Are We Lost?

Jerome Powell, the Chair of the Federal Reserve, gave a policy speech from Jackson Hole, Wyoming on Friday. It’s traditionally a wonky time for economists and those that follow the Fed. Without dissecting all his pros and cons as it relates to inflation and the future of interest rates, I’d focus on just one statement he made at the end of his prepared remarks when opining on setting interest rate policy going forward: 1

"We are navigating by the stars under cloudy skies.”

Meaning it’s difficult to make decisions during uncertain times.

It’s not the first time he’s suggested the Fed might be a bit lost in economic cycles. His comments at the Jackson Hole symposium in 2018 had the same language.

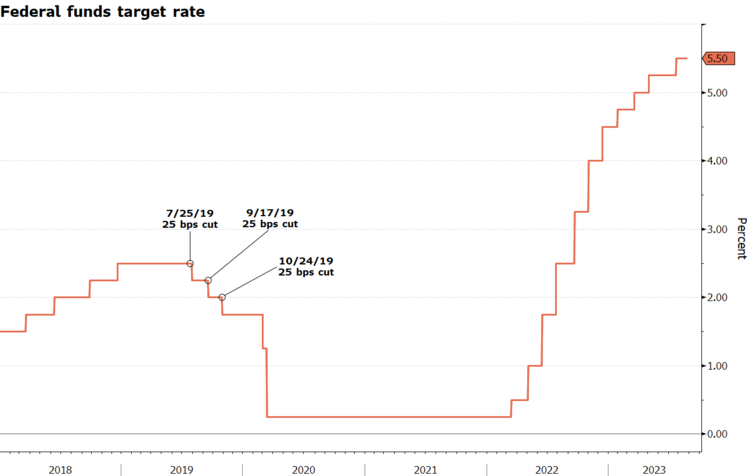

At that time, the Fed had raised rates three times to combat threats of rising inflation and very low unemployment. However, in 2019 the Fed cut rates almost immediately in response to a global economic slowdown. Sound familiar? 2

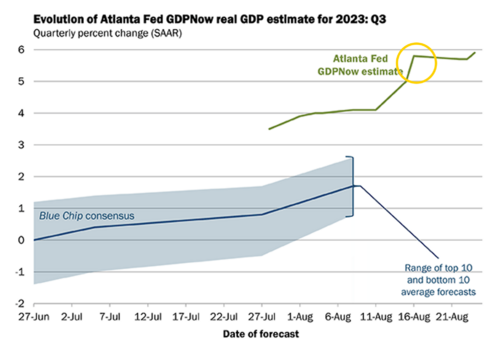

The current state of affairs in the U.S. economy is very strong, with GDP for Q3 expected to grow at nearly a 6% rate according to the Atlanta Fed. 3

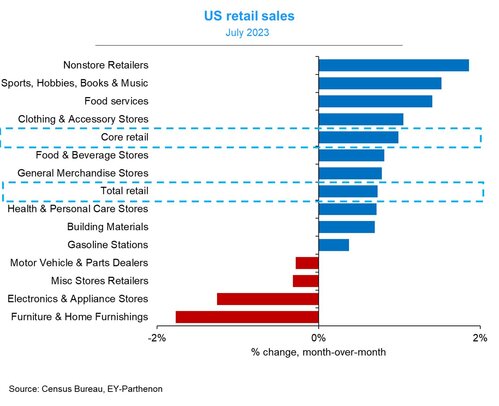

Much of the jump in expected GDP growth in Q3 is being driven by retail sales, which were up 0.7% in July – far exceeding expectations, with only 4 of 13 categories down. 4

However, an upcoming United Auto Workers authorized strike could shave off up to 1% from GDP growth if it lasts 45 days, according to a study by the Center for Automotive Research. The study also found that the strike could lead to the loss of 100,000 jobs in the auto industry and related sectors.

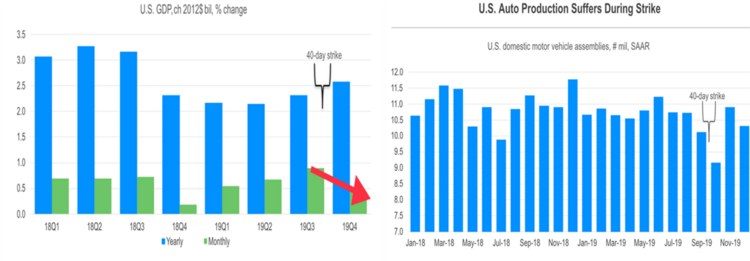

According to Moody’s Analytics, approximately 3% of U.S. GDP is tied to the U.S. auto industry. While the overall impact from the last strike in 2019 was minimal on a year-over-year basis, the monthly impact to GDP was meaningful. Not to mention the reduction in vehicle production that occurred during the 2019 strike. 5

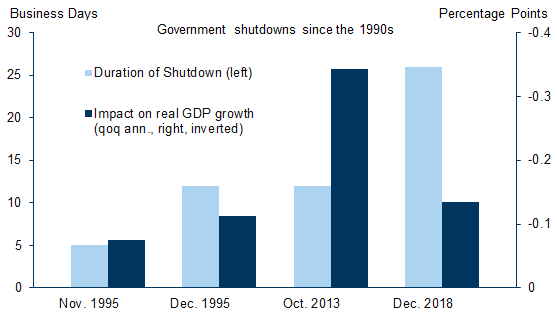

Another major upcoming event that could cause Fed confusion is the possible shutdown of the U.S. government from not approving the fiscal 2024 budget which is due by September 31st. The last shutdown was in 2019 and lasted for 35 days. According to Congressional Research Service estimates, the impact of a 35-day shutdown would be equivalent to a 0.2% reduction in GDP. Past shutdowns have been within that range of economic impact. 6

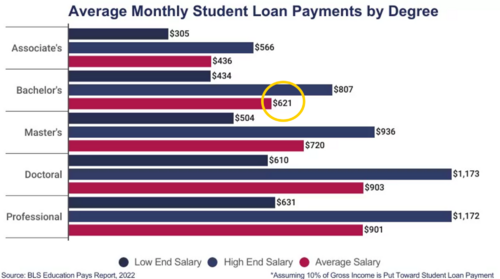

One other important drag on economic activity is the resumption of federal student loan payments, commencing on October 1st. According to a study by the Brookings Institution, the impact of student loan payments on GDP growth could range from 0.1% to 0.8%. The study found that the impact would be greater for borrowers with higher levels of debt and for borrowers who are struggling to make their payments. While those with graduate degrees will face less income pressure, those with bachelor’s degrees will certainly feel the crimp to consumer spending. 7

According to the Bureau of Labor Statistics, the median monthly earnings for workers with a bachelor’s degree who have been working for 5 or more years is $5,336. This translates to an annual income of $64,032. A $621 monthly payment would approximate to about a 12% reduction in monthly spending.

Are these the clouds that are blocking the stars for the Fed? Perhaps.

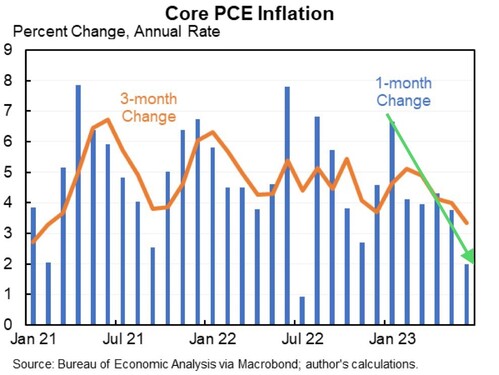

Or is it moderating inflation that is creating confusion? 8

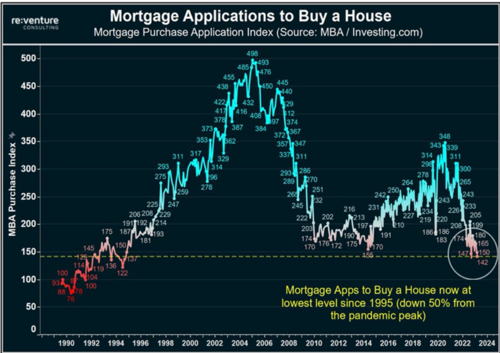

It’s clear to me the limits of the Fed’s rate increase cycle are fracturing some sectors. When it comes to home purchases, we are clearly seeing pressure on mortgage applications. Mortgage applications are at lows not seen since 1995! 9

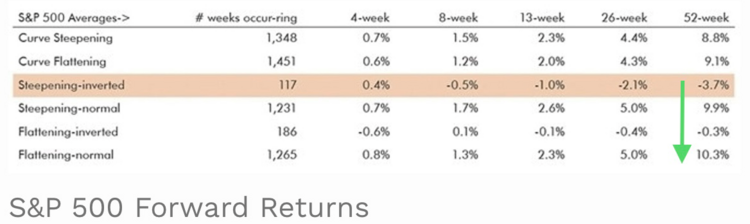

Whatever the Fed’s confused about, in the long run the yield curve is going to have to transition either via a recession or through some lowering from the Fed. Perhaps we benefit from that process in the coming year, according to the study by William O’Neil. 10

Good news, bad news, it’s clear the Fed is unclear what they are going to do next. Are they lost? Are we lost, might be a more relevant question. If you’re long-term focused you should buy in at good valuations, which means conserve cash in short-term fixed income and money markets and allocate before cloudy skies clear.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.federalreserve.gov/newsevents/speech/powell20230825a.htm

- https://fred.stlouisfed.org/graph/?g=18bOJ

- https://www.atlantafed.org/cqer/research/gdpnow

- https://twitter.com/GregDaco/status/1691430597757968384?s=20

- https://www.economy.com/economicview/analysis/395833/US-Economy-Faces-a-Risky-Ride-if-the-UAW-Strikes

- https://research.gs.com

- https://educationdata.org/average-student-loan-payment

- https://www.bea.gov/data/personal-consumption-expenditures-price-index-excluding-food-and-energy

- https://www.mba.org/news-and-research/research-and-economics/single-family-research/weekly-applications-survey

- https://origin.williamoneil.com