Ambiguity Aversion

In the next several days you will begin to see a dearth of predictions about 2014. How much will the S&P 500 go up or down? How much will the US economy grow in 2014? Unemployment? Wall Street firms know one thing about us that we generally don't realize.

Investors are predisposed to avoid ambiguity. We will buy investment letters that predict the future and forecast precisely the outcomes for stocks. We will make asset allocation decisions based upon the latest Wall Street prognostications. We might even go as far as believing large financial firms like Wells Fargo, JP Morgan and Goldman Sachs must know something we don't.

Unfortunately, for all of us, no one knows and generally the more precise that their predictions are, the more inaccurate they will be.

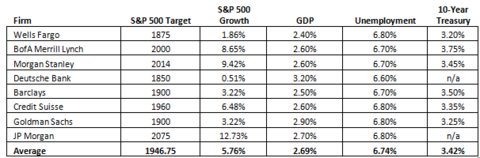

Last year in our forecast blog, we listed the predictions for some major Wall Street firms.

You can see the tens of millions of dollars these firms spend on prediction addiction got them precisely wrong. Wells Fargo predicted the market would drop by 2.54%, when instead we saw a rally of 31.74%. The group on average missed the actual return of the S&P 500 by 24.60%.

Worthless

I could go on and on about the variability of annual predictions but suffice it to say they are worthless. It's really not the prognosticators' fault. Fundamentally, they know they are going to be wrong and they still provide systemically bad data. Investors simply like certainty.

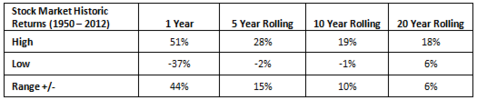

Look below at a chart showing the ranges of the highest and lowest market returns over various timeframes: [i]

With stocks returns deviating up or down by 44% in a one year period, you can only expect predictions to be wrong.

2014 Precisely Inaccurate Predictions

For those that enjoy the entertainment value in the predictions parlor trick, here are the 2014 predictions from the same firms we listed above for the S&P 500, GDP, unemployment, and interest rates. [ii]

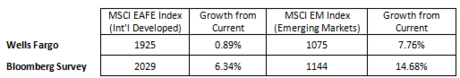

Here are also forecasts for developed markets outside of the US, and for emerging markets. [iii]

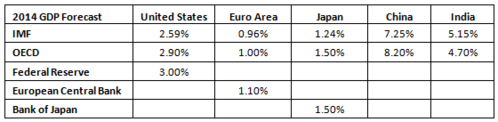

Below are GDP predictions for various economies, from central banks, the IMF, and the Organization for Economic Cooperation and Development. [iv]

If you’re investing for a one year period of time, the above data might be remotely relevant. But, if that is your time horizon, two things are apparent.

1) We have failed to educate our clients and readers on the importance of time arbitrage when it comes to investing. Targeting short term gains and market timing is a fool’s trap. Even if you’re successful, you will likely pay 43.4% in federal taxes if you’re in the top bracket—a big erosion of your gains.

2) You certainly don't need to be in an investment environment that will provide you with 44% up or down of annual variability.

Our predictions for 2014 are much broader and give us a small chance at being somewhat accurate.

1) Intermediate and Long-term treasury rates will rise but certainly not as much as the market currently expects.

2) Developed markets will continue to provide lumpy but positive returns by the end of 2014, much of which will be driven by improved balance sheets at banks.

3) Emerging markets will continue their Q4 trends and provide positive returns.

4) Global de-leveraging will continue and be the driver for better foreign returns.

5) Diversification will continue to be rewarded.

6) US corporate earnings will continue to moderate in 2014, which poses a significant threat to this current bull market.

From all of us at Phillips & Company, we wish you a very happy, healthy and prosperous 2014.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] “Historical Returns by Holding Period”, Barry Ritholtz, The Big Picture

[ii] “Here’s what 14 top Wall Street strategists are saying about the Stock Market in 2014”, Business Insider, December 13, 2013. “Wells Fargo Advisors Releases 2014 Economic and Market Outlook Report”, Wells Fargo, December 4, 2013. Bloomberg LP.

[iii] Ibid.

[iv] Bloomberg LP.