Are Tax Cuts Coming Soon?

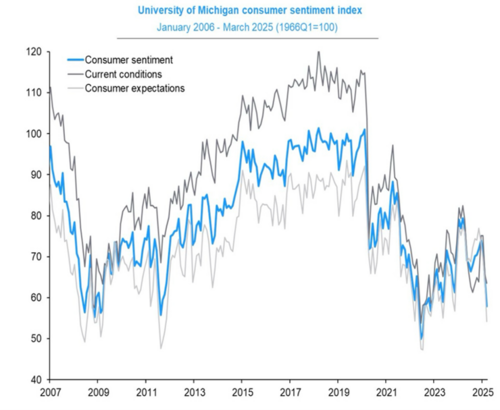

Sentiment has turned decidedly sour. The recent survey on consumer attitudes by the University of Michigan points to this marked decline.1

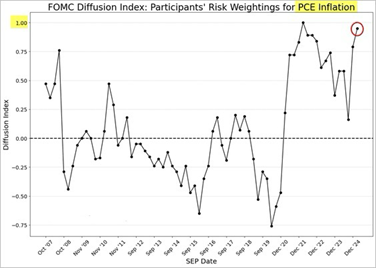

Inflation concerns, along with the headline uncertainty around tariffs, are to blame. Tariffs are a form of sales tax and that has certainly fed into the inflation fear. In fact, inflation expectations at the Federal Reserve have risen as of late.2

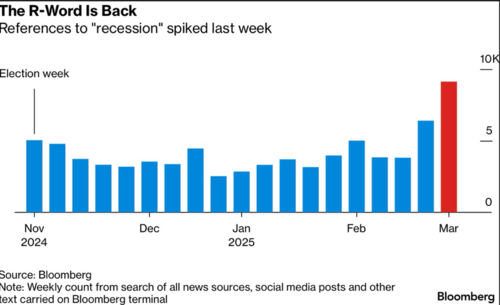

Adding to the general anxiety is the increase in recessionary fears. It appears the “R” word is back in the news and is amplifying the existing uncertainty.3

One byproduct of this heightened level of anxiousness is the extreme bearishness of the individual investor. Their pessimism has not touched these levels since the Great Financial Crisis or COVID.4

However, individual investors tend to show the most pessimism at the bottom and equity prices frequently rally off of these extreme levels.

We’ve been hearing a lot about tariffs lately and that has certainly spooked the consumer. I believe we are going to start to hear a lot about tax cuts to offset the tariff talk.

- No tax on tips

- No tax on Social Security

- No tax on overtime wages

- Perhaps no tax on anyone making less than 150k

- Extension of the Tax Cuts and Jobs Act of 2017

- SALT tax expansion

Tax cuts would certainly be welcome news for both consumers and the markets.

|

Year(s) |

President |

Type of Tax Cut |

Key Features |

Stock Market Reaction |

S&P 500 Change (approx.) |

|

1981 & 1986 |

Ronald Reagan |

Income, Capital Gains |

Lowered top income tax rates; cut capital gains tax |

Strong long-term rally (post-1982) |

+200% (1982–1987) |

|

2001 & 2003 |

George W. Bush |

Income, Dividends, Capital Gains |

Lowered marginal rates, reduced dividend and capital gains taxes |

Muted initially, strong rally post-2003 |

+90% (2003–2007) |

|

2010 |

Barack Obama |

Income, Payroll |

Extended Bush cuts; temporary payroll tax cut |

Helped sustain recovery |

+80% (2010–2013) |

|

2017 |

Donald Trump |

Corporate, Personal |

Corporate rate cut (35% → 21%), repatriation tax |

Immediate positive impact, earnings boost |

+19% in 2017 |

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://x.com/TihoBrkan/status/1893212394605699190

- https://thedailyshot.com/2025/03/20/fomc-risk-weightings-indicate-growing-stagflation-concerns/

- https://www.moomoo.com/community/feed/is-trump-crashing-the-us-stock-market-114147271639446

- https://realinvestmentadvice.com/resources/blog/the-sentiment-bark-is-worse-than-the-markets-bite/

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.