Are You Prepared for Retirement?

We all look forward to retiring with sufficient funds to enjoy the latter part of our lives, but data from retirement surveys indicate that many Americans may not achieve this goal. The statistics are frightening:

- 46% of Americans have less than $10,000 saved for retirement. [i]

- 36% of Americans say that they don’t contribute anything to retirement savings.[ii]

- 74% of American workers believe they will need to work during retirement.[iii]

- 37% of middle-income Americans think they will work until they die or become too sick.[iv]

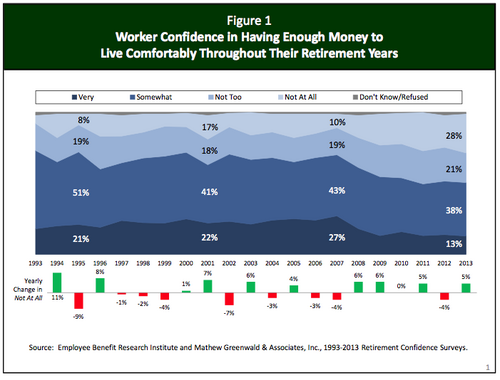

Americans seem aware of this dire situation, as 49% said they were not very or not at all confident about having enough money to live comfortably in retirement.[v] This is up from 27% in 1995.

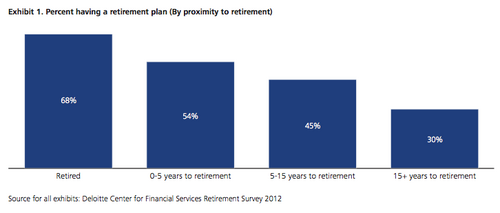

However, according to a Deloitte retirement survey, 58% do not have a formal retirement savings and income plan in place.[vi] As shown in the chart below, Americans are more likely to have a retirement plan as they get closer to retirement.

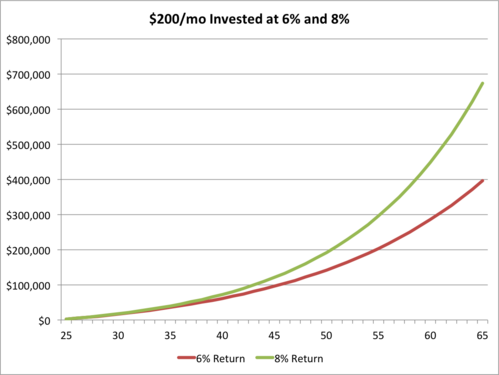

While over two-thirds of retirees have a plan, the younger age groups would benefit the most, as they have time on their side both to allow investments to compound and to make adjustments to ensure that their goals are met. For example, investing too conservatively could result in a large difference by retirement. The impact on a $200 per month investment over 40 years is almost $300,000 if it is invested at 6% instead of 8%.

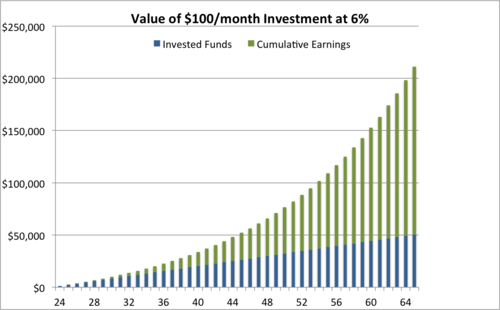

We plan for weddings, home purchases, vacations, and grocery shopping…why not for retirement? Two often cited reasons are other financial priorities get in the way and not having enough money to warrant a financial plan.[vii, viii]. However, even a small amount of money (for example, $100 per month, the cost of a Starbucks per day) can grow over time into a much larger sum through the power of compounding.

The compounding effect doesn’t kick in until the later years, so we must be patient and start early.

A retirement plan also goes beyond the financials by helping to first clarify goals and time frame. How can we decide when to retire without first deciding what we want in retirement and when? From there an advisor can assist with determining your risk tolerance, selecting appropriate investments and estimating returns, and providing a benchmark for gauging progress. The planning process provides a framework that can help you avoid some common retirement pitfalls.

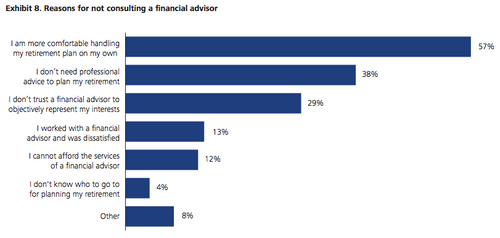

Deloitte found that about 66% of those surveyed did not consult a financial advisor, mainly because they preferred to handle the planning on their own.[ix]

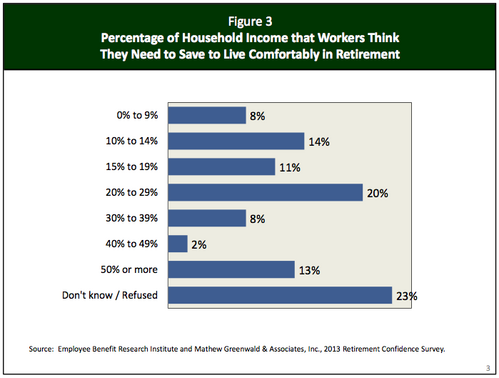

While some may have the financial expertise and experience to manage their own investments, the survey data suggests that for most, having an advisor to guide them through goal setting, a savings plan, and investment options would be beneficial. We don’t know what we don’t know and through omissions and assumptions, mistakes could be made including: not planning for your parents or children, failing to maximize Social Security benefits, not saving enough (or too much), and investing too conservatively or aggressively.[x] For example, the chart below illustrates the wide range of beliefs in terms of the percentage of income workers believe they need to save for a comfortable retirement. [xi]

Establishing a plan that outlines your goals, current financial state, and the steps to get to your desired retirement removes much of the uncertainty and will provide you with more confidence regarding your future. Research has also demonstrated that those who establish plans are more likely to engage in behaviors that help them achieve their goals.[xii] Periodically reviewing your plan with your advisor will ensure that any deviations, whether due to life changes, new goals, or unexpected market activity, are discussed and that your plan is updated accordingly.

We look forward to helping you prepare for your retirement. Contact an advisor to get more information about retirement planning or to review your current plan.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Jeff Paul, Senior Investment Analyst – Phillips & Company

Tim Phillips, CEO – Phillips & Company (Editor)

References

[i] Durden, T. (Jan 11, 2013). So You Want to Retire? Five Disturbing Statistics About Retirement: An Infographic. ZeroHedge.com

[ii] Ibid.

[iii] Peoples Bank POST (Dec 2013). Notable Retirement Statistics.

[iv] Rosenbaum, E. (Oct 22, 2013). Six feet under as a retirement plan?. CNBC.com.

[v] Helman, R.; Greenwald, M. & Associates; Adams, N.; Copeland, C.; and VanDerhei, J. (Mar 2013). The 2013 Retirement Confidence Survey: Perceived Savings Needs Outpace Reality for Many. Employee Benefit Research Institute.

[vi] Deloitte Center for Financial Services. (2013). Meeting the Retirement Challenge. Deloitte.

[vii] Ibid.

[viii] VALIC Financial Planning. Financial independence is a nearly universal goal, but few achieve it. Data source: HSBC, The Future of Retirement: The power of planning, 2011.

[ix] Deloitte Center for Financial Services. (2013). Meeting the Retirement Challenge. Deloitte.

[x] Nason, D. (May 27, 2014). Avoid these 8 retirement screwups. CNBC.

[xi] Helman, R.; Greenwald, M. & Associates; Adams, N.; Copeland, C.; and VanDerhei, J. (Mar 2013). The 2013 Retirement Confidence Survey: Perceived Savings Needs Outpace Reality for Many. Employee Benefit Research Institute.

[xii] Deloitte Center for Financial Services. (2013). Meeting the Retirement Challenge. Deloitte.