"After a Wild Week on Wall Street, the World is"…the Same

This magazine hangs in our offices as a constant reminder that the more things seem different and difficult on Wall Street, the more they stay the same.

I saved this Time magazine from the crash of 1987 as I was just two years into my career. At the time, the volatility seemed unsurvivable and indeed the world appeared to be different.

Like with most things I have seen "on Wall Street" in the past 28+ years as a professional investor, I'm comforted by a long-term perspective.

This week was another example of a wild week:

- Ebola in Texas and an inept US Government response.

- ISIS on the Turkish border with limited reaction to our bombing campaign.

- What appears to be a global slowdown signaled by a collapse in oil prices.[i]

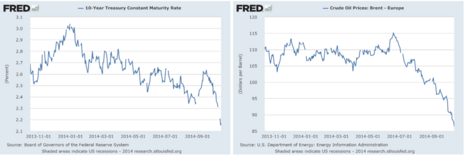

- A collapse in US interest rates with the 10-year treasury bond dropping from 2.61% to 2.17% since September 19th, 2014.[ii]

It's almost like investors have forgotten what drives valuation in equity prices. Truly over long periods of time, economic value drives price returns versus emotional value.[iii]

When I say economic value of a company, I'm talking about earnings per share growth and dividends. These are the two things investors can measure.

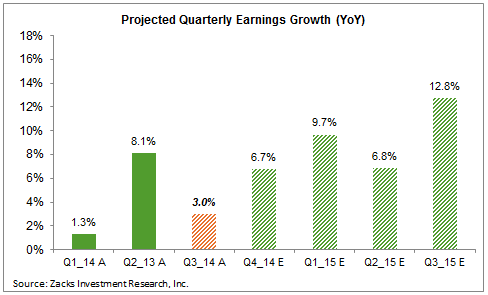

In recent postings, we have emphasized the upcoming earnings season as probably the most critical in years. With expectations so low for Q3, high for Q4, and valuations at peak levels, a lot rides on the outcomes. During this wild week, earnings season did ensue and there were some bright spots.[iv]

- 63.1% beat earnings per share expectations.

- Total earnings for the S&P 500 companies that have reported are up 2.1% year-over-year. (9.0% excluding the Finance sector)

- Revenues for these companies are up 5.3%. (5.6% excluding the Finance sector)

(Note: The finance sector’s earnings were impacted by the large litigation charge at Bank of America, which negatively impacted the overall results.)

While only 65 of the S&P 500 companies reported last week, we will see an onslaught of reports this week. Pay particular attention to the earnings per share growth numbers and the forward guidance from companies. If you see more Q3 numbers above 3.0% EPS growth and Q4 guidance above 6.7%, then markets may just well stabilize.[v] If not, expect more of the same volatility as last week.

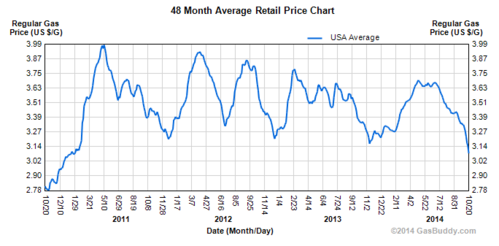

One special note on the significant benefits from the rapid drop in oil. While energy companies may suffer in the short run, the US consumer will receive a significant benefit. With gas prices down over 50 cents per gallon and at a 3-year low, the average US household will have an additional $500/year to spend.[vi, vii] I suspect this Christmas will be very beneficial to US retailers.

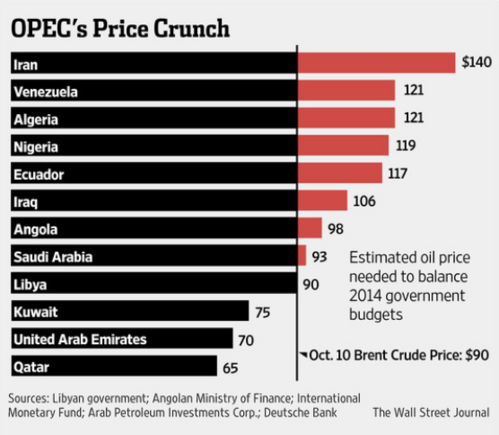

I would not expect this trend to last. Some believe the drop in oil prices is an intentional dumping by the Saudis in exchange for our willingness to bomb ISIS.

"Saudi Arabia wants to get Iran to limit its nuclear energy expansion, and to make Russia change its position of support for the Assad Regime in Syria"

according to Rashid Abanmy, President of the Riyadh-based Saudi Arabia Oil Policies and Strategic Expectations Center.[viii]

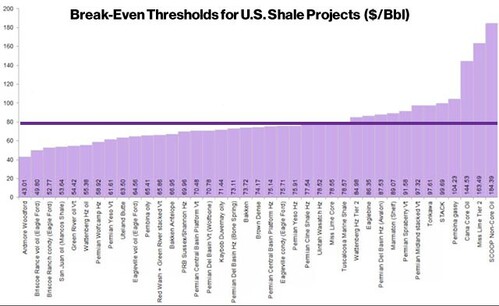

You can see from the chart below that our domestic oil production can survive some large cuts in oil prices.[ix]

With their $800 billion cash surplus, Saudi Arabia can run a deficit while we help them achieve their geo-political goals.[x,xi]

While things seem unstable, and in fact they are, the key themes should be:

- Earnings

- Extra consumer spending for the holidays driven by reduced spending on gas

- Interest rates staying lower for longer than currently anticipated

The actions we are taking are:

- Adding a bit of duration to fixed income as our manager has been doing

- Maintaining our US equity exposure

- Keeping a very watchful eye this week on earnings

As for all the rest of the events in the world, the more they seem different, the more the world seems the same to me.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] Federal Reserve Economic Data.

[ii] Ibid.

[iii] Bogle, J. (Jun 13, 2012). Thinking About What Lies Ahead for Investors. CFA Society of Washington.

[iv] Mian, S. (Oct 16, 2014). Is the Earnings Picture Good Enough?. Zacks Research. p 2-3.

[v] Ibid.

[vi] GasBuddy.com. (Oct 20, 2014). Regular Gas Average Retail Price Chart.

[vii] Randall, T. (Oct 17, 2014). Oil Is Cheap, But Not So Cheap That Americans Won’t Profit From It. Bloomberg.

[viii] Cabbaroglu, N. (Oct 10, 2014). Saudi Arabia to pressure Russia, Iran with price of oil. Anadolu Agency.

[ix] Randall, T. (Oct 17, 2014). Oil Is Cheap, But Not So Cheap That Americans Won’t Profit From It. Bloomberg.

[x] Ibid.

[xi] Faucon, B, et al. (Oct 10, 2014). Oil-Price Slump Strains Budgets of Some OPEC Members. The Wall Street Journal.