A Tale of Two Forecasts – The Consumer Debt Service Moat

I don’t put much weight into forecasts especially when it comes to long-term investing. Even those with the most access to the best data get it wrong. That point is made abundantly clear by our friend and bestselling author Morgan Housel. Take a quick look at this very short video to see what he’s talking about.

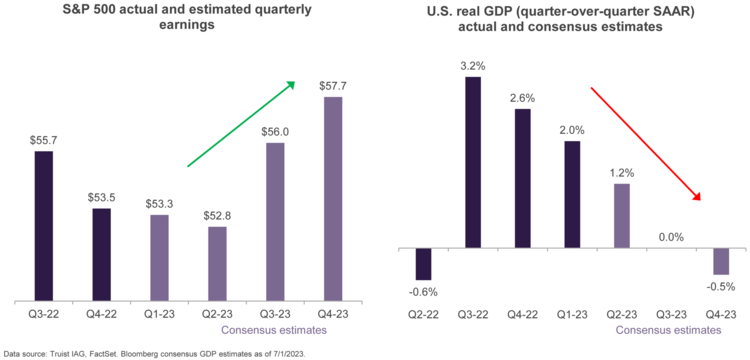

The modern-day version of the forecast fallacy is the large gap between what analysts believe corporate earnings will look like next year compared to expectations for economic growth. 1

It’s hard to reconcile a strong corporate earnings picture and a dour GDP growth forecast. It’s exactly why I put little weight into forecasts. However, I tend to favor the earnings expectations compared to the GDP expectations.

Economists that are forecasting GDP numbers are probably overreacting to the current interest rate picture. They are well educated traditionalists. Rising rates should crimp consumer spending, create a drag on jobs, and pull the overall economy into a recession. That’s reasonable from a historical standpoint.

But what if the consumer doesn’t react in a traditional way to rising rates? What if the consumer is perhaps a little sheltered from some of the rate increases for now?

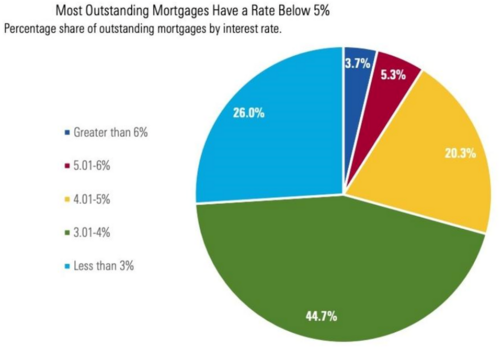

The most obvious area in consumer debt is in home mortgages. Coming off historically low interest rates gave most homeowners a chance to buy or refinance at very low rates. In fact, 91% of mortgages are below 5%. That adds remarkable strength to the consumer balance sheet and a wider moat from rising rates. While this might create some drag on secondary home sales, it’s not really hurting new construction. 2

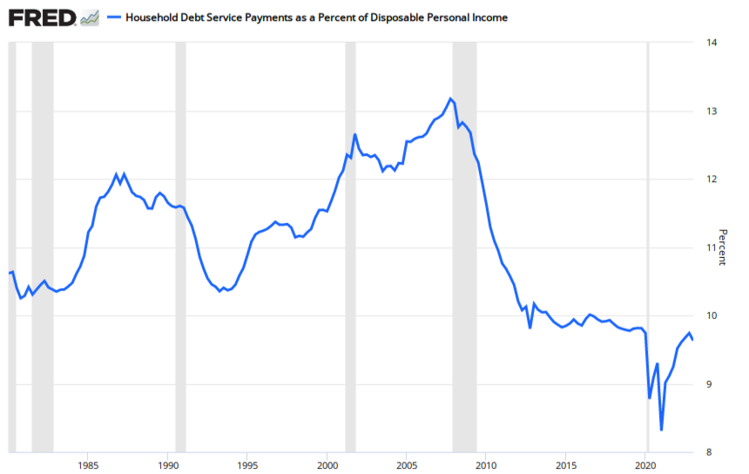

Further, consumers coming out of the Great Financial Crisis lowered outstanding debt levels. Couple that with near-zero rates from the past, and the consumer is not burdened by servicing large balance, high interest rate debt. 3

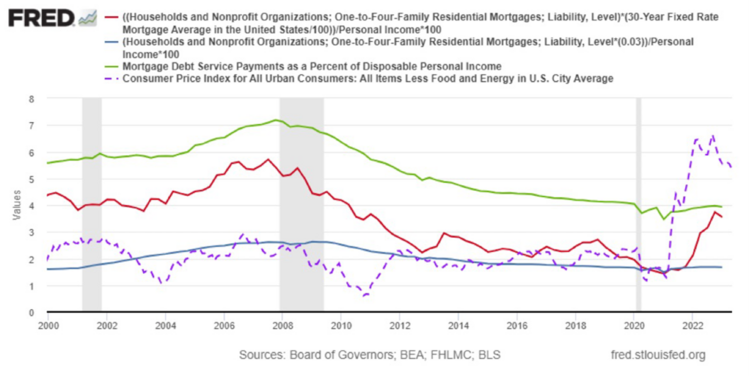

If we review overall debt service compared to mortgage debt service; the strength in the consumer balance sheet is profound. While consumer prices have risen (purple), mortgage debt service as a percentage of disposable income (green) has actually flatlined. 4

Again, my nontraditional view is the consumer is somewhat protected from the current spate of rising rates.

The consumer debt service moat is one reason we can have a soft economic landing while inflation cools naturally. I tend to favor those that forecast corporate earnings over economists that try and forecast economic growth.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: