(Almost) Everyone Is Happy

If you review our Q3 Look Ahead, our declaration that “The Consumer is in Control” is clearly playing out beyond our forecast.

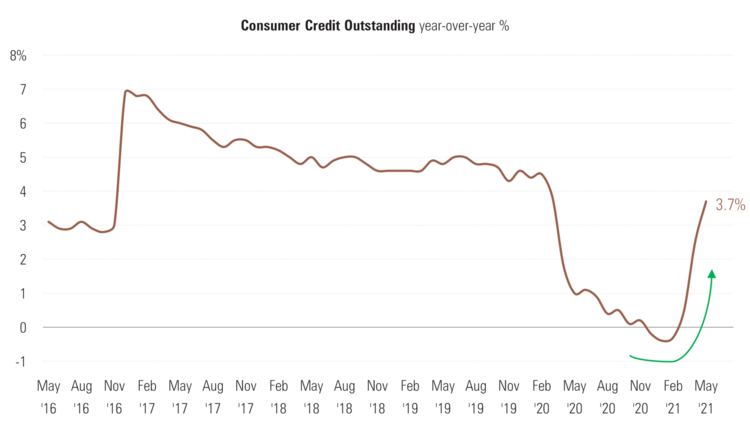

Recent data on consumer credit suggests the U.S. Consumer is looking pretty perky. [i]

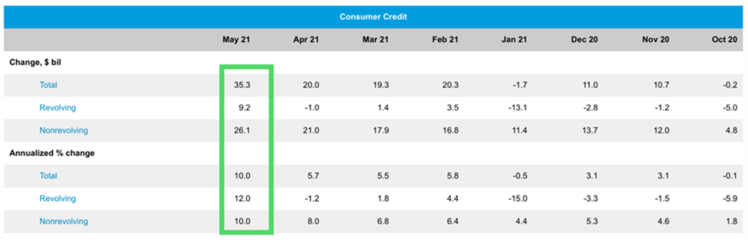

Consumers expanded their use of credit by a whopping $35 billion in May and expectations are looking strong for June as well. [ii]

Both revolving and non-revolving credit have expanded at record paces in the last several years. Non-revolving credit (like mortgages, student loans, auto loans, and other fixed assets) continues to expand, even though there are some supply constraints for automobiles.

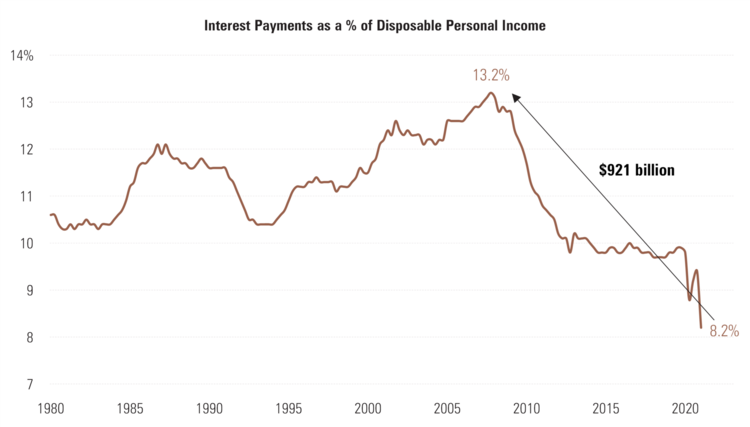

The addition of expansive credit will drive even more consumption to fuel the already red-hot consumer. The $35 billion hardly makes a dent in the level of debt a happy consumer can take on. With incredibly low interest rates, the consumer has a long way to go to meet prior debt service levels. [iii]

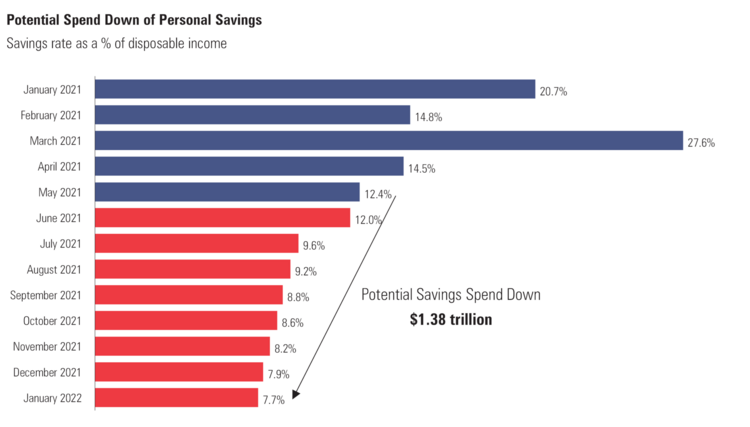

When we look at our forecast for consumers to spend down their precautionary savings, the use of credit will only stretch out the spend down schedule. [iv]

The combination of using debt and spending down savings back to historic averages could add $2.3 trillion or 10.44% to GDP.

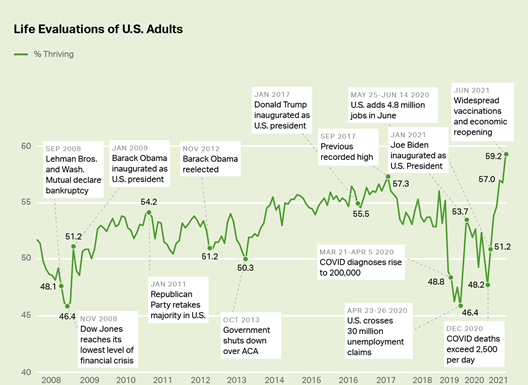

So, how happy is the consumer? Gallup recently surveyed over 4,000 Americans and 59.2% of those surveyed considered their lives to be “Thriving”. [v]

This is the highest we have seen in quite a while.

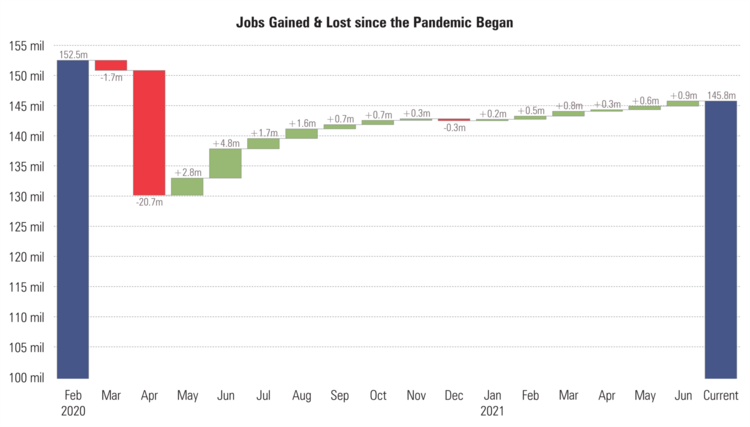

With the May jobs report showing the U.S. economy adding 850,000 jobs, that “thriving” feeling is likely to continue. [vi]

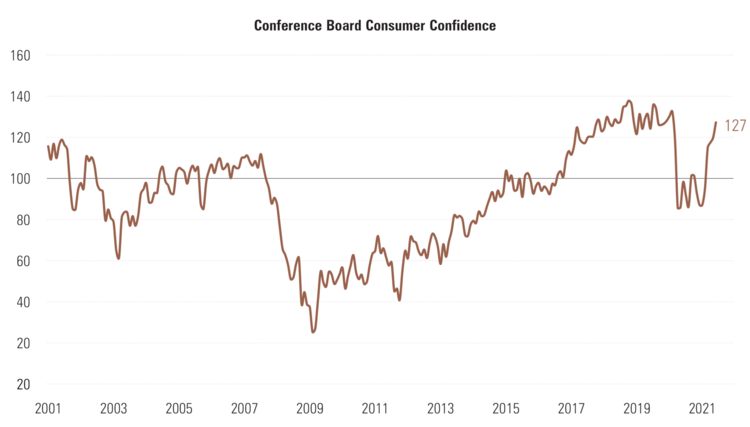

Further confirming the “thriving” consumer, consumer confidence, as reported by the Conference Board, jumped in June. [vi]

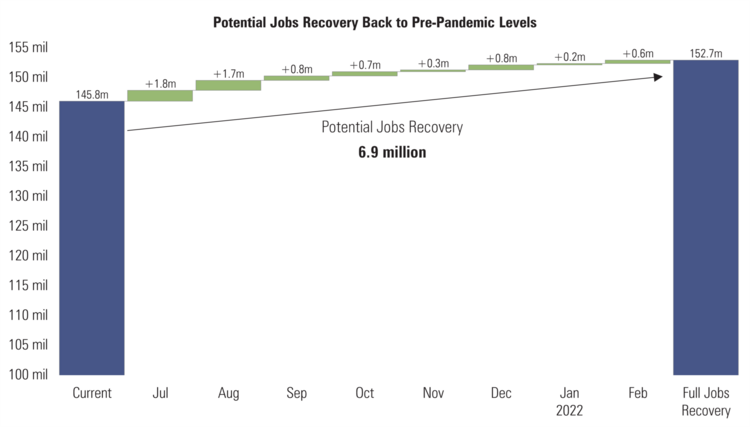

We are mindful there are still approximately 6.9 million people out of work but, our expectation is for those that want to work to be added back to the workforce over the next 8 months.

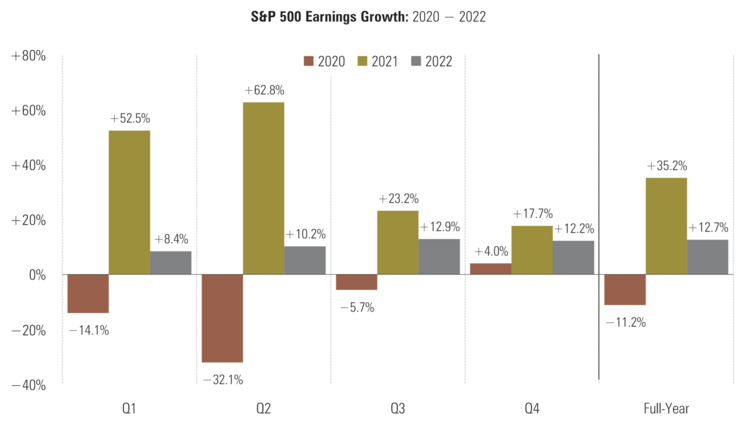

All of this might translate into better-than-expected corporate earnings per share growth. With second quarter earnings season kicking off this week, we won’t have to wait long to see if companies exceed expectations. [vii]

A happy consumer makes for happy companies and that might translate into happy investors. Almost everyone is happy right now.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/graph/?g=FlRl

ii. https://fred.stlouisfed.org/graph/?g=FlRo

iii. https://fred.stlouisfed.org/graph/?g=FgD0

iv. https://fred.stlouisfed.org/graph/?g=F8FI

v. https://news.gallup.com/poll/351932/americans-life-ratings-reach-record-high.aspx

vi. https://fred.stlouisfed.org/graph/?g=FlUp

vii. https://insight.factset.com/