Another Look Ahead – Is Early Better than Late

Last week, we presented our Q1 2020 Look Ahead (link here) that was predominantly focused on the U.S. markets. Over the last 12 months we at Phillips and Company have made a concerted effort to explore China and its domestic stock market for equity returns.

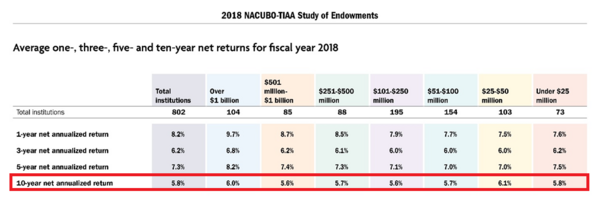

It’s a straightforward narrative: U.S.-based investors of almost all types (pension plans, endowments, and individual retirement savers) continue to struggle with sustainable, risk adjusted returns. Just look at the returns the largest University endowments—with billions in resources—have generated over the last 10 years. [i]

6% is hardly enough to meet any reasonable measure of payout, management expenses, and inflation. The same returns can likely be assumed for U.S.-based individual investors in a balanced portfolio.

If balanced returns are a struggle at the end of a great year like we had, how do we boost returns?

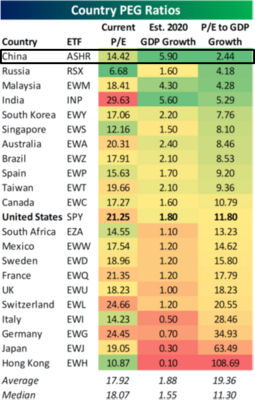

One area of focus for us to boost returns has been in China. In that spirit we invite you to view our Q1 2020 China Look Ahead. The bottom-line regarding China is its growth rates compared to its current equity valuations. [ii]

You can see from the table above China provides some of the best global valuations.

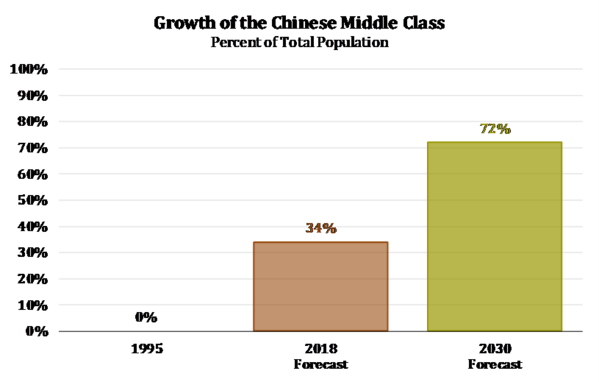

Another critical theme that China presents is a rapidly expanding middle class. 34% of the current Chinese population are in the middle class, with expectations for this number to increase to 72% by 2030. [iii]

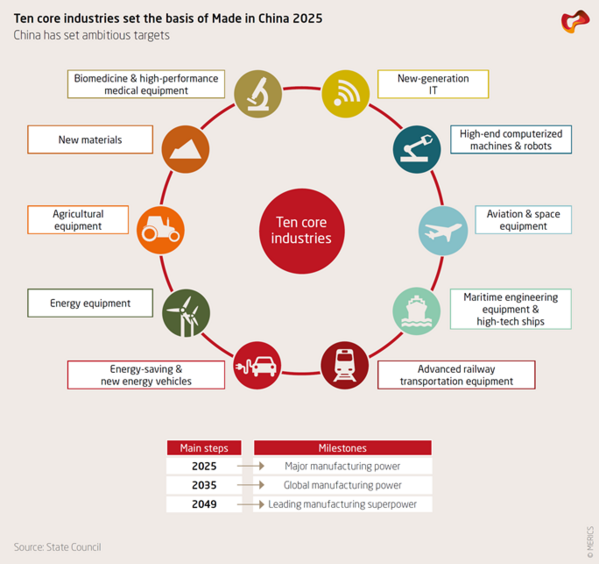

With just a little imagination, you can surmise the tremendous growth opportunities for certain segments and companies within China. Industries supported by the Made in China 2025 initiative are just a few industries we think will benefit. [iv]

Without spoiling our presentation, just click on this link to review our complete China Q1 2020 Look Ahead.

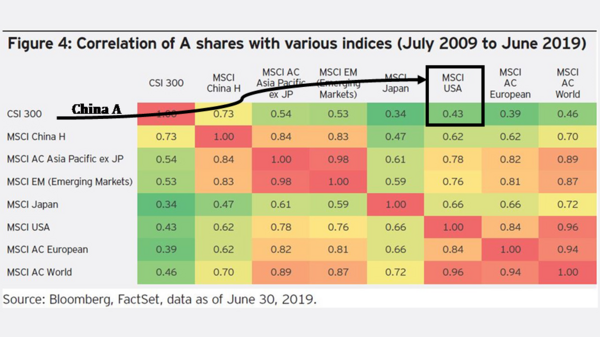

Further, the correlation between the China A share (domestic equity market) and U.S. equity markets is relatively low. If you view U.S. equities as rich in value, buying China could reduce some of that valuation exposure in some cases. [v]

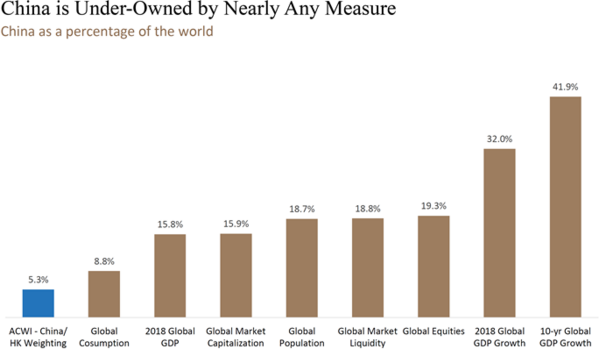

One final and important thought on why we want to be invested in China and why we think earlier is better. China is grossly under-owned within most indexes, including the MSCI ACWI (All Country World Index) at just 5.3%. Compare that to being the second largest stock market in the world, 19% of all global equities, and nearly 42% of global GDP growth over the last 10 years; it’s clear to me institutions will purse China. [vi]

Click here to see our full report.

While there are risks to being early, institutions will need returns as we all do; and my view is that they will land on China sooner rather than later. I’d rather be early than late.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.nacubo.org/Press-Releases/2019/US%20Educational%20Endowments%20Report%208%202%20Percent%20Return%20in%20FY18

ii. https://media.bespokepremium.com/uploads/2019/12/International2019.pdf

iii. https://am.jpmorgan.com/blob-gim/1383407651970/83456/MI-GTM_1Q20.pdf

iv. https://www.merics.org/en/papers-on-china/evolving-made-in-china-2025

v. https://www.invesco.com/invest-china/en/institutional/insights/taking-the-a-out-from-em-making-sense-of-a-dedicated-china-a-share-exposure vi. https://us.matthewsasia.com/china-investing/default.fs