A Little Silver Lining

As we approach what will likely be one of the most consequential elections in a long time―perhaps met with anger, conflict, and strife―there is some good news to reflect on.

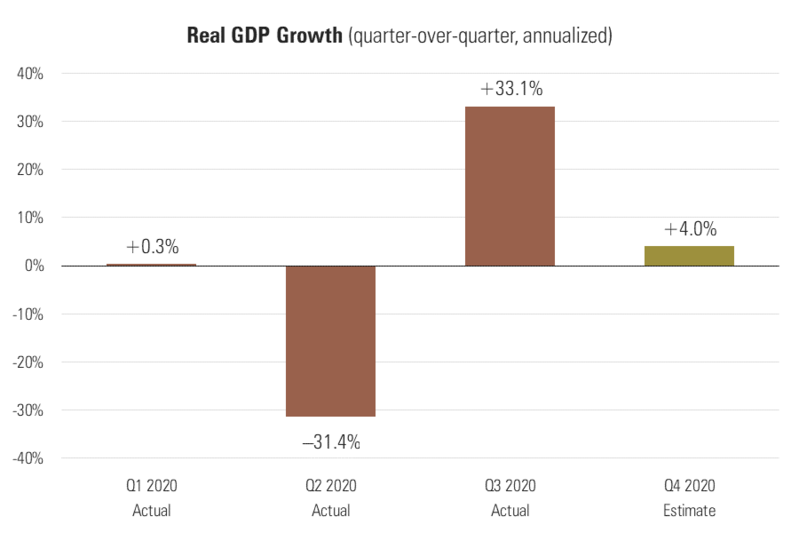

First, GDP for Q3 posted a record 33.1% annualized growth rate, coming off a tragic drop of 31.4% in Q2. [i]

This recovery would represent about 75% of the lost ground from the COVID low seen in Q2.

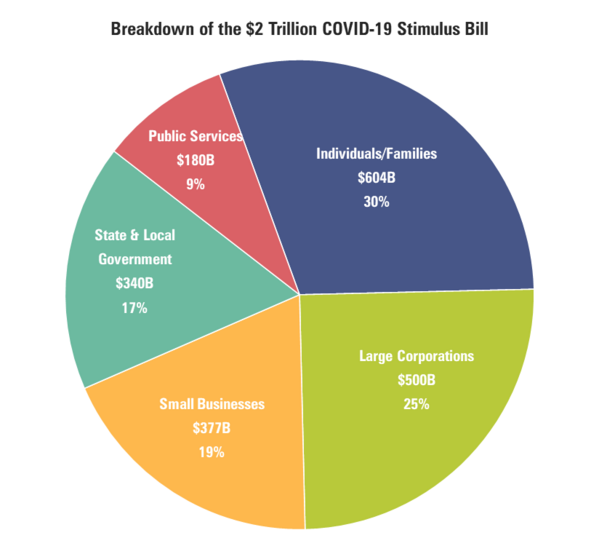

Of course, this is the outcome after over $2 trillion in stimulus. [ii]

It is hard to gauge how accurate the fiscal policy transmission was but, it certainly hit the mark when it came to the consumer.

Consumption added over 25 percentage points of the 33.1% GDP growth in Q3. Put another way, consumption was 75.3% of GDP.

Personal income also rose 0.9% in September. [iii]

That certainly reflects a recovery from the post-COVID depression in jobs, income and spending.

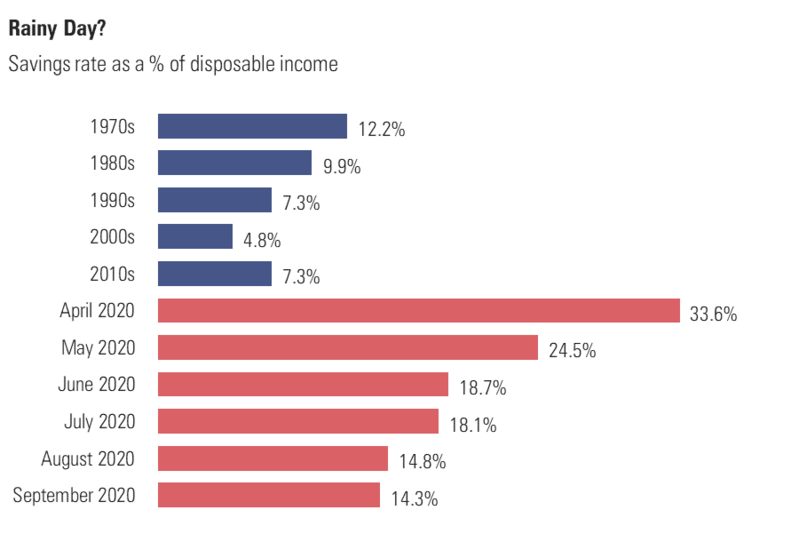

Once again, we are also seeing a drop in savings as consumers spend down their precautionary savings. The savings rate dropped from 14.8% in August to 14.3% in September. [iv]

This added approximately $92 billion to U.S. GDP.

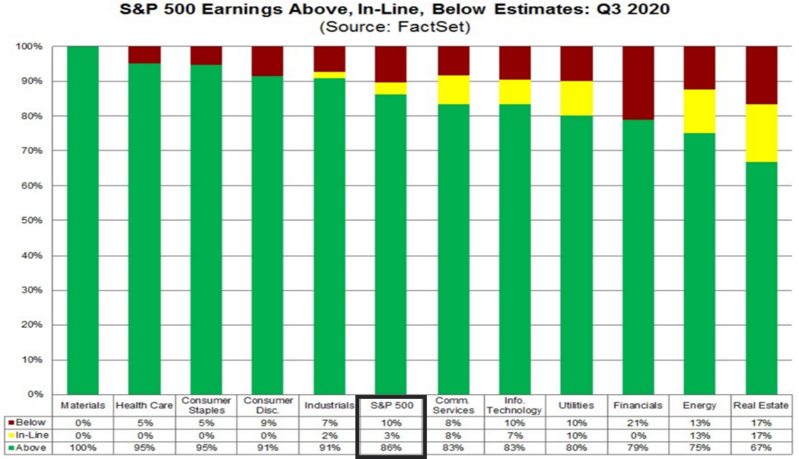

All these silver linings are reflected in U.S. corporate profits. According to FactSet, positive Q3 corporate earnings surprises are coming in at a record of 86%. [v]

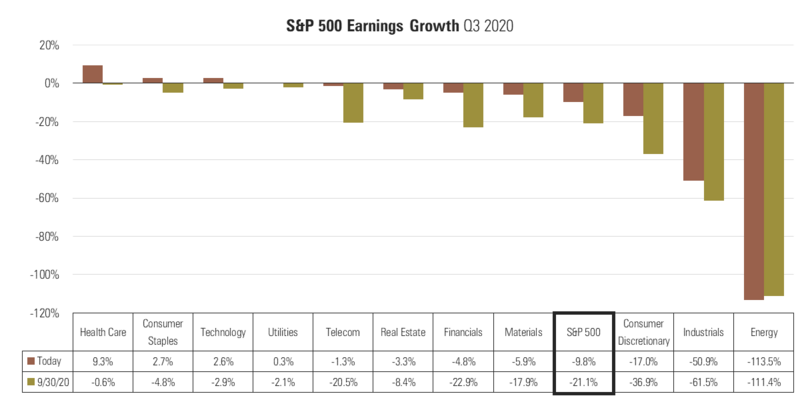

Although there is still an earnings recession in place, Q3 earnings continue to come in better than expected, with 64% of S&P 500 companies reporting as of Friday. As you can see, earnings are exceeding September expectations. [v]

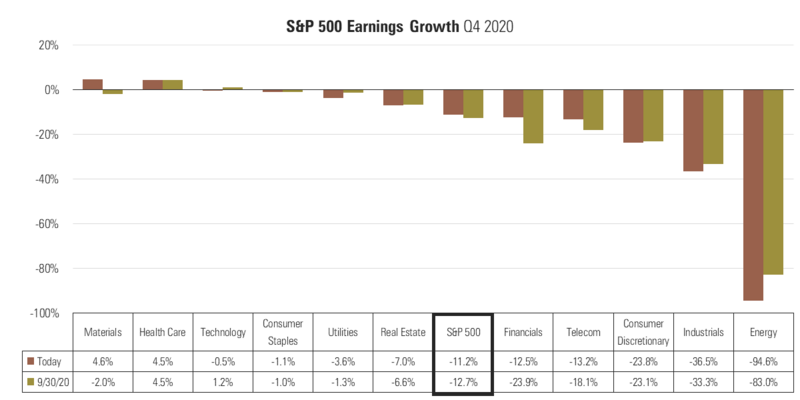

Looking forward there appears to be improving expectations for Q4. [v]

Rolling forward to 2021, there is a downshift in expectations although still in growth territory. Let’s realize it will be hard to do worse in 2021 compared to the full economic shutdown in 2020.

There is one opportunity to exceed expectations and perhaps put a base under our equity markets during the coming weeks of highly anticipated volatility: the passage of the $2 trillion-dollar stimulus package.

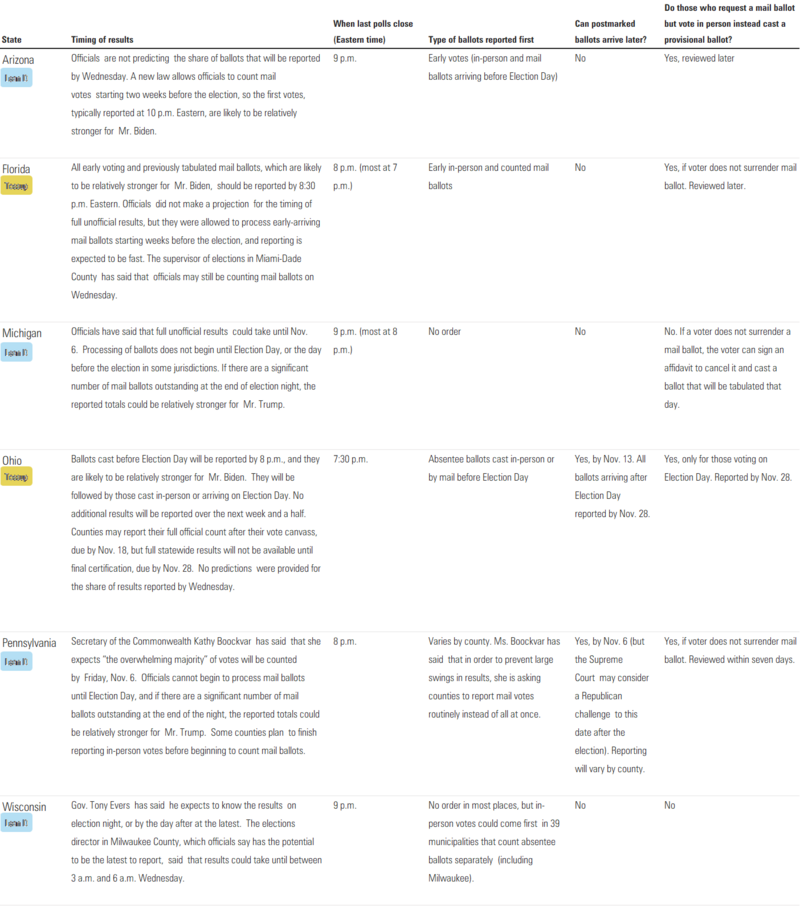

Without the stench of politics, I believe the political class will come together and get something done. However, that will require a resolution to the election. According to the New York Times, here are key timings for election results in swing states. [vi]

Unfortunately, Ohio has the latest reporting date of November 28th. It is likely if this election is close and comes down to one state, or if there is a dispute, stimulus will be placed on hold. That will likely put any economic silver linings in jeopardy.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/series/GDPC1

ii. https://www.visualcapitalist.com/the-anatomy-of-the-2-trillion-covid-19-stimulus-bill/

iii. https://fred.stlouisfed.org/series/DSPIC96

iv. https://fred.stlouisfed.org/series/PSAVERT

v. https://insight.factset.com/topic/earnings

vi. https://www.nytimes.com/interactive/2020/10/27/upshot/election-results-timing.html