Are You Lost?

It’s hard to keep track of the multiple narratives driving our economy and equity markets right now. Let me see if I can reduce the noise and clarify what should be the main focal points.

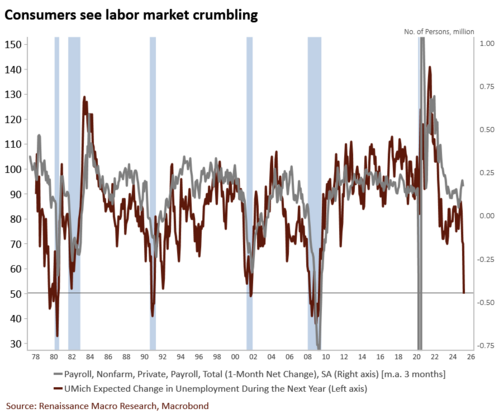

First, the most recent survey from the University of Michigan on consumer sentiment showed a continued drop in consumer attitudes. Much of that was driven by their diminished expectations for the US Labor market (red) compared to the actual strength in employment (grey).1

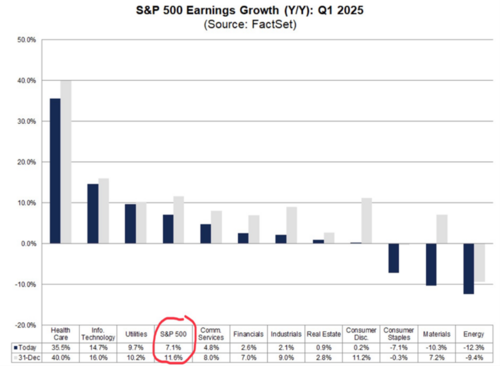

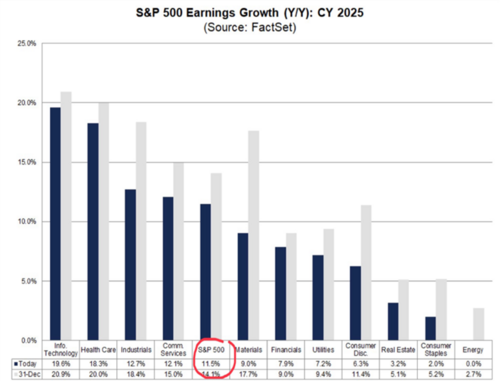

Second, expectations for corporate earnings growth for Q1 and full-year 2025 are also trending lower, albeit still healthy. If full-year 2025 EPS (earnings per share) growth comes in at 11.5%, that could drive equity repricing on the upside.2

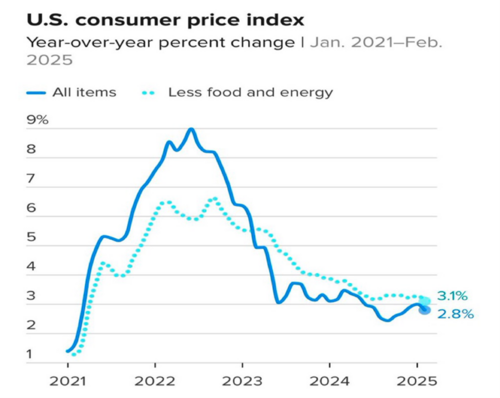

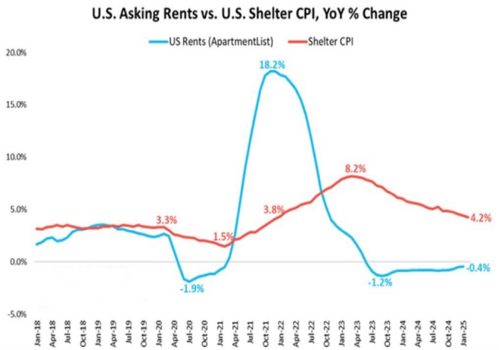

In the meantime, inflation cooled in February, showing only modest price increases. In fact, the very sticky shelter inflation reading is now back to 2022 levels. This certainly should give investors some good news to cheer about.3 4

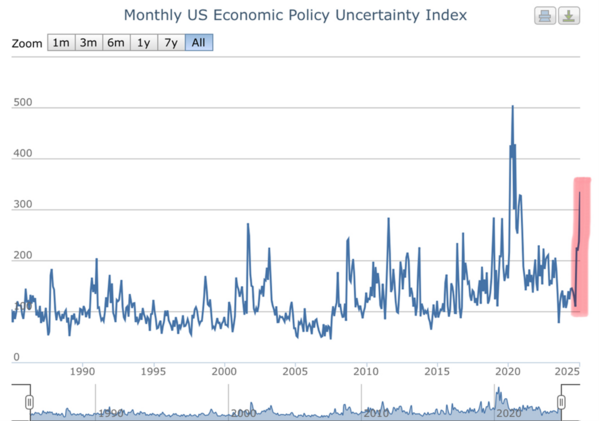

Of course, there is all the Trump administration policy noise around tariffs and trade wars. This most likely has been some of the root cause of the consumer and corporate sentiment adjustments. The Policy Uncertainty Index is reading at extreme levels and in the short run, that is never good news.5

You would have to go back to the Pandemic to find a more extreme level of policy uncertainty.

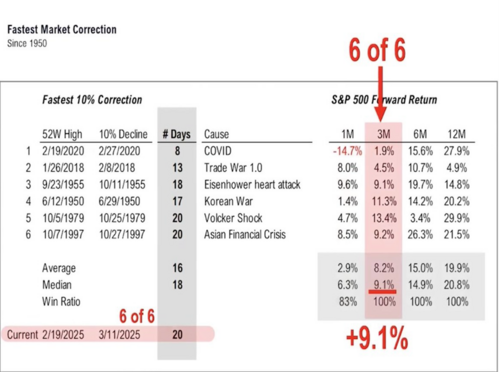

All this data is the framing of what I see as the crosscurrents in our economy and markets. It’s no surprise we have experienced one of the fastest corrections since 1950.6

Let’s not get stuck in our recent past. Fortunately, these types of corrections are often followed by some pretty powerful recoveries within the next 12 months. Even when you look at extreme levels of policy uncertainty you see historically strong equity returns.7

Just think back to the policy uncertainty of the Great Financial Crisis of 2009 or the Pandemic. Both provided extreme uncertainty around economic policy responses, yet within a year the markets were on a tear.

I think that could be the case this time as long as we don’t fall into a recession. Call me an optimist, but when we get to the April 2nd deadline for reciprocal tariffs, I believe we will have a proposed system that basically says “whatever you charge us we will charge you”, when it comes to tariffs. Those can be as low as 2.5% in many cases and much lower than the current 25%-50% level being bandied about now.

Perhaps the passage of the proposed legislation that extends tax cuts, increases state and local tax deductions, or exempts tips, social security, and overtime pay from taxes will be the other catalyst to increase policy certainty.

Will that be the certainty we need to kick off a strong equity rally? That’s my expectation and helps me avoid getting lost in all the crosscurrents and noise.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://x.com/RenMacLLC/status/1900550337498321398

- https://investor.factset.com/news-releases/news-release-details/factset-reports-results-first-quarter-2025#:~:text=Q1%20GAAP%20revenues%20of%20%24568.7,consistent%20with%20the%20prior%20year.

- https://www.cnbc.com/2024/05/15/heres-the-inflation-breakdown-for-april-2024-in-one-chart.html

- https://x.com/charliebilello/status/1899815667144011954

- https://www.policyuncertainty.com/index.html

- https://www.threads.net/@petersinguili/post/DHMpGxBzP1K?xmt=AQGzlFfuS2puq2mSHxlUdcyKPEgJtOOCmHwXq0N6zWOIOg

- https://x.com/dailychartbook/status/1899014864737128651

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.