A Chance at a Soft Landing

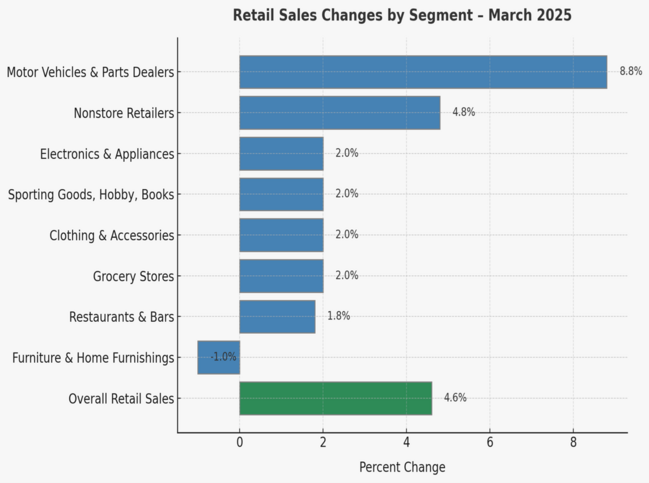

The US Consumer once again contradicted their self-reported dour mood and continued to spend in March. Retail sales were up 4.6% year over year. Some of this was a pull forward in consumption driven by the tariffs on autos, although almost every segment saw increases in consumption.1

Consumers are saying they’re concerned but clearly keep shopping, and that will likely drive corporate earnings growth into Q2.

In the face of massive market volatility, Q2 S&P 500 earnings are expected to grow by 7.2%, which is very similar to the expectations for Q1 earnings which are being released now. These growth figures are solid in any quarter.2

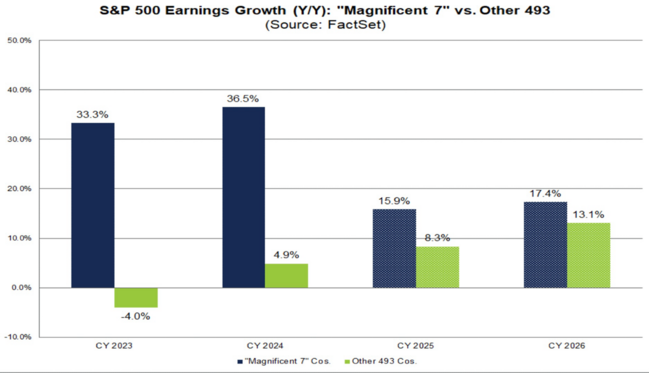

Don’t be fooled by all the negative talk about the Magnificent 7 (Apple, Facebook, Amazon, Nivida, Google, Microsoft, and Tesla) as they continue to drive massive earnings per share growth. 15.9% in 2025 is outstanding in any year for mature companies that are primarily service oriented. That’s 50% higher than the S&P 500 cumulative growth expectations for 2025 (10% according to FactSet).3

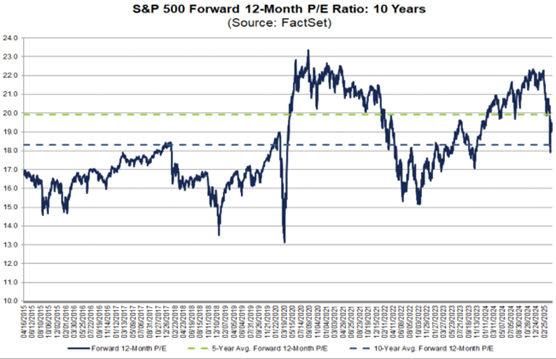

This continued earnings growth combined with the market correction means that valuations are returning to near normal levels based on both 5-year and 10-year averages. That’s good for buyers of equites.4

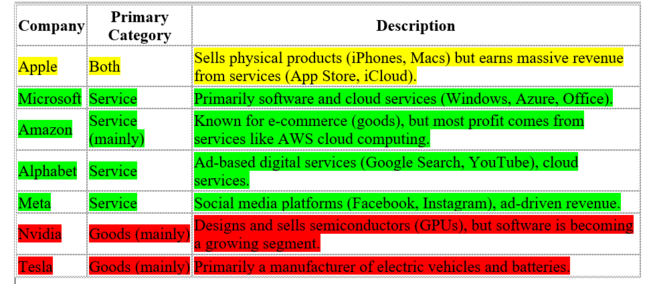

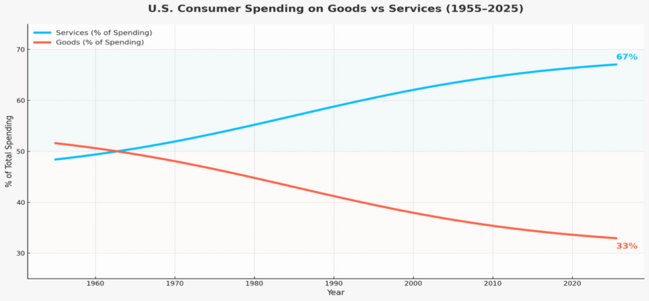

Though the focus has been on tariffs, one nuance that might go unmentioned is that the tariffs apply to goods only (or at least so far). There is no debate that we are a consumption economy. However, we have shifted from goods to service consumption, and that provides a layer of protection for corporate earnings, especially for the Mag 7.5

One reason I believe the consumption trend could continue is that many consumers are not overly affected by the stock market decline. The middle class and lower income cohorts' wealth is in real estate, which is still at all time highs. While they may be in a bad consumption mood they are still doing well overall.6

As hard as this trade war is, the service economy can still give us a chance for a soft landing, but time is growing short. Consumer and corporate concerns are mounting. The “hard trade war” must soften soon!

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- Monthly Retail Trade - Sales Report

- FactSet Insight - Commentary and research from our desk to yours | Earnings

- Are “Magnificent 7” Companies Still Top Contributors to Earnings Growth for the S&P 500 for Q1?

- S&P 500 Forward P/E Ratio Falls Below 10-Year Average of 15.0

- Consumer Spending | U.S. Bureau of Economic Analysis (BEA)

- How much wealth does the American middle class have? | USAFacts

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.