Are We Too Late?

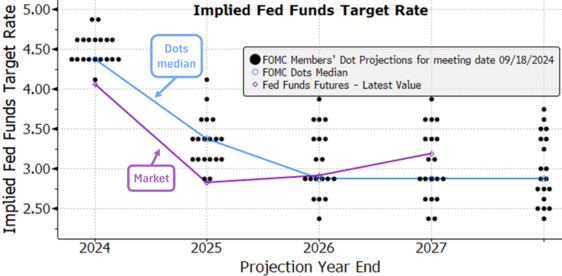

The Federal Reserve's much-anticipated interest rate cut materialized last week. The Fed slashed rates by 50 basis points (bps) and signaled more reductions on the horizon. The Federal Reserve Board's rate-setting committee provided some forward guidance: an additional 50 bps cut this year, followed by 100 bps next year, and 50 bps in 2026. 1

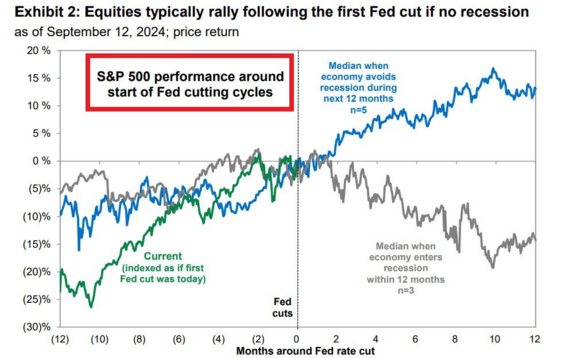

As we discussed in last week's blog, rate cuts are generally beneficial for equity returns and longer-duration fixed income.

A lot depends on whether this rate cut cycle precedes a recession. Outcomes tend to be binary: +10%-15% returns 12 months after rate cuts begin without a recession, versus -15%-20% with a recession. 2

With that in mind, let’s just look at the primary leading indicators for a recession:

Consumer sentiment is a great leading indicator. If the consumer is in a dour mood, then they tend to reduce discretionary spending. So far, so good on that front, as sentiment has been improving. 3

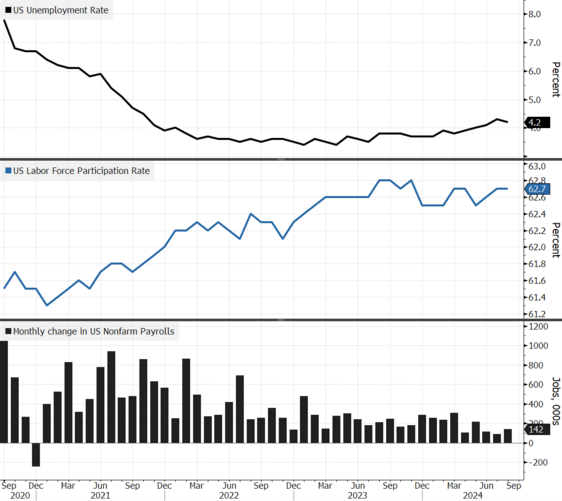

Jobs are an obvious indicator. If we see any significant deterioration in the jobs picture, that will certainly lead to cautious consumers. Again, so far, so good. The unemployment rate, participation rate, and employment numbers all look solid. 4

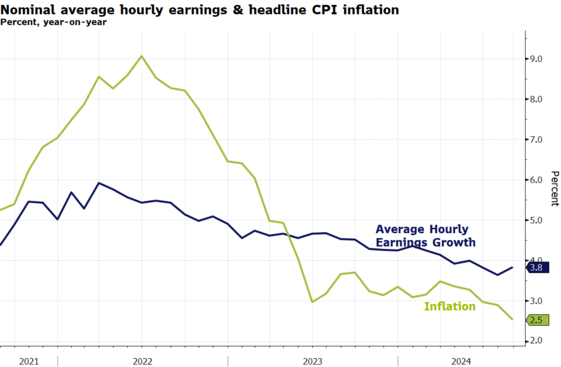

Along with jobs, if we see real wages (wage increases above inflation) continue to grow, that should keep the consumer spending. This too looks solid, following a period where wage increases lagged behind inflation. 5

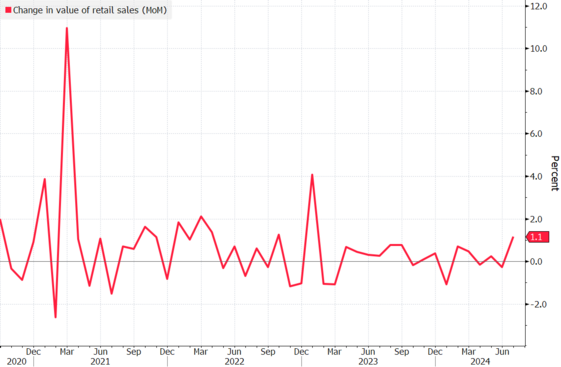

Finally, retail sales are a good indicator of recessionary tendencies. Once again, this too looks to be in solid shape as consumers continue to earn and spend. 6

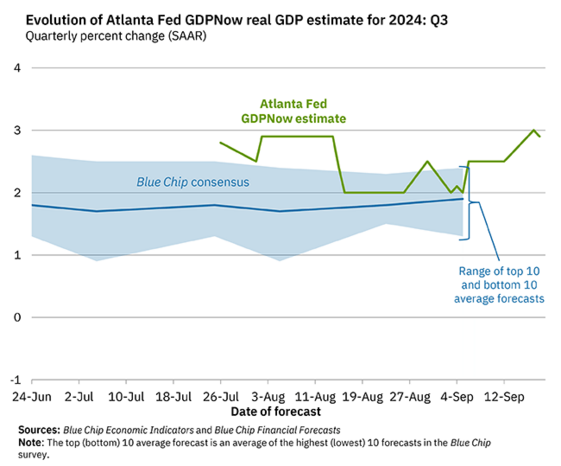

It’s no wonder that the Federal Reserve of Atlanta is forecasting GDP growth of 2.9% in Q3. 7

Based upon the Fed’s aggressive rate cut projections, they clearly believe more weakness is buried somewhere in our economy. Perhaps the aggressive 50 bps rate cut now adds the necessary boost to ensure we stay ahead of any potential economic slowdown. Perhaps the Fed is not too late.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- Bloomberg

- https://publishing.gs.com/

- http://www.sca.isr.umich.edu/

- https://www.bls.gov/news.release/pdf/empsit.pdf

- https://fred.stlouisfed.org/graph/?g=1ub6o

- https://fred.stlouisfed.org/graph/?g=1ub7r

- https://www.atlantafed.org/cqer/research/gdpnow

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective and circumstances, and in consultation with their professional tax, financial or legal advisor.