Are Fed Rate Cuts Always Good News for Investors?

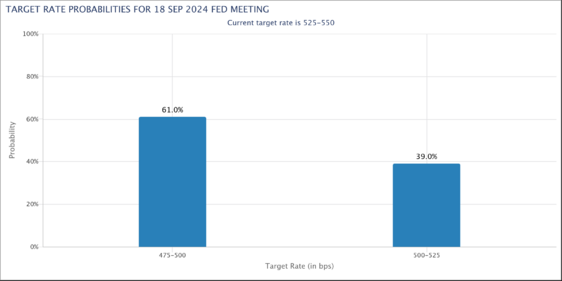

This week the Federal Reserve will almost certainly cut interest rates. In fact, current market expectations suggest a 39% probability of a 25 basis point cut and a 61% chance of a more substantial 50 basis point reduction. But is this good news for investors? 1

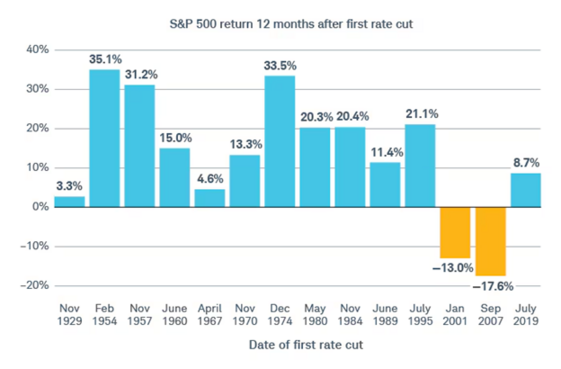

I, among so many others, want to believe that these first rate cuts will propel us into another great bull market cycle in stocks over the next 12 months. 2

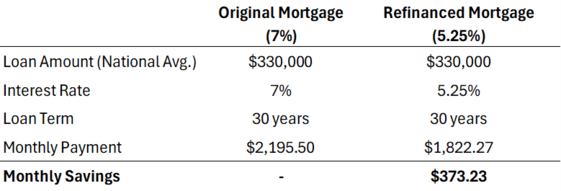

The basic fact is lower interest rates should stimulate more growth for both corporations and individuals. Consider a household with a 7% mortgage rate refinancing to 5.25% – this could free up approximately $373 per month, injecting significant spending power back into the economy.

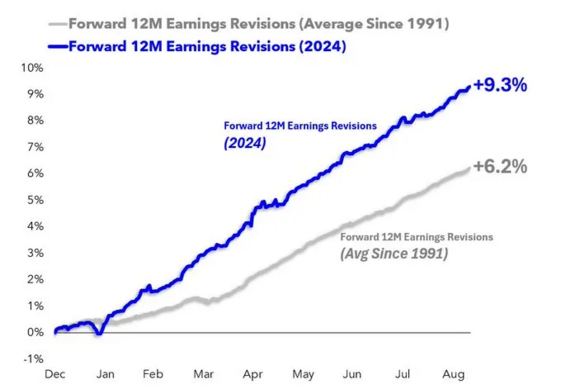

All of that would seem to drive better equity values. Perhaps that’s why we are seeing massive revisions to corporate earnings. Over three percentage points higher than normal. 3

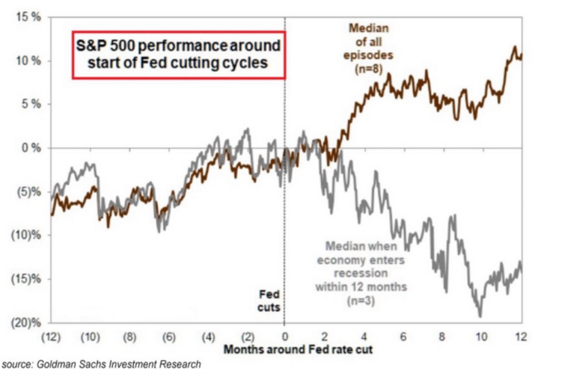

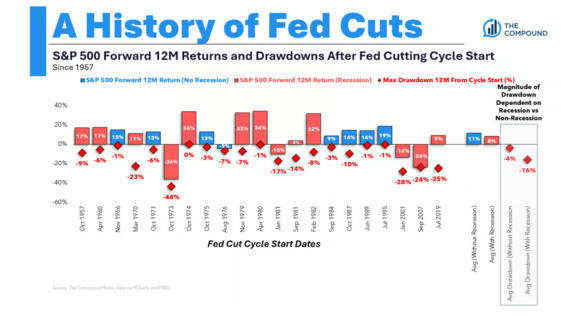

Rate cuts can and do stimulate growth, but it might not be as obvious an outcome for equity prices. A lot depends on how the U.S. economy is doing when rate cuts ensue. While the median return across all Fed cutting cycles is approximately 10%, the picture changes dramatically if a recession follows within a year. In such scenarios, the median 12-month return drops to -15%, with potential drawdowns reaching 20%. 4

With recessions, the drawdown is the critical factor to understand. Without a recession we can experience a typical -4% drawdown. With a recession, that drawdown can quadruple to -16%. Interestingly, when you look at rate cuts with recessions you still get positive returns if you look back to 1957. 5

A common misconception in investing is that specific inputs (like rate cuts) always lead to predictable outputs (such as equity returns). In the coming months, we will know more about the direction of the economy and if the Federal Reserve pulled off an economic soft landing.

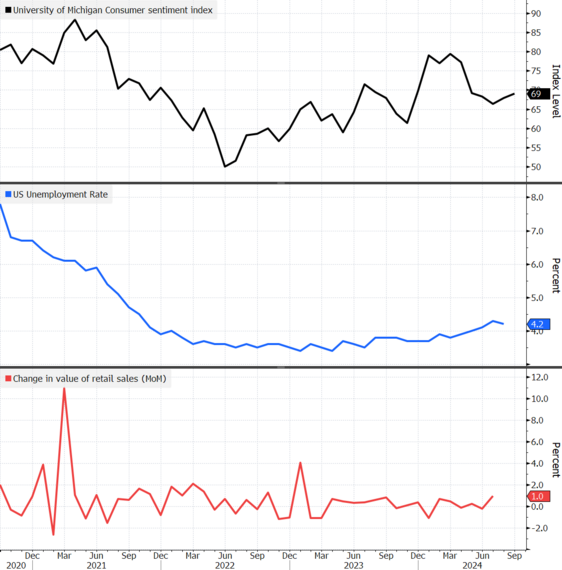

Consumer sentiment, employment, and retail sales will be the early indicators to watch in the coming months. 6

The reasons why we are entering this rate cut cycle matter.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- https://www.schwab.com/learn/story/what-past-fed-rate-cycles-can-tell-us

- https://x.com/dailychartbook/status/1833807709172305951

- https://www.isabelnet.com/sp-500-index-pre-and-post-fed-rate-cuts/

- https://www.downtownjoshbrown.com/p/happens-first-interest-rate-cut

- Bloomberg

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.