A House Divided

While President Trump extends the drama of the election to energize his base for his post-political career, the outcome is certain: President-elect Biden will face a divided Congress when it is all said and done.

There will be two runoff Senate races in Georgia this coming January and the results from those will determine the final balance of power in the Senate. It is unlikely that Republicans will lose both and, in fact, only need to pick up one seat in a largely Republican state. Senator Kelly Loeffler will face a runoff as she and other republican candidates split votes in the general election but combined, they have over 49.3%. [i]

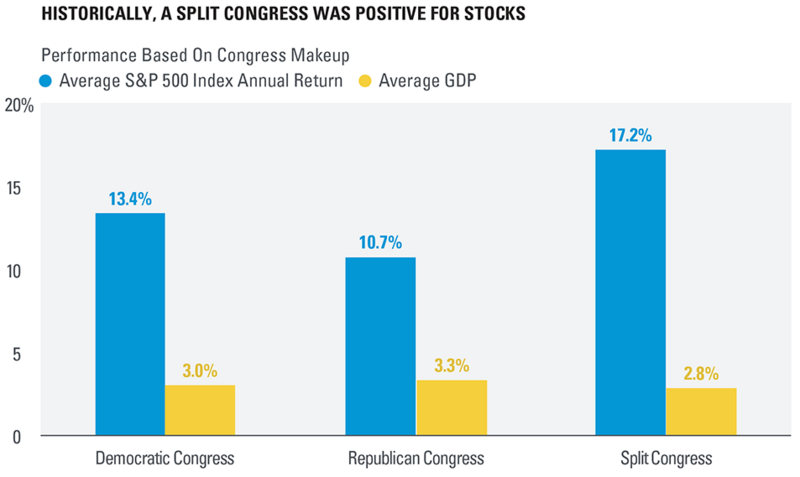

With a divided government, markets have done exceedingly well. [ii]

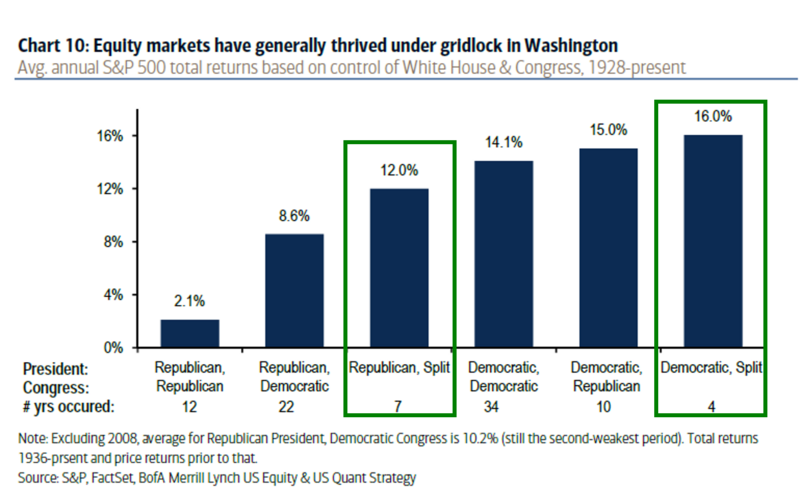

Per Merrill Lynch, since 1926 the S&P 500 has returned about 16% annually when there is a Democratic president and a split congress. When there is a Republican president and a split congress, the S&P 500 has returned approximately 12%. [iii]

The theory goes that a divided government creates a moderation that typically benefits free markets. With little in the way of onerous regulations or tax policy, companies are better able to generate profits.

We can expect very little in the way of meaningful legislation other than another round of pandemic relief before year-end. Senate Republican Leader McConnell said on November 4th that, despite prior reservations about passing new pandemic relief legislation before the end of the year, he now believes Congress should do so. He also signaled greater openness to state and local fiscal aid than he had before the election. The timing is hard to predict, as it is unclear whether President Trump and Speaker Pelosi will agree with McConnell on the details and size of a package, and the Georgia runoff elections further complicate the political incentives on both sides. For reference, here are some details on Joe Biden’s proposed pandemic relief package: [iv]

• Provide for additional direct payments to individuals and families should conditions require

• Forgive a minimum of $10,000 per person of federal student loans

• Increase monthly Social Security checks by $200 per month

• Provide emergency paid sick leave to everyone who needs it

• Ensure that no one has to pay out of pocket for COVID-19 testing, treatment, or vaccine

• Provide necessary fiscal relief to states so their workers get the help they need

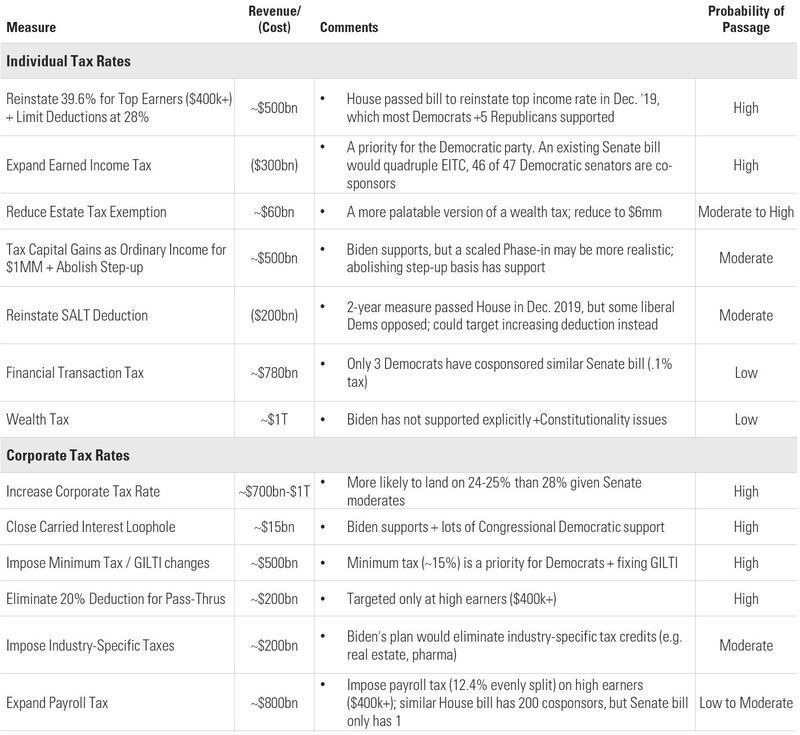

The need for additional deficit-funded pandemic relief will more than likely render the Biden tax plan, highlighted below, all but dead for the foreseeable future. [v]

While any president would have a difficult time raising taxes right away in the middle of a pandemic, there is almost nothing Republicans and Democrats agree on in terms of tax policy, which means that little will happen while Washington remains in a divided government.

*Upcoming Phillips & Co. Webinar*

Q&A with Morgan Housel | December 10 at 10:00 a.m. Pacific

Tim will interview Morgan on his new book, "The Psychology of Money"

They will explore topics like: Luck & Risk, Compounding, Getting Wealthy & Staying Wealth

Click here to Register

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.nbcnews.com/politics/2020-special-elections/georgia-senate-results

ii. https://lpl-research.com/hoc/images/full/historically-a-split-congress-was-positive-for-stocks.png

iii. https://markets.ml.com/

iv. https://joebiden.com/the-biden-emergency-action-plan-to-save-the-economy/#

v. https://www.pimco.com/en