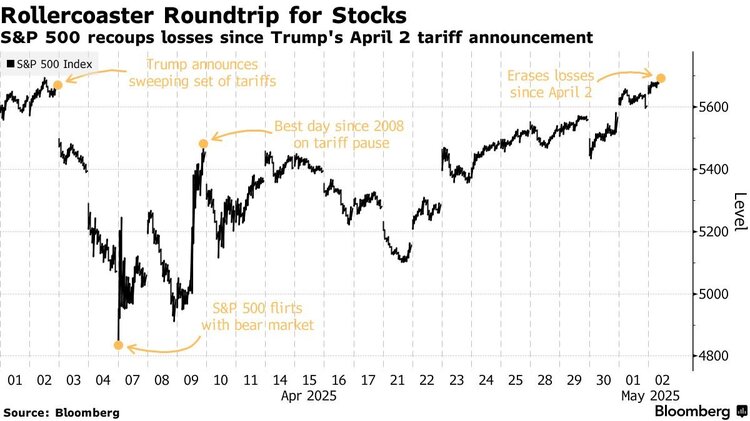

Are We Really Back to Even?

Over the last nine consecutive days, the S&P 500 has recovered all its losses since the April 2nd launch of the Trump trade war. This is the longest S&P 500 winning streak in the last 20 years.1

The historic rally occurred even considering a mix of economic headlines.

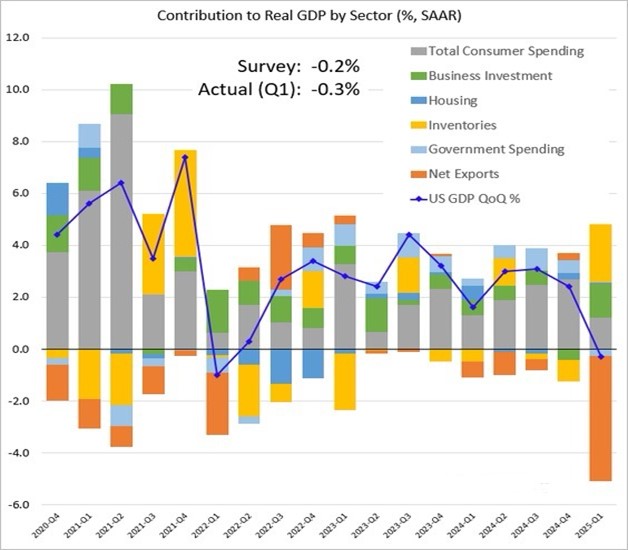

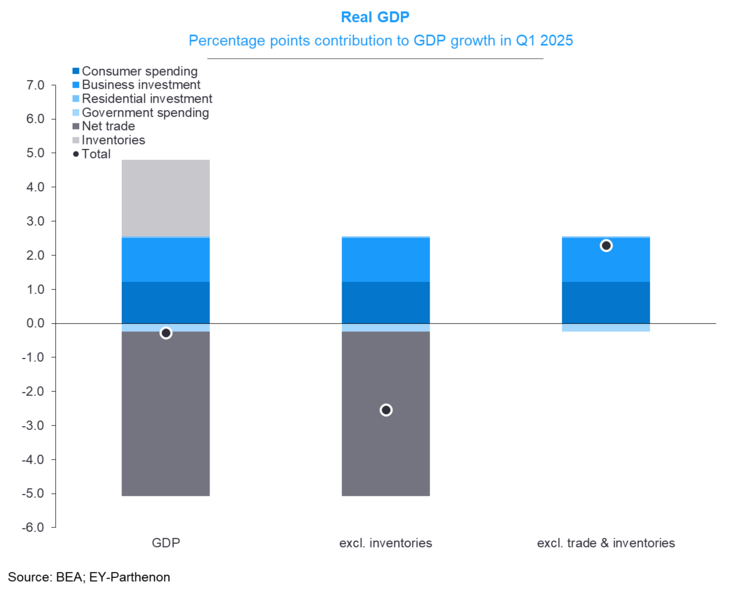

The US economy contracted 0.3% in Q1 but when you remove the front-loaded trade imports and inventory build-up from the data, the economy expanded by 3%.2 3

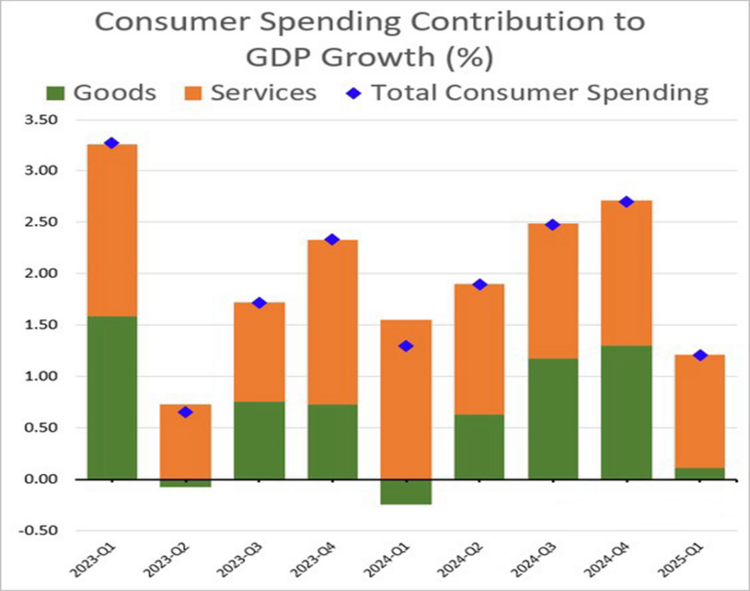

Below the headline GDP number is the strength in the consumer. Service consumption remains the largest part of our overall spending mix, and services are not affected by tariffs because they are domestically oriented.4

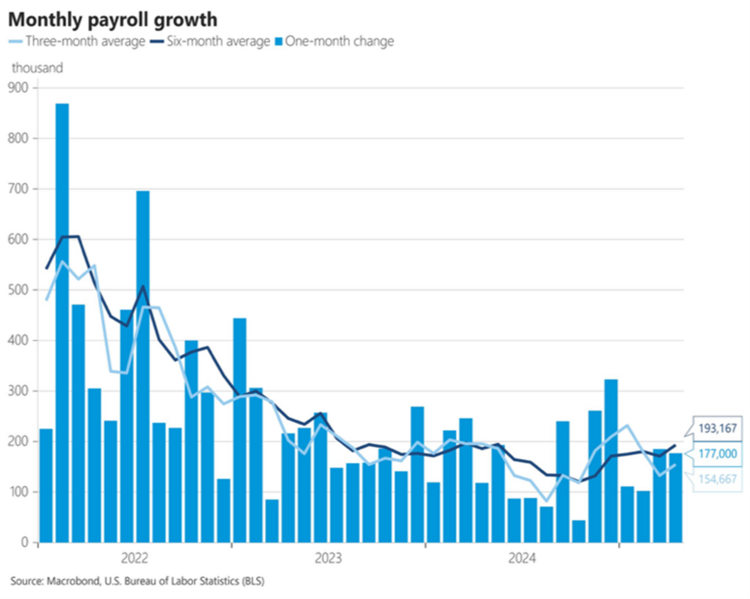

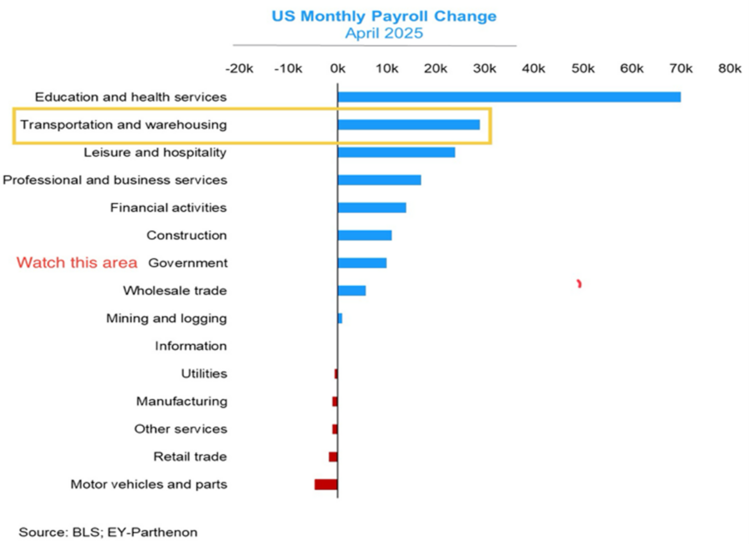

Further, jobs were plentiful in April with the economy adding 177k jobs. The 6-month average is now 197,000 jobs per month which is well above the number of jobs needed to absorb new entrants. Even if you pull out the 29,000 warehouse jobs because of the threats of tariffs, you still get a strong job market.5 6

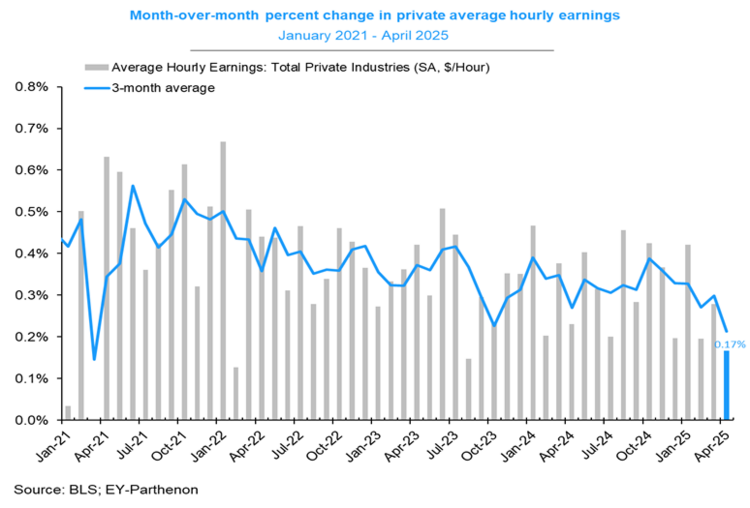

Let’s keep going. Wage growth, while moderating, continued to increase month over month in April.7

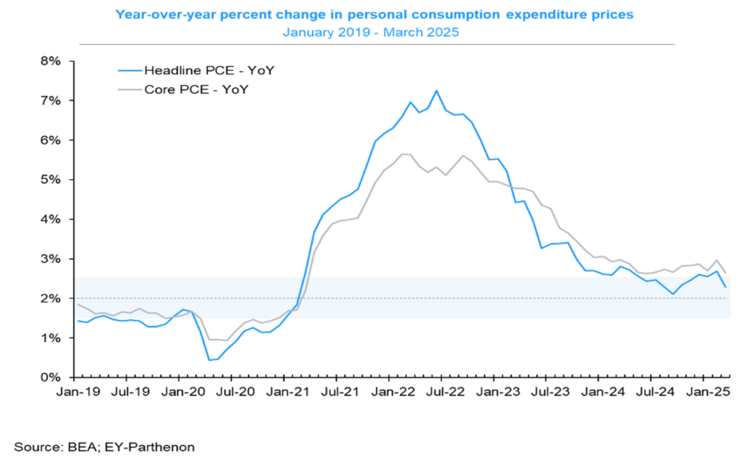

Inflation continues to moderate back to the 2% target, setting the stage for an interest rate cut by the Fed in June.8

What lies ahead if nothing changes with the “trade war” will be more moderating wages, plus some job losses in transportation and warehousing along with federal government employment.

However, it appears that two of the three things I have previously written about (tax cuts, tariff moderation, and rate cuts) might be coming about.

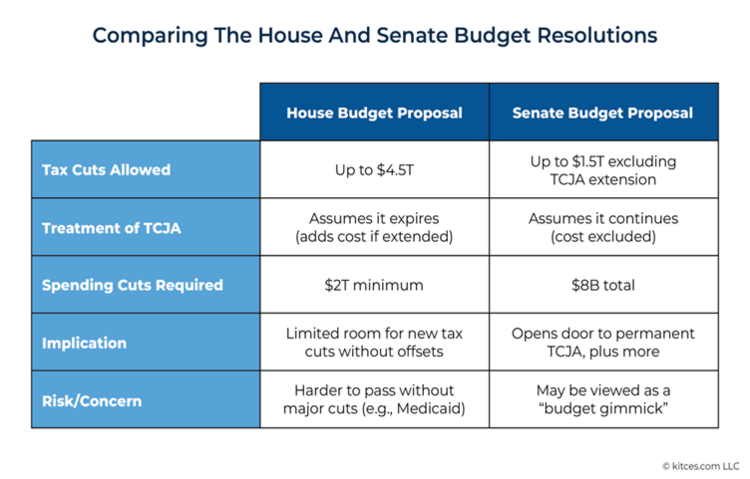

Congress is getting closer to reconciliation on the tax bill between the House and Senate. Cost cuts will need to be part of the mix to get to an agreement on this and those cuts appear likely to take place.9

Additionally, tariffs are making their way through negotiations with a first deal to be announced in the coming week or two.10 11

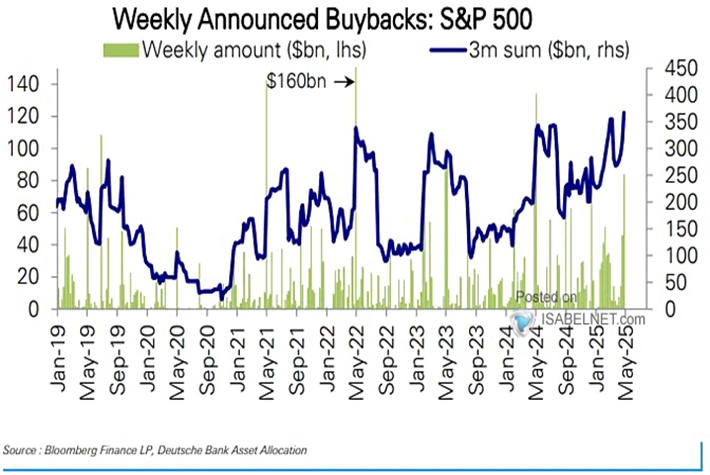

Adding to this, S&P 500 companies have announced significant record stock buybacks. The most knowledgeable investors think their companies are undervalued.12

While we are still reeling from the political uncertainty, equity investors continue to look ahead for some clarity. Even this weekend, famed investor Warren Buffett commented on our current state of the market and America.13

While equity investors are reflecting maximum optimism about where we are heading, we will need to get there, or being back to even will once again become a thing of the past.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.bloomberg.com/

- https://dailyshotbrief.com/the-daily-shot-brief-may-1st-2025/

- https://x.com/GregDaco/status/1917566536409063648

- https://thedailyshot.com/

- https://x.com/NickTimiraos/status/1918283292991693176

- https://x.com/GregDaco/status/1918309147340165336

- https://x.com/GregDaco/status/1918311480052633651

- https://x.com/GregDaco/status/1917591466987380934

- https://www.linkedin.com/posts/michaelkitces_recently-the-house-and-senate-agreed-to-activity-7323330322870198272-9Kme?utm_source=share&utm_medium=member_desktop&rcm=ACoAAA0qtvUBj4EzzZzFsmNDY0gRckNID1F5IT4

- https://www.bloomberg.com/politics

- https://financialpost.com/pmn/business-pmn/japan-sees-trade-talks-speeding-up-hopes-for-june-agreement

- https://x.com/ISABELNET_SA/status/1916778743189667896

- https://www.bloomberg.com/

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.