Are We in Another Counterintuitive Moment?

I often have to catch myself when things look a little grey on the macro picture. We’ve had a spate of economic releases and earnings expectations that suggest maybe things are slowing, or at least not as rosy as we would like.

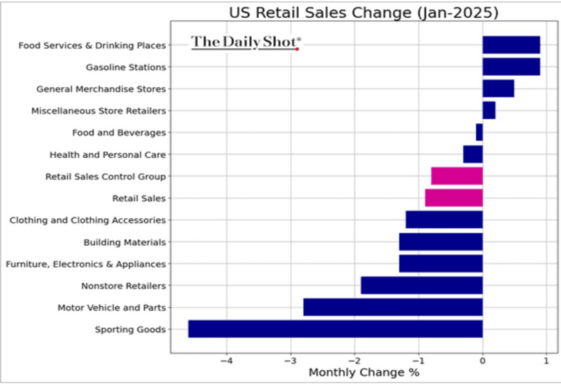

Retail sales were weaker than anticipated in January, with almost every sector showing declines on a monthly basis. 1

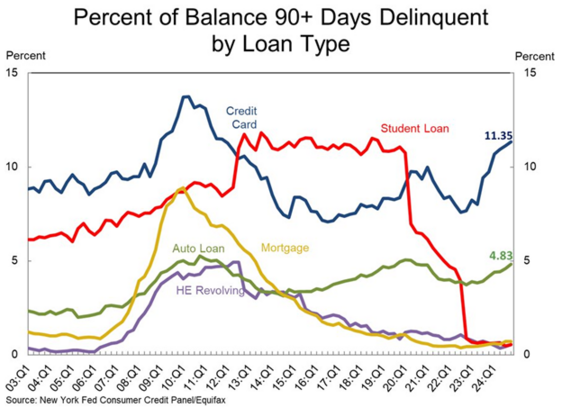

Consumers are defaulting on their credit cards at higher rates than in the past 10 years. 2

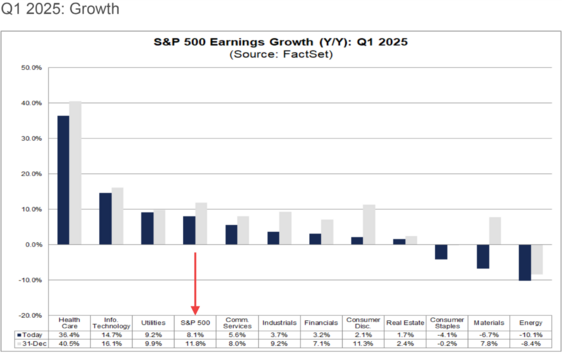

Corporate earnings, while fantastic for Q4 2024, are showing a weakening trend for Q1 2025. While still strong, they’re not as strong as when we kicked off the year. Shifting down from 11% EPS growth to 8% is something to pay attention to. 3

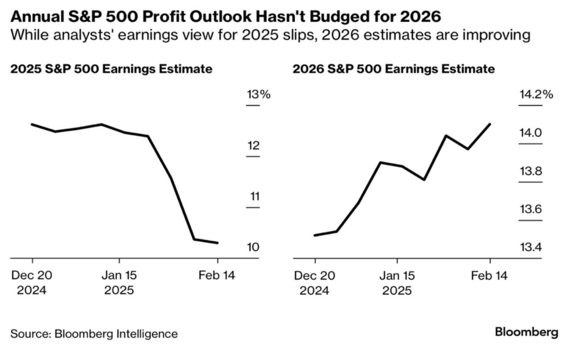

Full-year 2025 earnings guidance is also trending down but remains very positive. If you are one to believe we buy the future, 2026 looks remarkable albeit with a lot of ground to cover before we get more clarity. 4

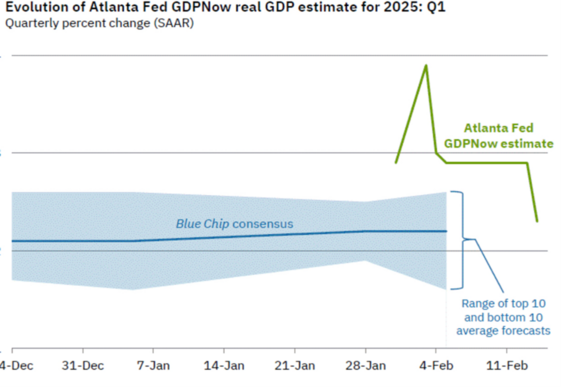

Q1 2025 GDP growth expectations are still very positive but being revised downward, reflecting a slight weakening in the consumer. 5

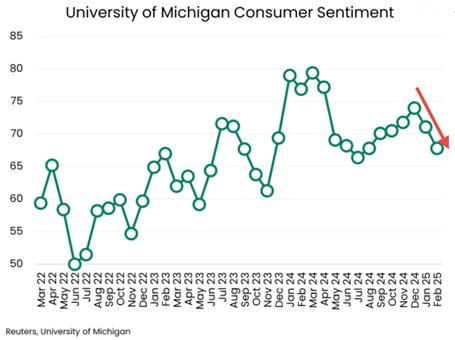

Consumer sentiment is trending downward, with inflation data still reflecting higher prices for food and energy (Headline CPI). 6

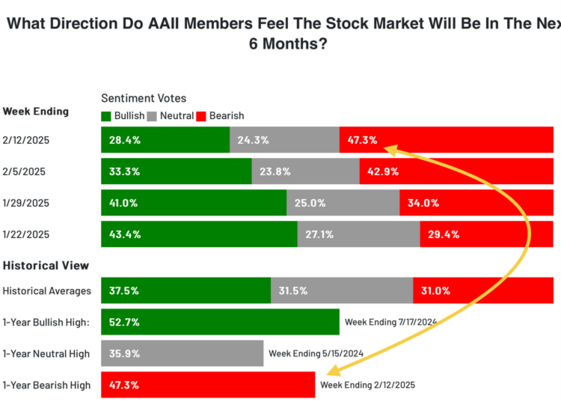

It’s no wonder the individual investor is in a pretty sour mood. The recent AAII (American Association of Individual Investors) survey suggested a very bearish sentiment amongst individual investors. In fact, the spread between bullish and bearish is one of the widest in a long time. 7

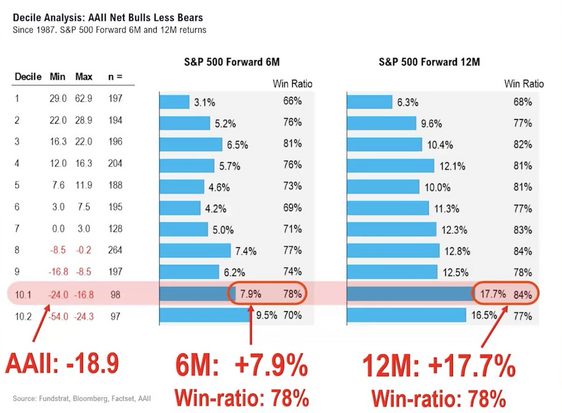

The counterintuitive aspect is this: Individual investors tend to zig when they should zag. History suggests when individual investors are this bearish, markets tend to rally. 8

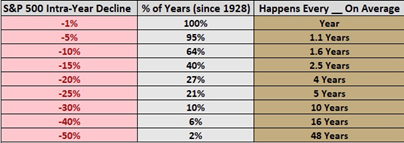

However, I would be remiss not to prepare investors for corrections. They happen all the time and we should expect them to happen this year. 9

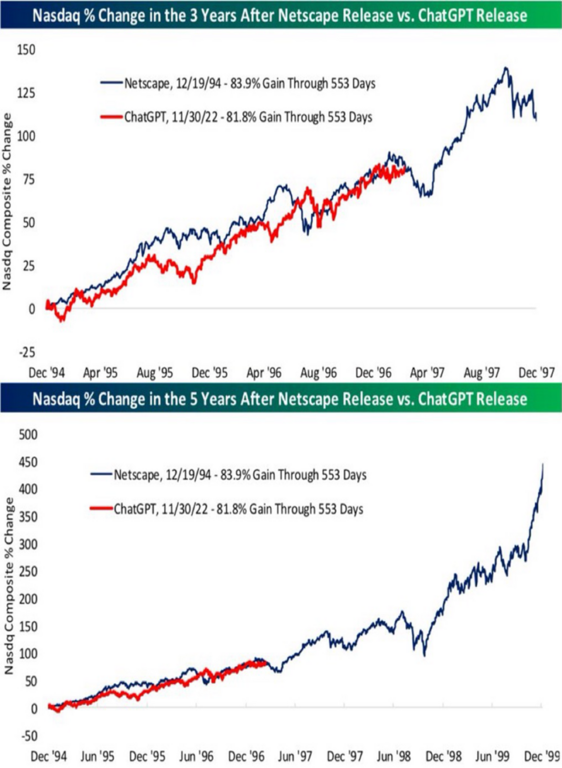

Corrections and drawdowns are what create upside momentum. We can’t ignore that simple reality. Yet despite elevated earnings, if this AI productivity trend is real (and I believe it is) then we are still in the very early stages of a long equity growth cycle compared to the internet cycle. 10

When you get nervous, and you might at times, just reflect on my piece “Equity Investing – Know the Game You are Playing.” Here is the link to the piece for you to review.

Investing is counterintuitive and I’m reminded of that fact in the most chaotic times.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://thedailyshot.com/2025/02/17/consumers-pulled-back-in-january/

- https://x.com/charliebilello/status/1890797965809229956

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_021425.pdf

- https://www.bloomberg.com/news/articles/2025-02-15/corporate-america-s-souring-profit-outlook-clouds-equity-rally

- https://www.atlantafed.org/cqer/research/gdpnow

- https://insights.ever.ag/2025/02/11/chart-of-the-day-02-11-university-of-michigan-consumer-sentiment/

- https://www.aaii.com/sentimentsurvey

- https://x.com/SethCL/status/1890372414623613182

- https://bilello.blog/2022/the-price-of-admission-in-stocks

- https://x.com/bespokeinvest/status/1890727590689755529

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.