Are We There Yet?

The nonstop nagging question of the last couple of years has been, “When will inflation abate?” I was certainly in the transitory camp, expecting inflation to subside much earlier than it did. However – and I say this cautiously – we may finally be witnessing the long-awaited moderation in inflation. While Americans might not feel immediate relief until prices actually decrease, the slowing rate of price increases is a positive sign.

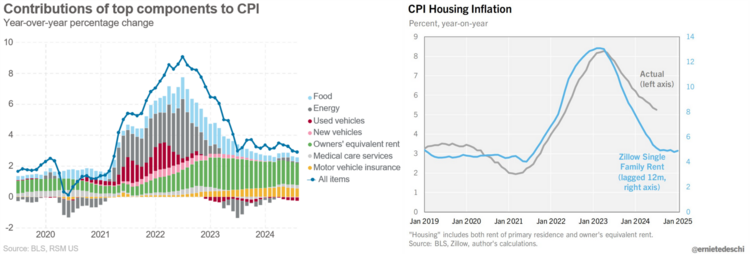

The latest inflation data reveals a moderation in price increases across a wide range of goods and services. Notably, the stubborn housing inflation is finally showing signs of easing, as illustrated by the green bars in the chart below. 1 2

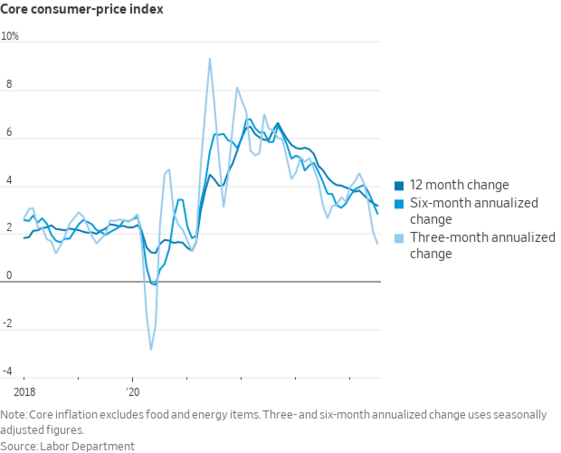

The most recent core CPI reading showed inflation rising by a modest 0.17% month-over-month. This has brought the year-over-year rate down to 3.2% – the lowest we've seen since May 2021. Even more encouraging, the 3-month annualized change has dipped below the Federal Reserve's 2% target. 3

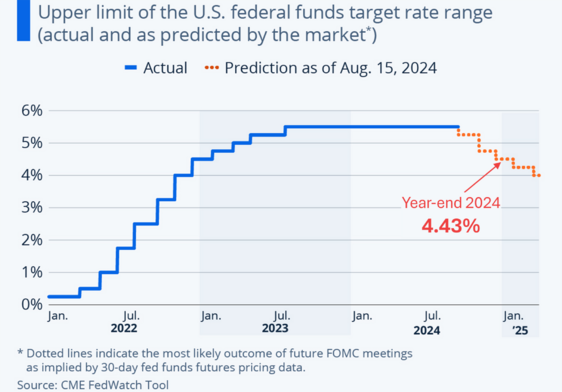

The Federal Reserve should be poised to cut interest rates in September and try to “soft-land” the economy. In fact, the expectation for rate cuts is as follows for the rest of the year. 4

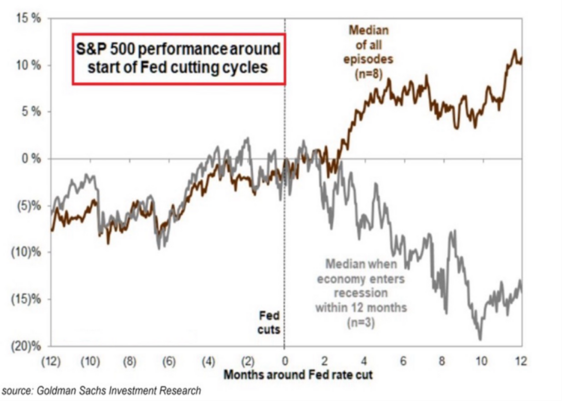

Assuming these rate cuts don't coincide with a recession, they could usher in several positive outcomes:

- Improved debt service costs, potentially boosting corporate balance sheets and income.

- Stronger portfolio values for small and community banks, providing a much-needed offset to the ongoing commercial real estate challenges.

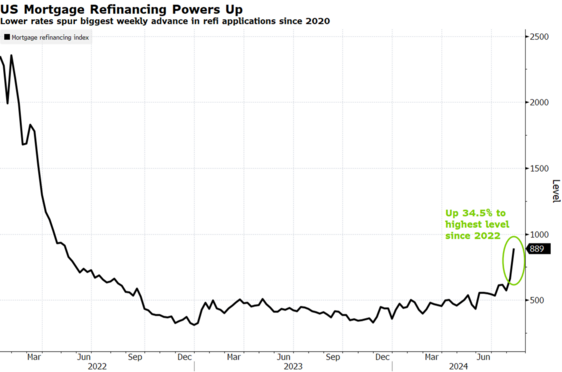

- Relief for mortgage holders, with recent data showing a surge in refinancing activity – jumping over 30% in just the last couple of weeks. 5

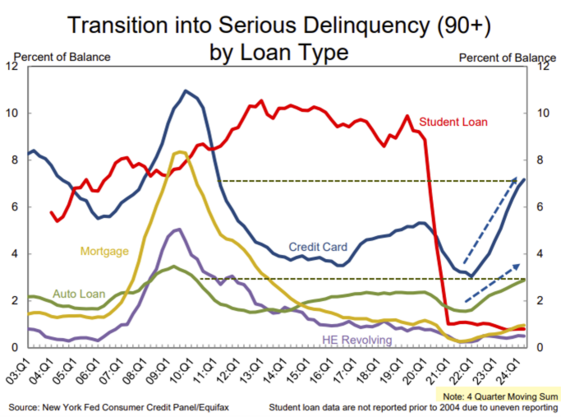

- Potential easing of default rates for consumers grappling with auto loans and credit card debt, which have been on the rise. 6

- Enhanced stock valuations as investors apply lower discount rates to future cash flows.

As long as this rate cut cycle does not coincide with a recession, there are a lot of positives. 7

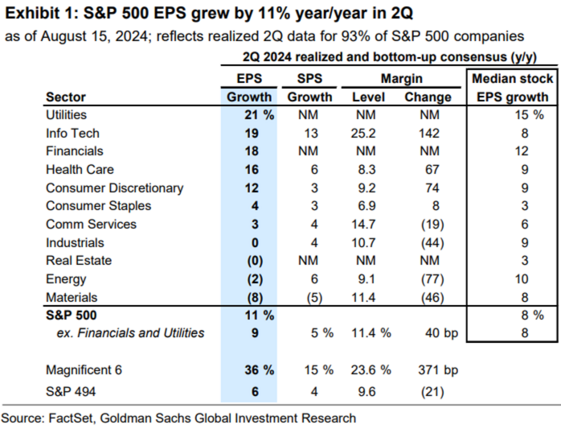

Perhaps investors can now shift their focus to a key driver of long-term stock performance: corporate earnings. Corporate earnings have been quite remarkable in Q2 and profit margin expansion has been amazing for the largest technology stocks (Magnificent 6). Earnings growth at 11% is a winner in almost every scenario and the nearly 4% increase in margin for those special six stocks tells us there is still more opportunity. 8

“Are we there yet?” It is still a little elusive to know for sure, but corporate earnings have certainly arrived.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://realeconomy.rsmus.com/us-july-cpi-further-moderation-in-inflation-as-fed-prepares-policy-pivot/

- https://x.com/ernietedeschi/status/1823702961073348743

- https://x.com/NickTimiraos/status/1823701000831836259

- https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- https://www.bloomberg.com/news/articles/2024-08-14/us-mortgage-refinancing-surges-by-most-since-2020-on-lower-rates

- https://mishtalk.com/economics/credit-card-and-auto-loan-delinquencies-surge-in-the-second-quarter/

- https://www.isabelnet.com/sp-500-index-pre-and-post-fed-rate-cuts/

- https://publishing.gs.com/