A 2% Chance of Death

Just as we digest the possibility of a soft economic landing later this year, we will face a perilous self-inflicted wound: the debt ceiling.

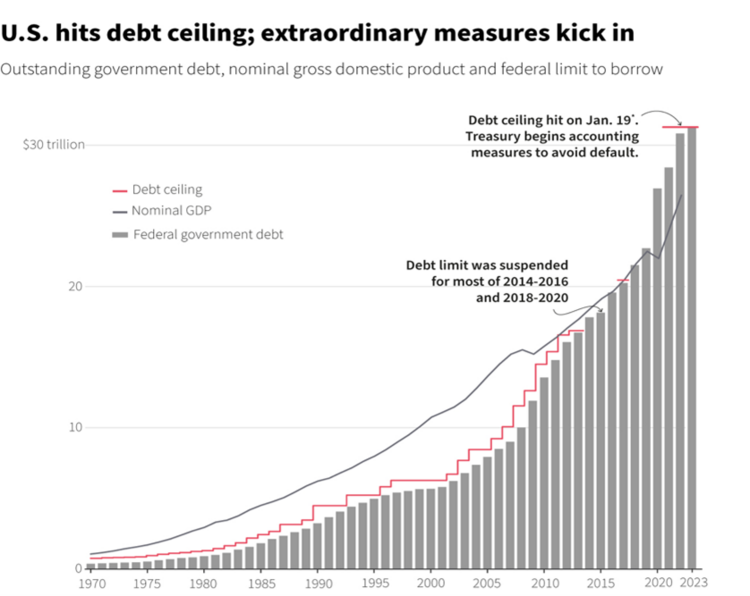

The U.S. government reached its borrowing limit last week and Congress must contend with expanding the amount of debt the Treasury department can issue. Right now, we are in debt to the tune of over $31 trillion dollars. That’s over 120% of GDP. No doubt an extraordinary amount. 1

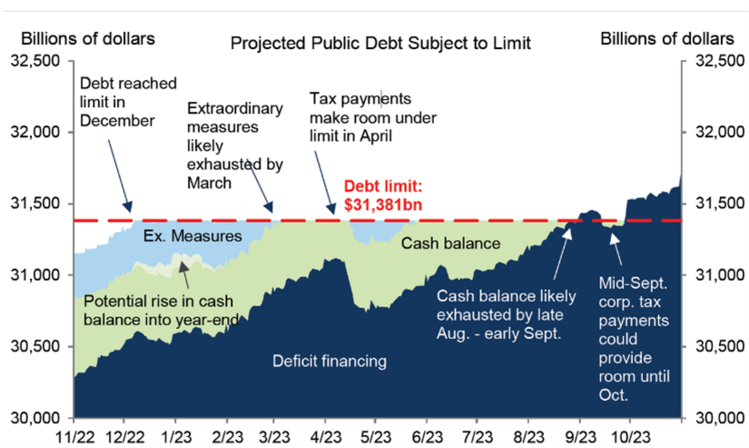

Fortunately, there are “extraordinary” measures the Treasury Department can deploy to forestall a default on our debt payments. Congress has until as late as August before running out of cash to reach some kind of negotiated compromise to lift the current debt limit. 2

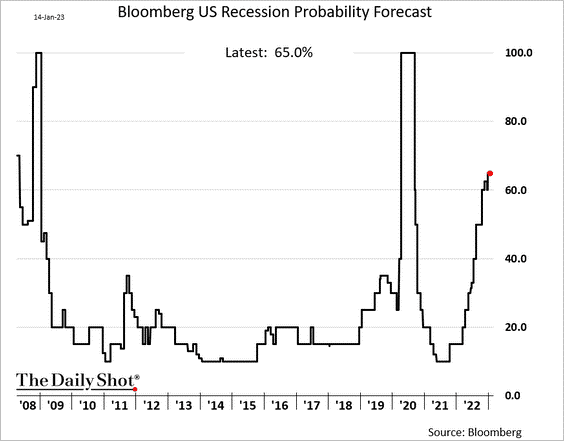

The risk of recession is predictably high right now without the consideration of a debt default. 65% of economists surveyed by Bloomberg predict a recession sometime in 2023. 3

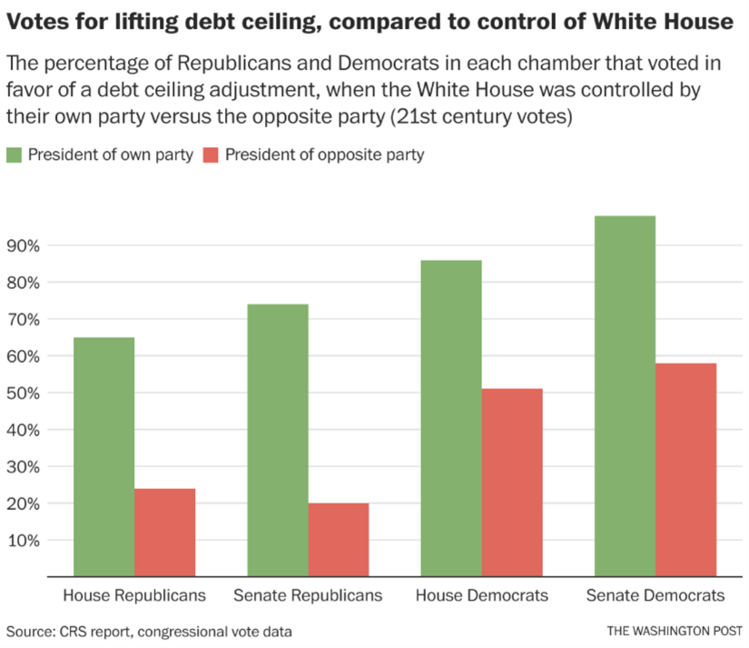

As Congress plays chicken with the U.S. economy, that forecast will likely accelerate the closer we get to August. Similar to our current political make up, historically Republicans have been much less willing to raise the debt limit when Democrats control the White House. 4

So, beyond the monetary game of interest rate chicken the Fed is playing with the economy, we need to prepare for Congress to play a similar game.

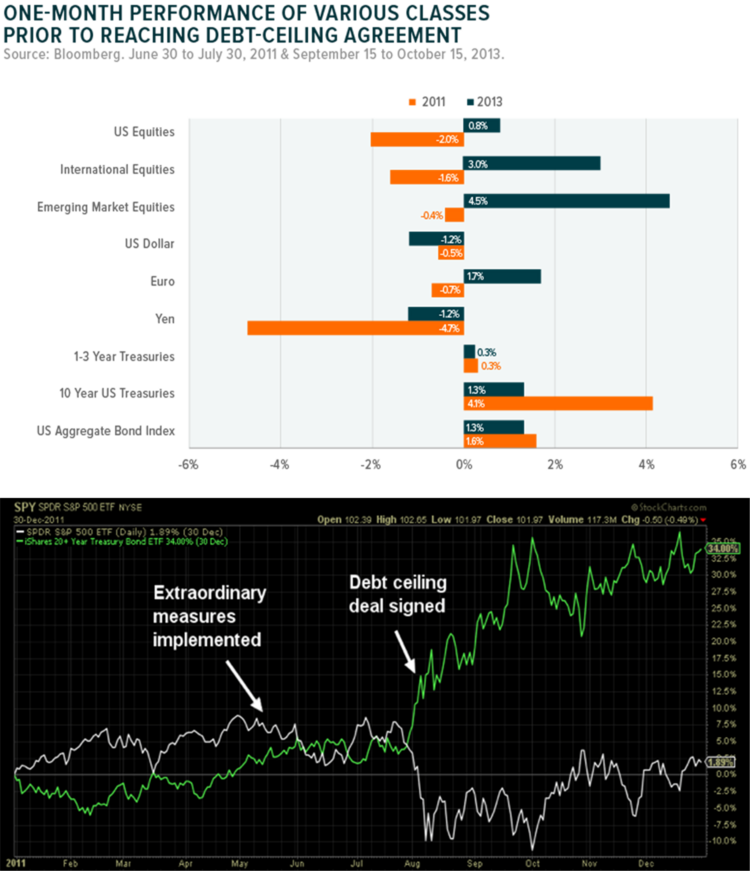

In the past, close calls with the debt ceiling have been met with mixed and mostly muted reactions by investors. 5

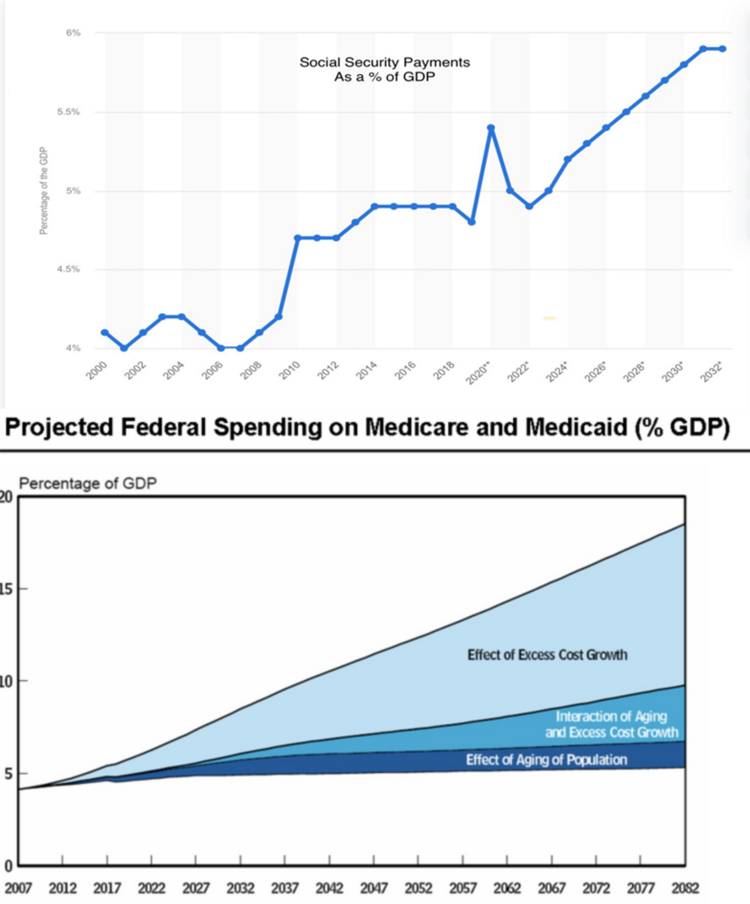

Here’s the risk! Defaulting on our debt has global security consequences, not to mention higher interest rates for future debt we may issue. Beyond that, the domestic realities are unthinkable. Just imagine a suspension of Social Security payments or Medicaid and Medicare payments.

Social Security payments represent over 5% of GDP and health care is a whopping 18%. 6

Nearly 23% of our economy would be starved of cash flow and an economic collapse would occur. While the odds of this are only like 2% in my opinion, I would hate to have an illness with a 2% chance of death.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.reuters.com/markets/us/looming-us-debt-ceiling-fight-is-starting-worry-investors-2023-01-19/

- https://research.gs.com/

- https://thedailyshot.com/

- https://www.washingtonpost.com/politics/2023/01/20/debt-ceiling-votes-white-house/

- https://www.globalxetfs.com/chart-looking-back-at-past-debt-ceiling-crises/

- https://cepr.net/