A Case for Optimism

I completely understand we are still in the doom and gloom phase of the current economic growth detour. It’s far too early to declare the coast clear from headwinds real and imagined.

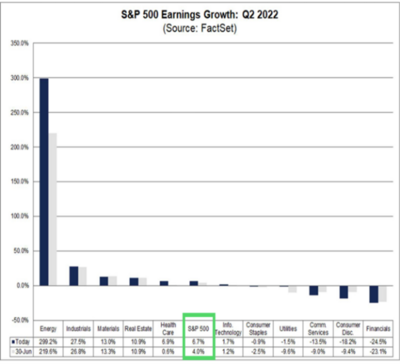

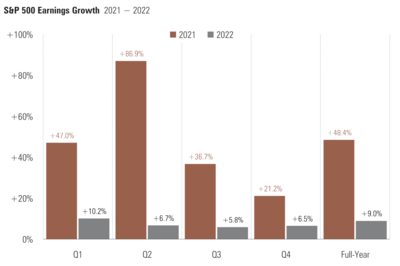

With Q2 earnings season effectively over, companies fared much better than expected. S&P 500 companies grew earnings by 6.7%, compared to the 4% expected earnings growth at the end of June. 1

This is remarkable considering the year-over-year comparison against 87% growth in Q2 of last year. 1

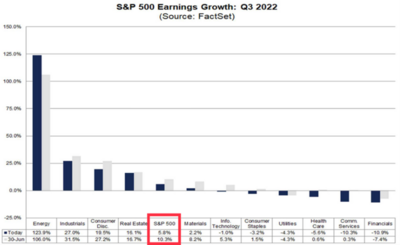

Pivoting to Q3 earnings, things look a little less hopeful according to Wall Street analysts. Earnings growth is anticipated to come in at 5.8%, compared to an expectation of 10.3% at the end of June. 1

I’m more optimistic, perhaps, than the Wall Street crowd for an earnings surprise to the upside in Q3.

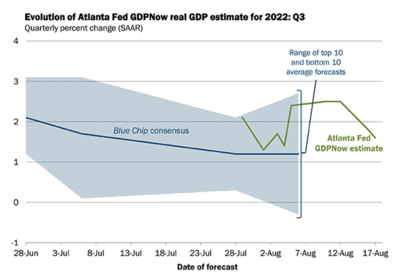

First, the U.S. economy should return to growth mode after two quarters of contraction. The Atlanta Fed GDP Now tracker is trending toward 1.6% growth. 2

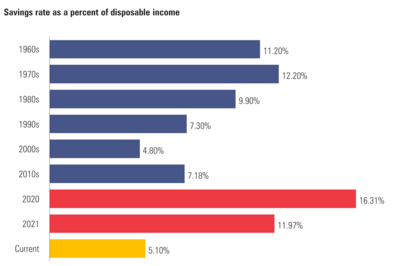

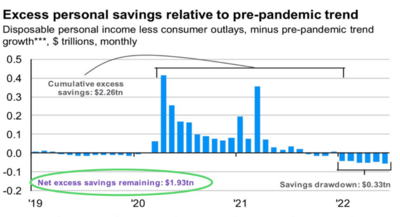

Second, the U.S. consumer is sitting on plenty of firepower in the form of accumulated savings. While the consumer has returned to normal on their savings rate they are still sitting on a large stockpile of spendable cash. 3 4

$1.93 trillion in excess savings can translate into nearly 8% of GDP.

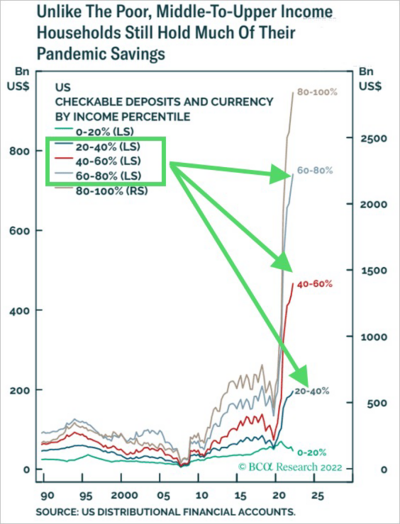

While its certainly true the highest income cohort is sitting on the largest savings and historically does not spend down their nest egg, the middle 60% have tremendous reserves and propensity to spend. 5

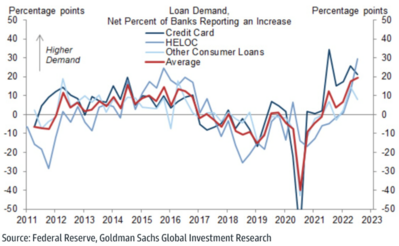

Further, consumers are turning to readily available credit sources to continue to spend. 6

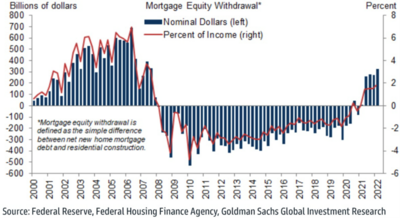

Most interesting is the increase in home equity lines of credit. This form of borrowing is at levels not seen since the Great Financial Crisis. 6

To most, increased borrowing would be a bad thing, and from a financial planning perspective it certainly is. However, from a near-term macroeconomic and corporate earnings perspective, it should propel earnings beyond current expectations.

This is my case for optimism in the third quarter.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: