A Recession – The Medical Antidote to the Virus

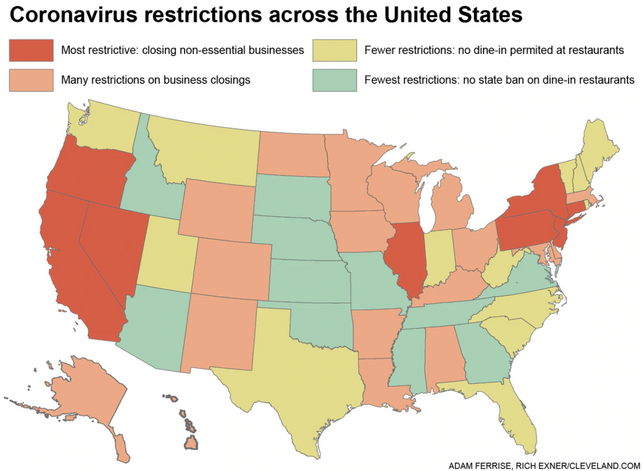

At the time of this writing, a full 25% of Americans have been ordered to stay at home in an effort to contain the spread of COVID-19. [i]

By the time this blog is published, we may very well wake up to a Monday in America that has our entire nation shut down aside from “essential services.”

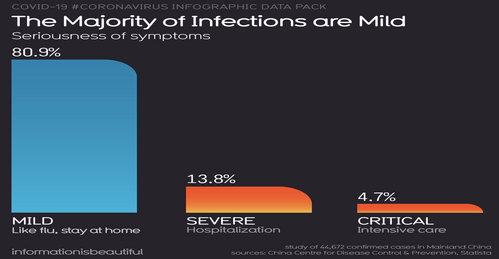

Let’s first deal with a common reprise that this is a widespread overreaction. After all, the virus has stricken 32,356 Americans, with at least 414 deaths. According to the CDC, the common flu afflicts between 9 million and 45 million Americans each year, resulting in 12,000 to 61,000 deaths. However, COVID-19 has a significantly higher mortality rate than the flu and is more easily transmitted.

“You are always behind where you think you are” -NIH

The real bottle neck with the current numbers is the fact that what we see reported today is a mere fraction of what is occurring in our country. Simply put, the data is growing exponentially, and we are at a minimum of a 14-day lag.

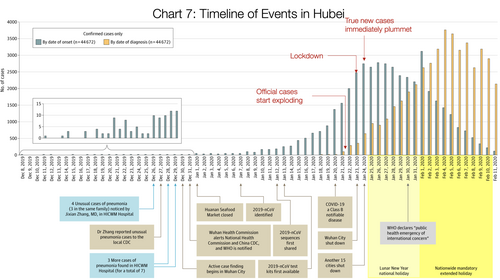

Using Hubei Province in China as an example, the gray bars in the chart below represent the true cases when authorities looked back at the data and the orange bars represent the official cases. You can see on January 21st, official cases were as low as 100, but when looking back at reports from hospitals the true cases were over 1,500. [ii]

Everything we see in the data now will be 15 times worse in the coming days.

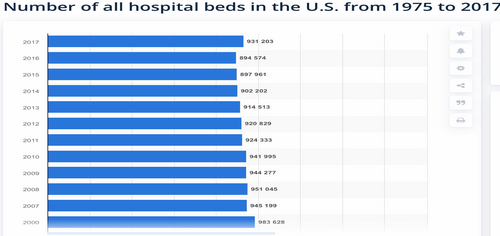

Consider the cases we see as a numerator with the available hospital beds as the denominator. Here are the number of beds in the United States: [iii]

The United States has fewer than one million hospital beds. Drilling down to ICU beds, the denominator looks even worse. According to data from Johns Hopkins Center for Health Security, we have less than 200,000 available ICU beds. Now looking at current rates of hospitalization, cases over 6.9 million would swamp our health care system leaving no room for other ailments that afflict Americans. Stopping this now is a health care crisis—period.

Overreaction today will also save the lives of even those who need hospitalization for other things (car accidents, heart disease, and other emergencies).

So our local, state, and federal governments have responded to the health care accessibility crisis by stopping the economic heart of our country.

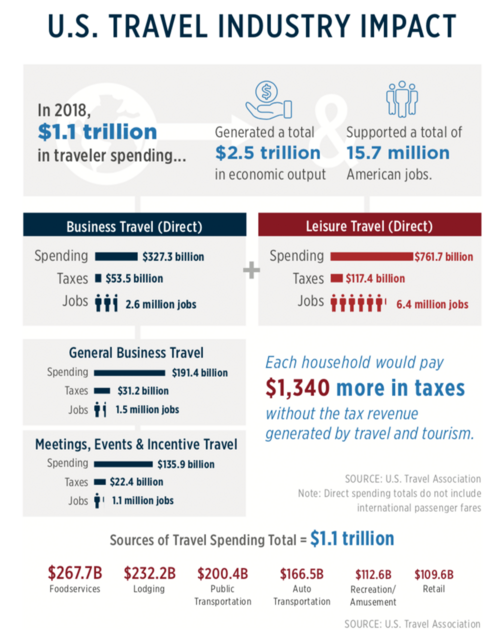

If we weren’t in a recession last week, we certainly are now. Unemployment rates are rising rapidly with mass layoffs and furloughs across the country. The travel, leisure, and hospitality industries are shutting down and just those jobs alone represent a significant numbers of workers. [iv]

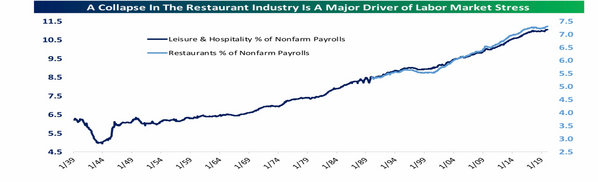

Put another way, leisure and hospitality represent 10.5% of nonfarm payrolls and restaurants represent about 7.5% of nonfarm payrolls. Large numbers! [v]

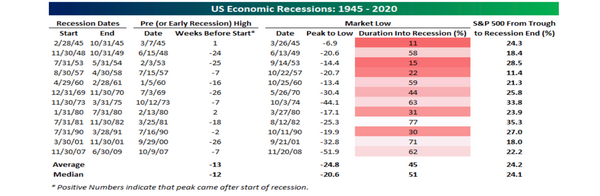

Before we all run for cover, much of this short-run economic demise has been baked into the cake in my opinion. With a 30% drop in equity prices, the markets have built-in a certain recession. The question is how deep and how long? [v]

China might be the key.

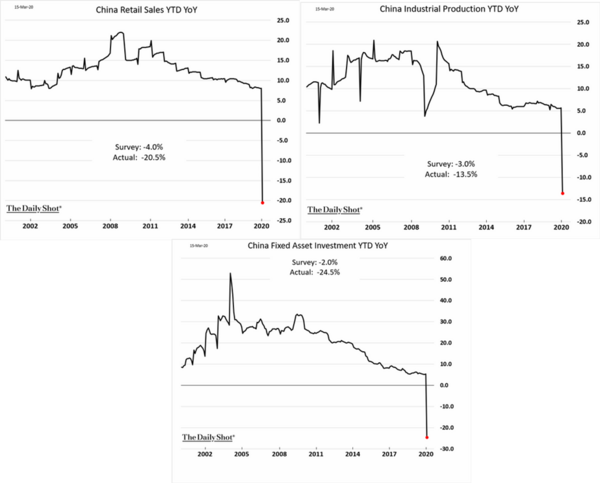

Last week, China reported four days in a row of zero new COVID-19 cases. They also published their first look at economic data from their “shelter in place” protocols. Retail sales dropped 20%, industrial production declined 13.5%, and fixed asset investment dropped 24.5%, just to name a few statistics. [vi]

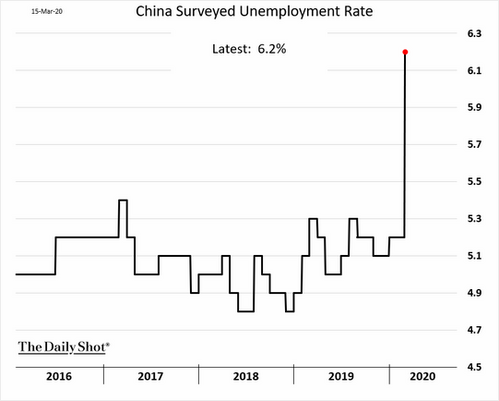

More importantly, unemployment jumped to 6.2% from 5.2% in just one month. [vi]

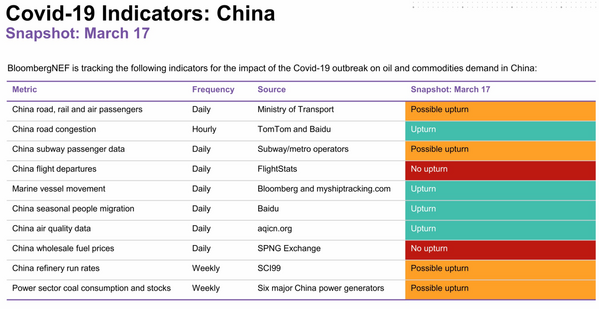

Once the home quarantine protocols were lifted, China saw their economy begin to thaw and is now reporting upturns in several categories: [vii]

China applied significant fiscal stimulus to their economy in anticipation to shock their economy out of cardiac arrest and it seems to have worked.

Much of our recovery will be predicated on the fiscal stimulus pumped into our economy. Under a normal recession a Keynesian fiscal stimulus approach of pumping money into the consumer’s hands works. However, with this pandemic-induced recession, special fiscal policy will be needed.

Consumers will need survival money while the economy is on ice and businesses will need relief from taxes and other obligations until the consumer can be released from shelter in place and resume their ordinary lives.

Currently, a whopping $2 trillion in stimulus– about 9% of our GDP– is being considered by congress in a rare bipartisan approach. A host of methods to get cash to consumers and businesses are being considered, namely:

- Unemployment insurance that replaces nearly all income lost. Typically, only about 57% of wages are replaced– getting this to nearly 100% will provide current cash to sustain employees and allow employers to reduce costs ASAP.

- Loans to small businesses. The Trump administration is targeting up to $50 billion in available loan funds, in addition to a one-year deferment before repayment begins.

- Medicare and Medicaid expansions for states.

- Targeted loans to the most impacted industries (hotels, airlines, hospitality).

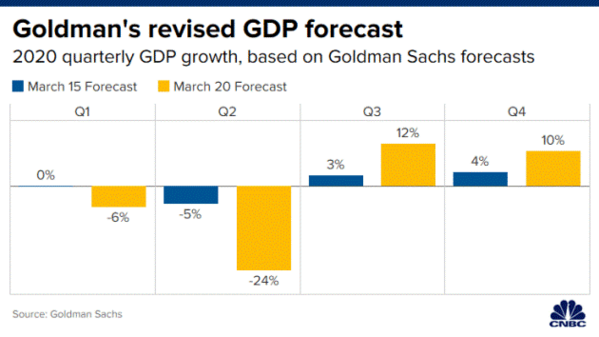

While the contraction will be painful, the good news is the recovery can be tremendous. Goldman Sachs suggests we might have a 20% decline in Q2 GDP growth, following a 6% drop in Q1. The silver lining is the economic recovery they predict will be quick, with 12% growth in Q3 and 10% growth in Q4. [viii]

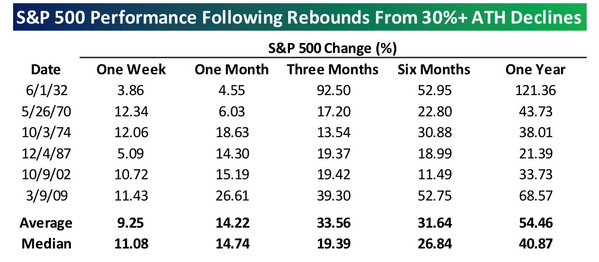

In my opinion, with equity prices down more than 30%, a recession has already been anticipated. After 30%+ declines from all-time highs, markets generally have strong recoveries with one-year averages of 54%. [v]

Recessions are not something you want to mess with unless you are prepared to declare a fiscal war against it. This recession is necessary as part of the prescription for saving lives and our health care system. I expect the antidote to both the virus and the recession will be the largest fiscal stimulus this country has ever seen.

When we get through this troubling period, I predict the following:

- A global commission on virus detection and eradication that sets the protocols for private capital to flood this very space.

- Privatized virus detection that is not dependent on the United Nations, with the sole purpose of pursuing “patient zero” quickly and decisively.

- Internet access equity between rural and urban America as the gap for the poor and rural is causing a strain on education and tele-health. Likely, a national effort to roll out true 6Ghz 5G with dramatically reduced red tape.

- Increases in research for vaccines that are quick to market, along with FDA reforms.

- New styles of work as employees and business learn to adapt to work-from-home vs. large and expensive commercial spaces.

- Interest rates much lower for much longer.

- An OPEC+ to induce consultation from the United States to adapt energy supplies to meet changing demands.

Your entire team at Phillips and Company is here to serve you in this anxious and uncertain time. We hope you and your family are healthy and safe.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.cleveland.com/metro/2020/03/50-states-of-coronavirus-how-every-state-in-the-us-has-responded-to-the-pandemic.html

ii. https://jamanetwork.com/journals/jama/fullarticle/2762130

iii. https://www.statista.com/statistics/185860/number-of-all-hospital-beds-in-the-us-since-2001/

iv. https://www.ustravel.org/sites/default/files/media_root/document/Coronavirus_2020_Impacts_WEB.pdf

v. https://media.bespokepremium.com/uploads/2020/03/The-Bespoke-Report-032020.pdf

vi. https://blogs.wsj.com/dailyshot/

vii. https://about.bnef.com/

viii. https://www.cnbc.com/2020/03/20/goldman-sees-an-unprecedented-stop-of-economic-activity-with-2nd-quarter-gdp-contracting-by-24percent.html