A Little Colder

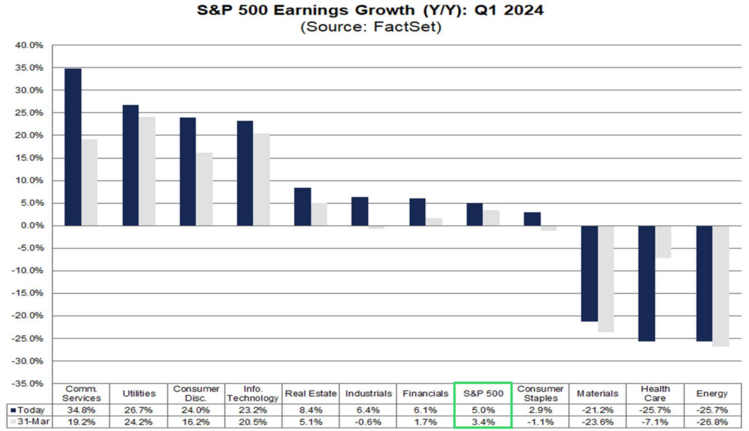

U.S. companies are finishing Q1 2024 earnings season on a strong note. So far, 80% of S&P 500 companies have announced earnings and they have exceeded expectations. If the 5% growth rate holds, this would be the highest earnings growth rate since Q2 2022 as per FactSet. 1

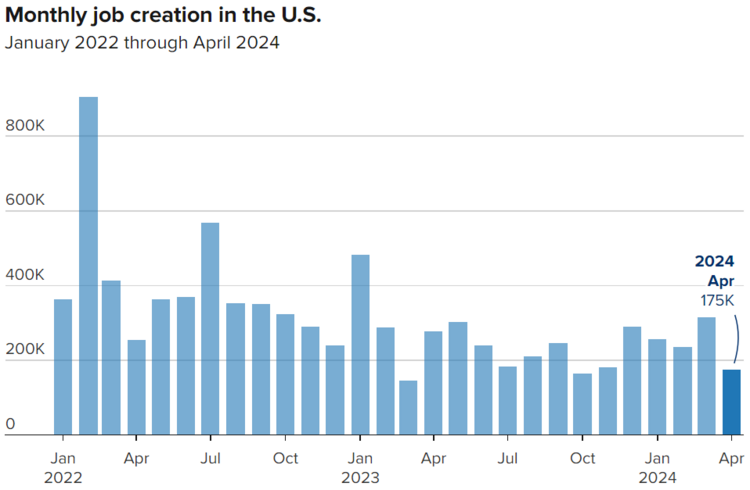

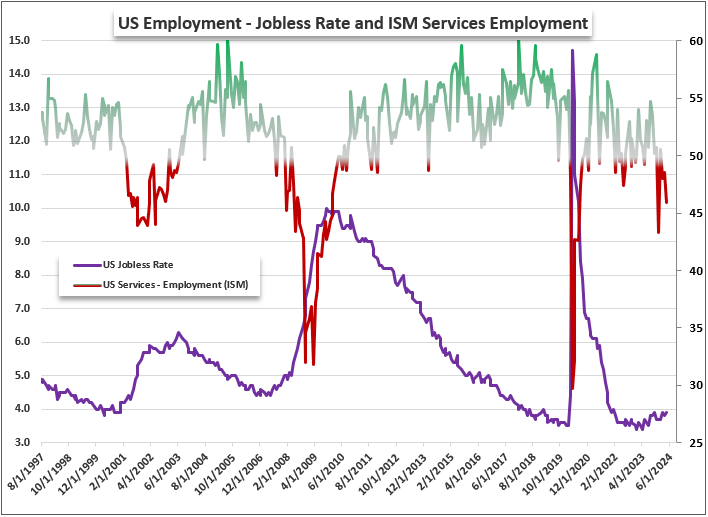

Simultaneous to great corporate earnings, the jobs market is finally slowing down. In April, the U.S. economy only saw 175k new jobs. That’s much lower than the anticipated 225k. 2

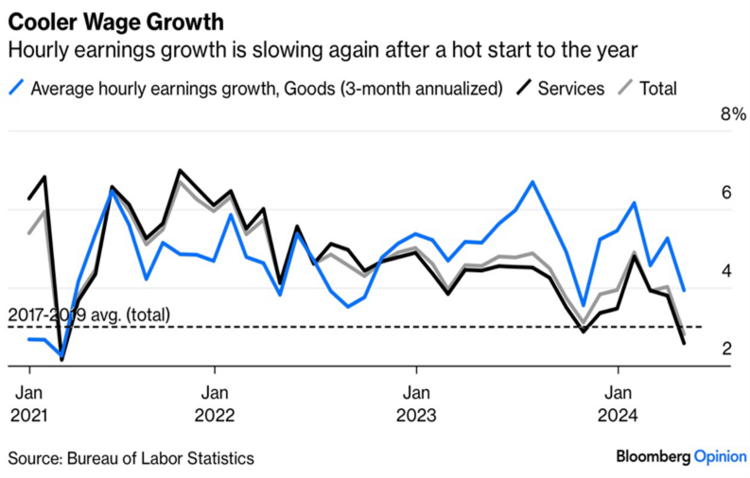

In addition, wage growth is cooling in both the services and goods-producing sectors. 3

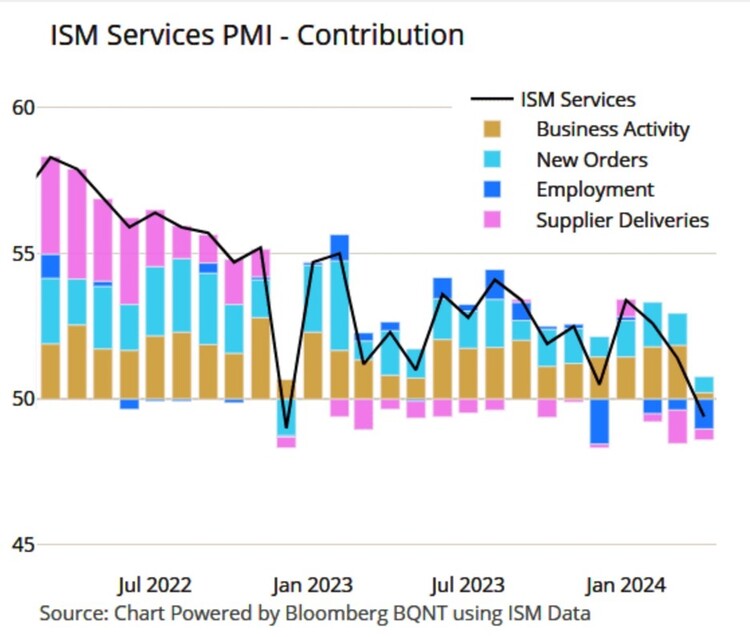

One of the drivers of lower growth in wage inflation is a slowdown in the services sector. According to a recent reading from the Institute of Supply Management (ISM), the ISM Services index dipped into contractionary territory. 4

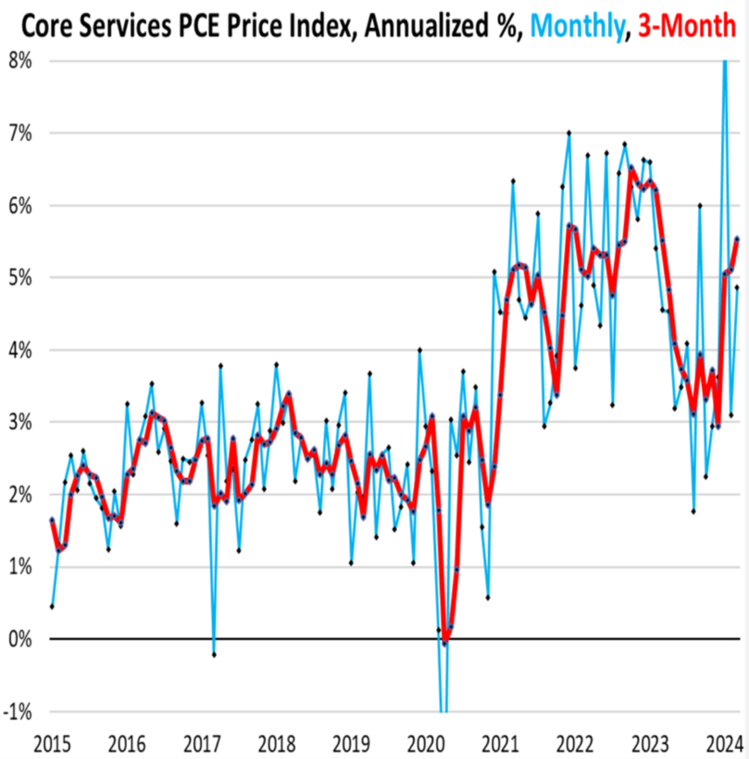

All of this is to say we should expect to see some more easing of inflation – especially in the red-hot services sector. Services inflation has been the main challenge for the Federal Reserve and their interest rate-setting committee. 5

As the U.S. services sector contracts, we can expect softness in employment and slower inflation to persist. 6

While one jobs report doesn’t make a trend, the reality is that there are early warning signs that the Fed should lower rates. Corporate earnings growth can persist as long as the Fed does not crush the labor market too much. Emerging markets and longer-duration fixed income should benefit from this. Those are areas we have tilts toward in many cases.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_050324.pdf

- https://www.cnbc.com/2024/05/03/jobs-report-april-2024-us-job-growth-totaled-175000-in-april.html

- https://www.bloomberg.com/opinion/articles/2024-05-03/markets-were-confused-and-misled-the-fed-wasn-t

- https://thedailyshot.com/

- https://wolfstreet.com/2024/04/26/feds-wait-and-see-on-rate-cuts-further-supported-by-extra-hot-core-services-pce-inflation-hot-core-pce-inflation/

- https://x.com/JohnKicklighter/status/1786435128723468489