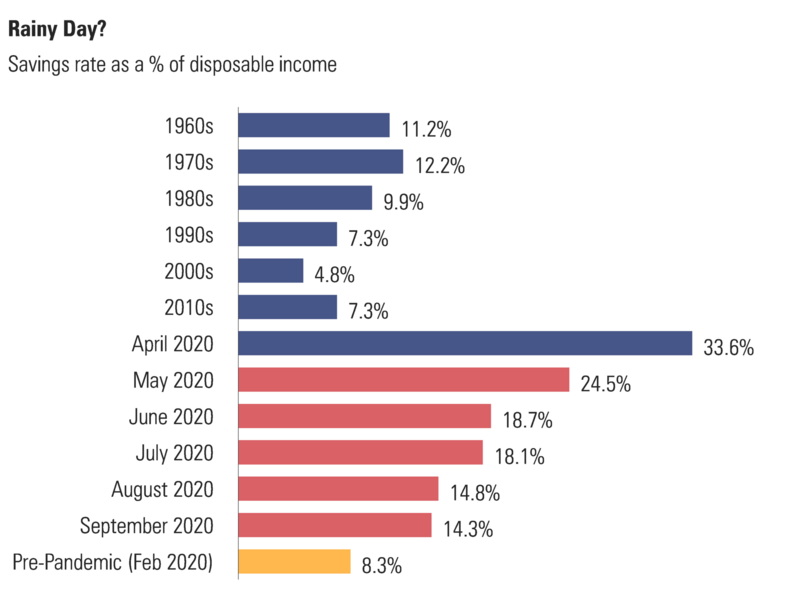

If you follow our blog regularly you know we have been tracking the precautionary savings levels the U.S. Consumer has been squirreling away. [i]

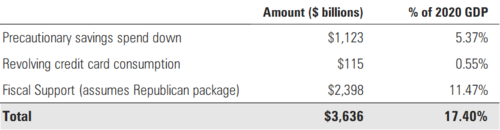

If the consumers feel safe with their jobs and health, I predict an epic return of their animal spirits in 2021. That could be equivalent to about $1.1 trillion, or 5.4%, added back to GDP if they return to pre-pandemic savings levels.

Pandemic-driven consumer caution was certainly a major theme for 2020. Consumers not only built-up precautionary savings—mostly from fiscal support—they also paid down their credit cards, as shown by the steady decline of credit card balances throughout 2020. [ii]

Balances have declined 13.6% from a peak of $847 billion in December to $732 billion at the end of September. Again, it’s entirely possible that the consumer can and will reinflate their discretionary credit card spending back to pre-pandemic levels in 2021. If so, that could add another $115 billion or 0.55% back to GDP in 2021.

What could unleash the consumer’s willingness to spend? Two factors: more fiscal support and a COVID-19 vaccine.

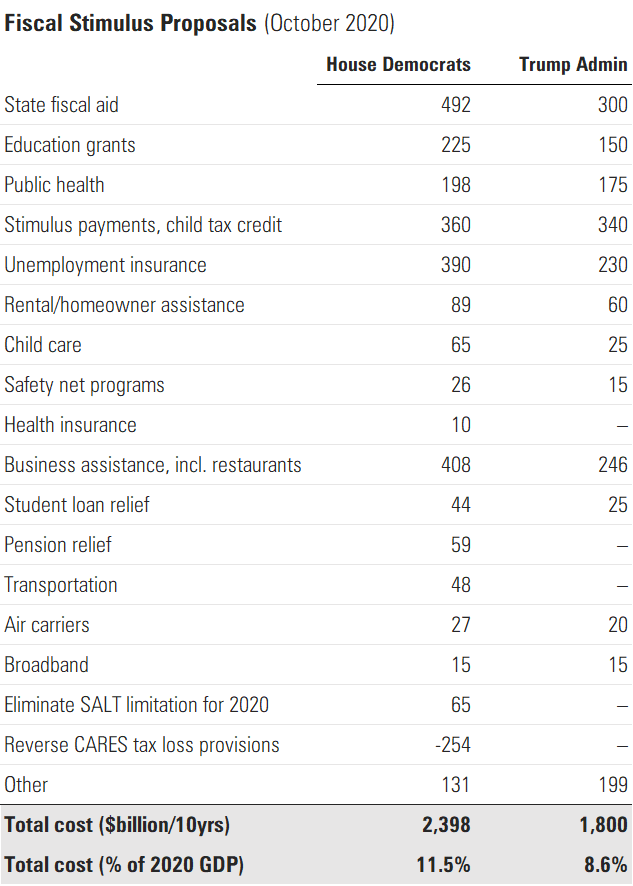

The control of the Senate will certainly have an impact on the depth and breadth of the fiscal stimulus provided by the federal government. My guess is the support will fall somewhere between $1 and $2 trillion depending on the outcome of the Georgia Senate races.

The table below details the differing views on fiscal support between Republicans and Democrats. [iii] [iv]

The Republican version would add about 8.6% to GDP while the Democratic version would add 11.5% to GDP in 2021.

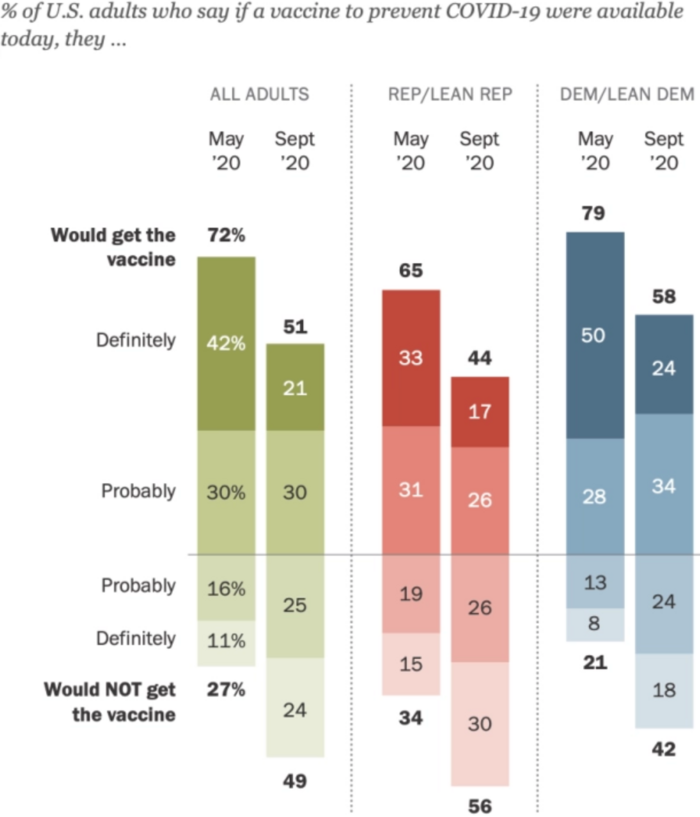

The ultimate liberator for the U.S. Consumer will be the COVID-19 vaccine. With FDA approval imminent, the acceptance of the vaccine by the U.S. Consumer becomes the decisive factor.

Attitudes about getting the vaccine in the United States have deteriorated considerably since May and it is no surprise this has become very political. 49% of all adults surveyed by Pew Research suggest they would not get a vaccine. [v]

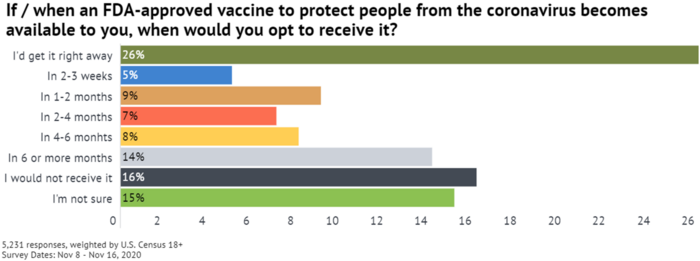

Looking at vaccine acceptance over time provides a more optimistic view. Only 16% say they would not receive it at all, with 15% undecided. More time means more willingness to get vaccinated. [vi]

That economic reality likely suggests a very strong second half consumption uplift cycle as more and more American consumers gain comfort and security in a vaccine. That should be the catalyst to drive additional consumption-driven corporate profits.

Let’s add all of this up:

That could be a jaw-dropping $3.6 trillion flooding our economy and over 17% of GDP.

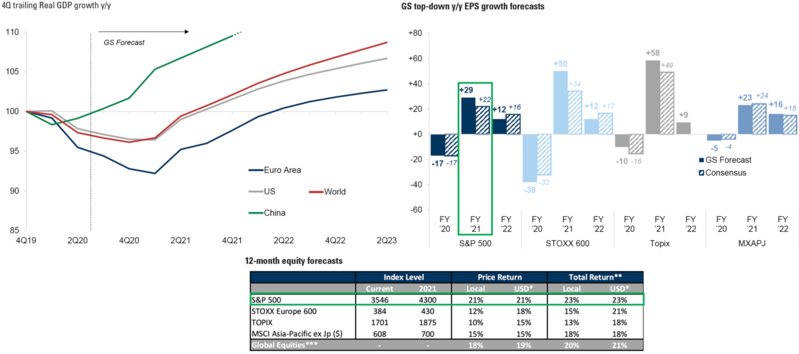

It’s likely why Goldman Sachs sees a strong rebound in GDP growth, EPS growth and a whopping 23% return for the S&P 500 in 2021. [vii]

One of my favorite financial writers, Morgan Housel, says you should “save like a pessimist and invest like an optimist.” I hope you can join us when I interview Morgan on December 10th. Sign up by clicking this link. He won’t disappoint with his great stories that simplify the complexity of money.

2021 looks like it could be the perfect sunrise to help us out of a dark year. The entire Phillips & Company Advisor Team wishes you a very healthy, happy, and safe Thanksgiving.

*Upcoming Phillips & Co. Webinar: Q&A with Morgan Housel*

Join us on December 10th at 10:00 a.m. Pacific

Tim will interview Morgan on his new book, "The Psychology of Money"

They will explore topics like: Luck & Risk, Compounding, Getting Wealthy & Staying Wealth

Click here to Register

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/series/PSAVERT

ii. https://www.axios.com/credit-card-balances-recession-spending-0d3ea967-1258-4f71-b02f-b9364d3f443c.html

iii. https://appropriations.house.gov/news/press-releases/house-passes-updated-heroes-act

iv. https://home.treasury.gov/news/press-releases/sm1155

v. https://www.pewresearch.org/science/2020/09/17/u-s-public-now-divided-over-whether-to-get-covid-19-vaccine/ps_2020-09-17_covid-19-vaccine_0-01a/

vi. https://civicscience.com/after-new-of-promising-vaccine-trials-coronavirus-vaccine-comfort-starts-to-tick-up/

vii. https://research.gs.com/