Are Tariffs Beautiful?

“To me the most beautiful word in the dictionary is tariff…” – Donald Trump, October, 2024 1

As we enter an era of America First trade and economic policies, it raises the question: can tariffs be beautiful? Note, this is an explanation and not a rationalization.

Here is how tariffs work. Typically, all roads lead to higher prices/inflation with tariffs, and that’s a common refrain from the mainstream financial media. 2

However, it’s also possible tariffs don’t lead to higher prices and inflation. Here’s how:

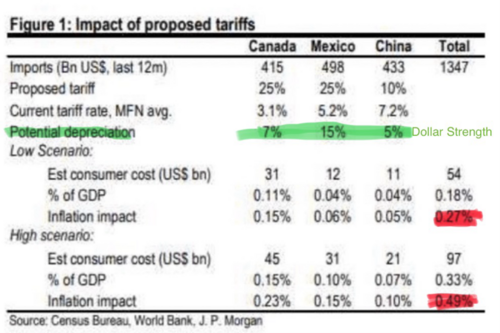

If you look at the current base rate of tariffs, you can see how they stack up from our largest trade partners.

Of note, under the current regime and with proposed tariffs of between 5%-15%, you get a very minimal boost to inflation (red in the chart above). That’s largely driven by the strength of the U.S. dollar and the weakness of foreign currency (green).

The logic is simple: the stronger the U.S. dollar becomes compared to a foreign currency, the cheaper those goods become to import. We (United States consumers) can buy more goods at lower prices due to a strong currency, which can offset the modest price increase due to tariffs. That’s something we don’t hear much about from the mainstream financial media.

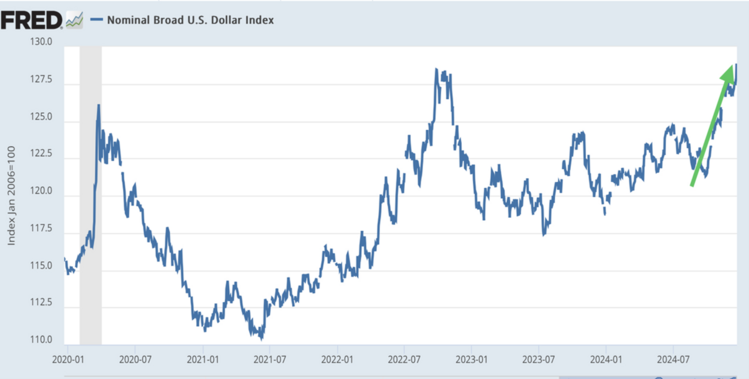

The dollar has rallied about 6% since last year and should continue to do so as long as we remain in a soft economic landing posture. 3

Trump will need a strong dollar to offset his proposed tariffs and manage to keep inflation in check. Alternatively, he might wait on tariffs and allow import deflation to moderate prices in the United States.

That might allow the Fed to cut interest rates and help the economy. That would be a beautiful thing.

Yet the Trump 2.0 tariff move is tricky and a risky maneuver for a global economy. Still, it’s possible tariffs can raise revenue for our government without creating a cost-push inflation spiral. Is that beautiful? We will see.

On behalf of the entire Phillips & Company team, we wish you a healthy, happy, and prosperous 2025.

Reminder: Phillips & Company is migrating our client accounts from BNY/Pershing to Charles Schwab. Please connect with your advisor to hear all the details and benefits.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.wsj.com/livecoverage/harris-trump-election-10-16-2024/card/trump-calls-tariffs-the-most-beautiful-word--YMVPAupw4EjBRp6yobOy

- https://gensteel.com/resources/infographics/how-steel-tariffs-affect-your-building-price/

- https://fred.stlouisfed.org/graph/?g=1CwpA

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.