Are We Recession Bound--Signals and Noise

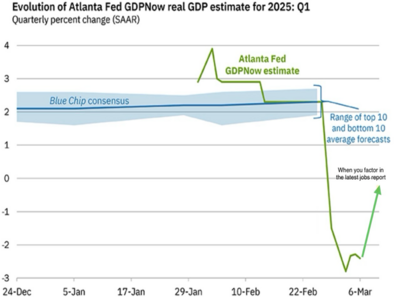

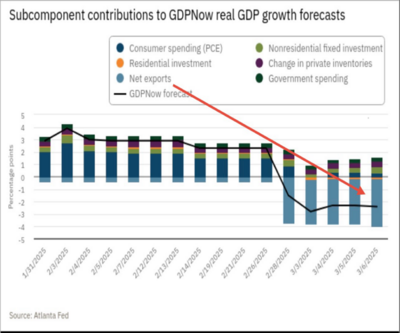

The wall of worry investors are facing continues to expand, and as we wrote last week, the policy volatility is not alleviating any tension. However, much of the worry is still noise. For example, the Atlanta Fed’s GDPnow forecast suggests we are in a recession in Q1. But much of that was predicated on the January net export readings which implicated consumption erroneously.1

When you factor in the latest jobs report, we should expect to see a sharp rebound in consumption in February and a revision upward to the US economic growth forecast.

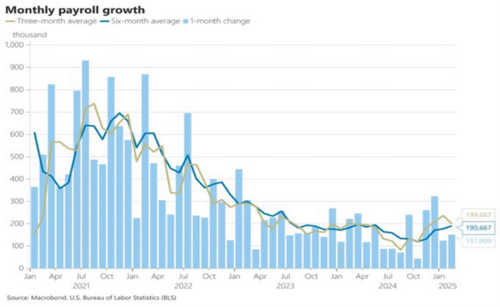

The US added 151k jobs in January and that’s a long way from a recession, especially when you consider the 3mo and 6mo averages of 199k and 190k respectively.2

Just keep this simple formula in mind when you start to worry about a recession:

Jobs = Wages = Consumption = GDP Growth = More Jobs

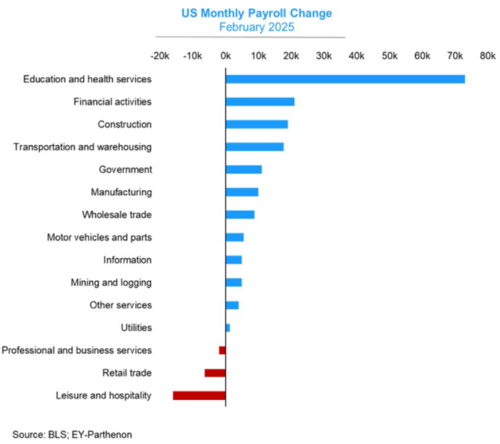

January job growth is still very broadly based on our economy, especially considering we came off an epic holiday spending season. It’s intuitive to think we would dial back spending on retail and hospitality in January. Dry January might be a real thing.3

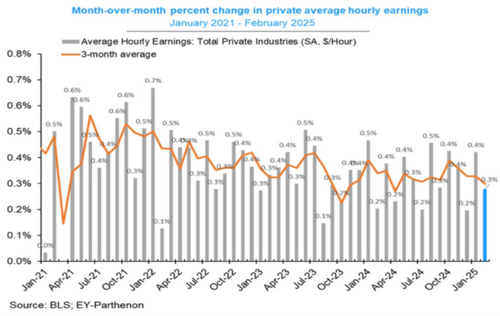

Following my simple formula above, wage growth is still at a reasonable level on a month over month basis.

Jobs = Wages. It’s hard to slip into a recession with those two components working together.4

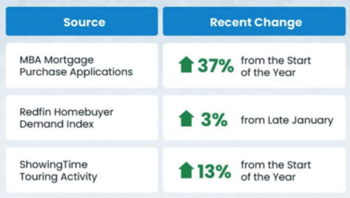

One proof point is the uptick in mortgage activity with the recent interest rate drop.5

So, the natural question you have to be asking yourself is why all the volatility in the equity markets? Let’s turn to the Federal Reserve Chairman Powell to see what he says.6

According to Powell, the economy is in good shape which allows them the time to focus on sorting out the signal from the noise. In my experience, we’re seeing the markets react to all the noise in policy and short run economic indicator anomalies.

I’m reassured in overlaying the Trump 1 to Trump 2 market reactions as they relate to tariffs. Can you see the similarities between the two?7

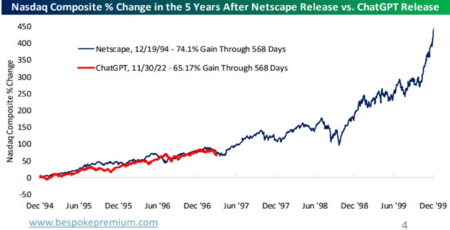

When you blend in the incredible productivity power of AI and overlay that with the internet revolution, you can see the potential for long term growth and possibilities. Comparing the launch of ChatGPT to Netscape (the leader in online connectivity) you can see we are still in the early stages of this revolutionary change.8

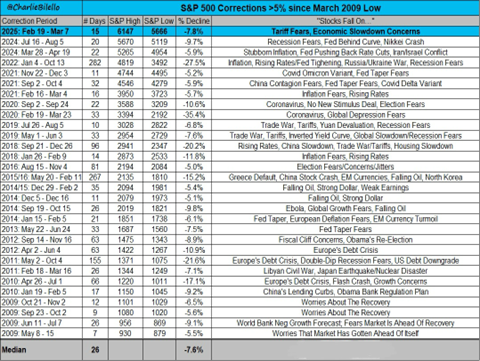

As I’ve pointed out in the past, corrections happen and we live with and off of those risk adjustments. There have been 30 such 5% or more corrections since 2009 and we’ve survived and thrived, as painful as some of them have been.9

Thankfully, they tend to be short lived, with richly rewarding returns on the upside.10

It becomes even more critical at these perceived inflection points to take a pause to decipher what’s noise and what’s signal.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.atlantafed.org/cqer/research/gdpnow

- https://x.com/NickTimiraos/status/1898004234190115180

- https://x.com/SethCL/status/1898025792866574440

- https://x.com/dailychartbook/status/1832395896207630403

- https://www.instagram.com/p/DGzbgsqu99Q/?utm_source=ig_web_copy_link

- https://www.ft.com/content/a2e9eee6-e52d-4d3f-8984-fda8e935cd11

- https://x.com/KobeissiLetter/status/1897755375677718791

- https://flexibleplan.com/news/market-update-12-9-24

- https://x.com/charliebilello/status/1898929761931423906

- https://www.linkedin.com/posts/mac-winchester-principalfunds-pbckx_in-times-of-market-uncertainty-client-anxiety-activity-7303282412124360705-vTZv?utm_source=social_share_send&utm_medium=member_desktop_web&rcm=ACoAAA0qtvUBj4EzzZzFsmNDY0gRckNID1F5IT4

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.