A Glimmer of Hope & Portfolio Humility

Hope is not an investment strategy and humility is at the core of managing money.

A transitioning inflationary picture has been our thesis for over 18 months. It’s been a much longer process than anticipated and, along the way, we used humility to adjust portfolios.

✔ Transitioned some large cap growth to quality to capture better pricing power in companies – mid-March 2022

✔ Added base industrial metals like copper for a commodity super cycle and inflation – mid-April 2021

✔ Increased our exposure to MLPs (energy pipelines) to hedge inflation and supply demand constrains – mid-January 2022

✔ Added health care exposure to hedge inflation with better pricing power in companies – January 25, 2022

All these actions provided some anchor to windward as we faced what we believe to be supply-side driven inflation; albeit much longer lasting than expected.

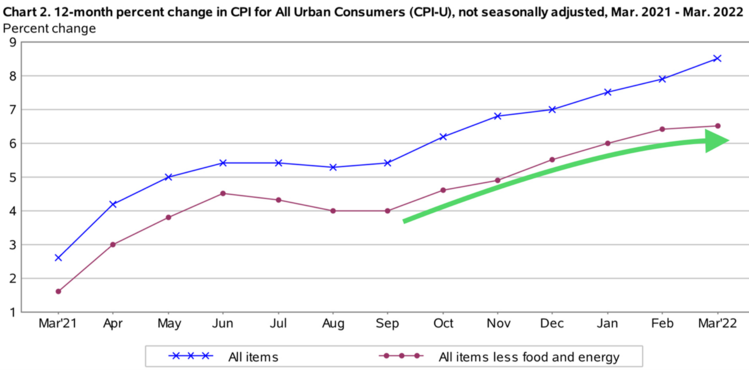

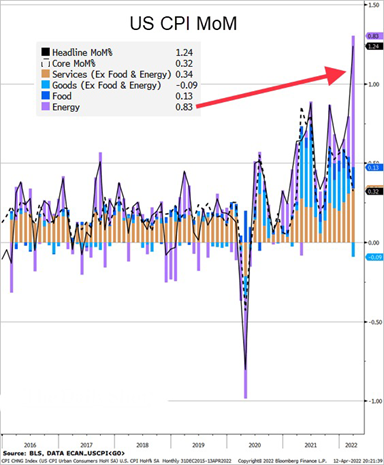

For the first time in a long time, we saw a glimmer of hope in reported inflationary data last week. Core CPI (inflation minus food and energy prices which are incredibly volatile) rose at a moderating pace in March. 1

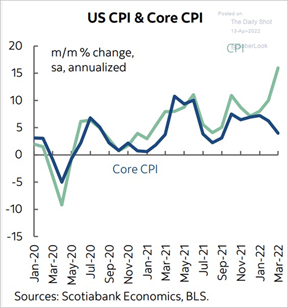

I could be accused of seeing things I want to see—and that’s a fair criticism—yet, the rate of change in core CPI is easing, especially compared to all items CPI. Looking at the month-over-month on an annualized basis provides some better clarity. 2

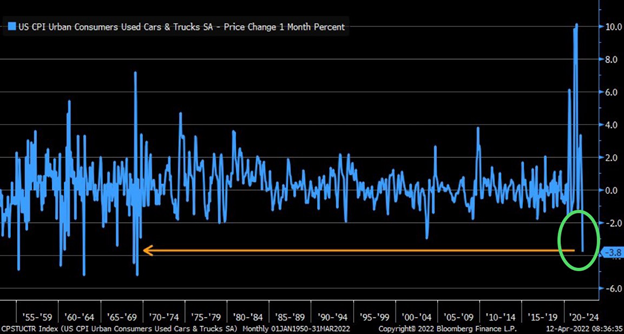

Deflation in used auto prices helped. Recall last year when used auto prices were rising by 10% a month; now they are dropping. This is part of the base effect, perhaps. 1

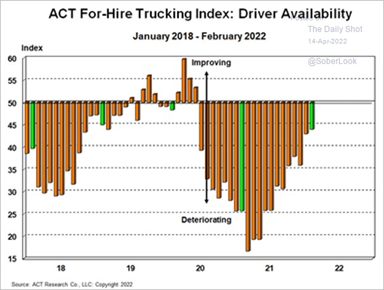

When it comes to supply chains, we are seeing some easing on the transportation front. Driver availability constraints look to be lessening. 2

Still, headline inflation is at peak levels. The Fed will likely tumble towards a 50bp rate increase in May, even though much of the headline is driven by energy prices. No explanation needed; we all get what’s going on with energy prices. 1

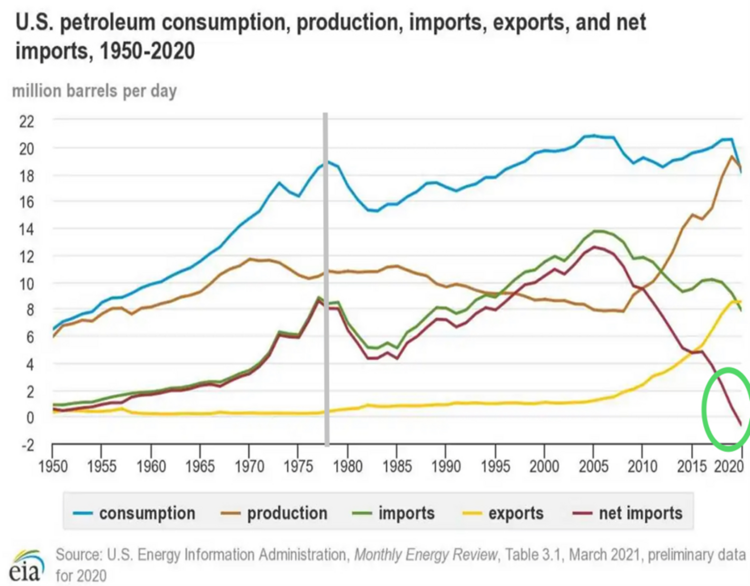

The drumbeat of 1970s-style inflation is on the minds of many and it is the nearest headline to grab ahold of. However, the 1970s were plagued with a series of bad policy decisions, embargos, and energy wars. Today, the United States is in a materially different spot. We are now almost entirely energy independent with net imports near zero in 2020 and not too dissimilar in 2022. 3

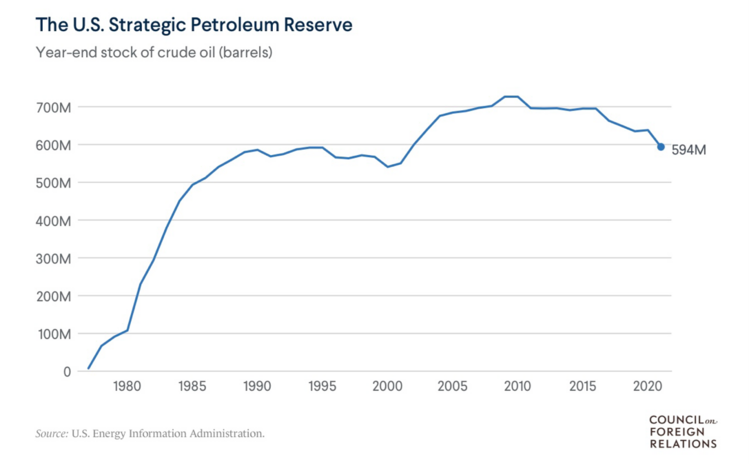

With the summer driving season fast approaching, it’s hard for the political class to tolerate high prices at the pump considering they have a tool at their disposal. The Strategic Petroleum Reserve has nearly 600 million barrels of oil buried in caves in Texas and Louisiana. The President has the authority to release up to 4.4 million barrels a day with the stroke of his pen. That makes up almost 50% of our imported oil. 4

We anticipate more releases from the Strategic Petroleum Reserve which would help moderate energy prices and provide a little more inflation relief in the coming months.

Staying convicted to a moderating inflation picture has been challenging, yet there are glimmers of hope. However, we’ve also positioned portfolios for humility in being wrong. Knowing that we don’t know a lot is part of the investment process.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: