America’s Ownership Society

Investing isn’t just for the wealthy anymore — and that’s a good thing.

For decades, ownership in America—of homes, businesses, and stocks—was concentrated in the hands of a few. But that’s changing, at least as far as stocks are concerned. The past five years have marked a quiet revolution in who owns the country’s productive assets, and the data is clear: more people are participating in the markets than ever before.

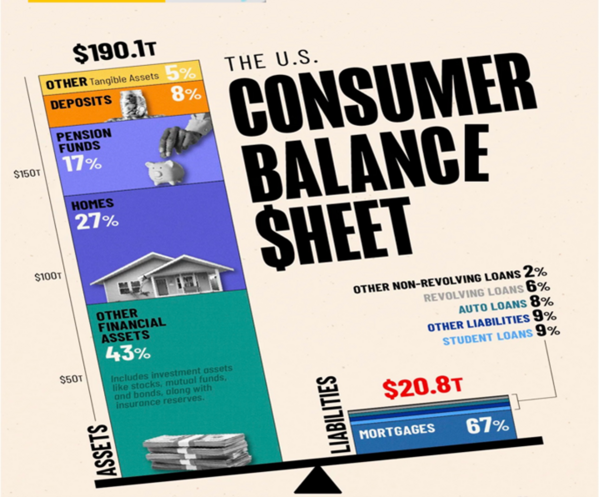

U.S. households now hold a record $197 trillion in assets, according to J.P. Morgan’s Guide to the Markets. Nearly half ($87 trillion) sits in financial assets—stocks, bonds, and retirement accounts. Homeownership still anchors family wealth, but the balance sheet shows a clear shift toward financial participation.

Americans are investors again—through 401(k)s, IRAs, the various investing apps and with advisors like us. With total liabilities of just $21 trillion, household balance sheets remain strong, giving this ownership trend staying power. The pandemic years cracked open the gates to market participation. Stimulus checks, time at home, and zero-commission trading transformed savers into shareholders.

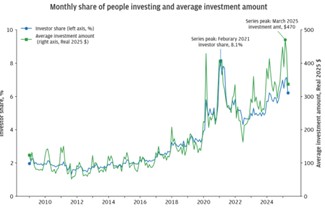

Since 2019, both the number of investors and their average monthly investment have surged. By early 2025, the average investment reached nearly $470—proof that investing has become a recurring habit, not a momentary fad.

It’s not just high-income households driving the market. The share of below-median-income investors has risen sharply since 2020.

Even as stimulus faded, participation held strong—evidence of a durable behavioral shift. For many Americans, investing has become the new form of saving, a slow and steady path to wealth creation that spans income levels.

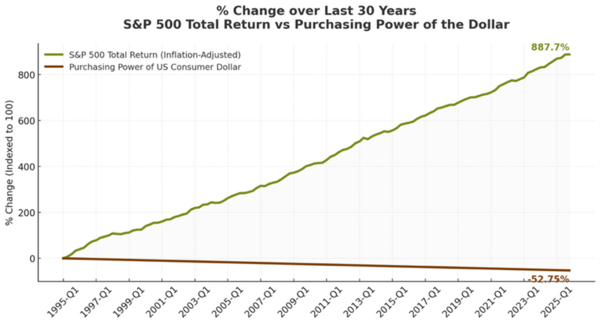

The past 30 years tell a powerful story: those who owned productive assets—stocks, real estate, businesses—saw wealth multiply, while those who stayed in cash saw purchasing power shrink.

The S&P 500’s inflation-adjusted return is up nearly 887% since 1995, while the purchasing power of the U.S. dollar has fallen by half. Inflation quietly taxed the uninvolved.

But the next generation of investors may be less exposed to that erosion. They invest automatically, with fractional shares, diversified portfolios, and disciplined contributions. Corporations, too, are structurally stronger—leaner, more profitable, and fueled by innovation.

This new ownership class may not just survive inflation; it may outpace it—because ownership itself has become more frictionless, more frequent, and more intentional.

This isn’t about beating inflation anymore. It’s about participating in growth.

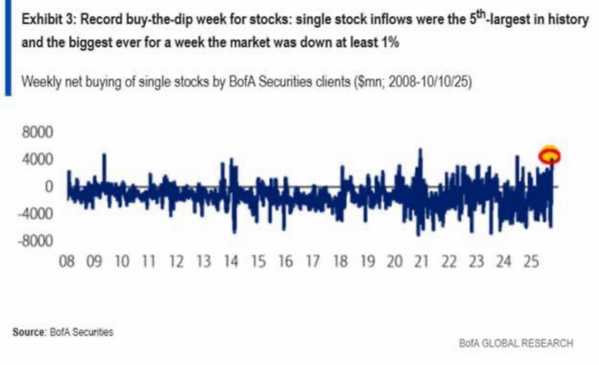

One clear benefit of this new investing class is behavioral strength. Rather than panic-selling into weakness, today’s investors are buying the dips.

Bank of America data shows the fifth-largest single-week inflow to individual stocks in history, and the largest ever during a market decline of 1% or more. That’s not reckless speculation—that’s confidence. Even industry leaders are taking note: Charles Schwab CEO Rick Wurster recently remarked that retail traders are “buying dips and selling rips,” a sign that individual investors are actively leaning into volatility rather than retreating from it.

This new breed of investors sees volatility not as a threat but as an entry point, a chance to accumulate ownership while prices are discounted. In effect, they’re turning short-term fear into long-term opportunity.

Many of these investors are channeling their capital into innovation—with A.I., cloud computing, and platform companies leading the next productivity cycle.

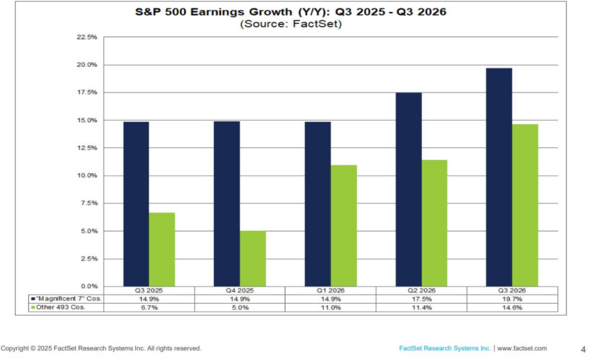

The Magnificent 7 continue to post double-digit earnings growth, well above the rest of the index. These are the companies reshaping industries, driving profit margins, and delivering the returns that reinforce the ownership mindset.

America’s ownership society is expanding. More people own productive assets, and they’re proving more resilient, disciplined, and opportunistic than ever before.

In a world where inflation eats cash and innovation compounds wealth, ownership isn’t just a privilege—it’s a strategy.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.