Asset Holders and the Scorecard

When we talk about “asset holders,” it’s not just the ultra-wealthy—it’s anyone who owns assets, has liquidity, and benefits from policy tailwinds, including those that have a 401k. With a rate cut expected this week, the scorecard is about to tilt even further in their favor. They’re not the intended target for interest rate cuts; that belongs to those losing jobs.

Earnings Growth

Corporate America has posted strong profit growth, with many firms managing to hold margins despite higher costs. A rate cut lowers borrowing costs, boosts valuations, and eases debt service. Once again, the asset holders—public companies and their shareholders—get a lift.

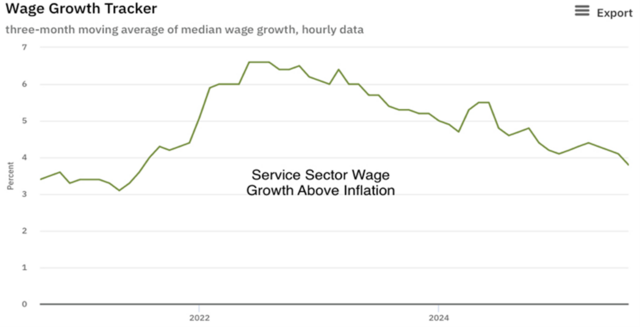

Wage Growth

Wages are still growing above inflation, especially in service sectors. A rate cut doesn’t put more dollars in paychecks directly, it just keeps asset holders ahead of wage earners, extending their lead.

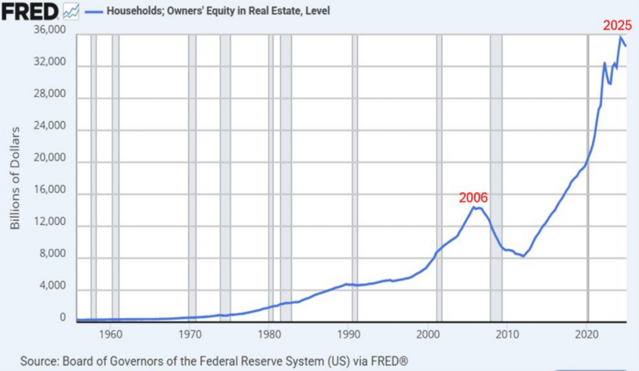

Real Asset Growth – Homes

Housing remains sticky on price. A Fed cut won’t move locked-in mortgage holders, but it can reignite demand and soften the landing in real estate. Homeowners will benefit from rate cuts which should boost demand. And when U.S. homeowners are sitting on historic levels of housing wealth--36 trillion--that is no small matter. Renters, on the other hand, may lose more ground.

Money Market Growth

Nearly $7 trillion is parked in money market funds. A cut reduces their yields, which could push some cash back into risk assets, like stocks. Those with money market funds already in place—institutions, wealthy households—can pivot quickly to chase higher returns. That’s privilege asset holders enjoy.

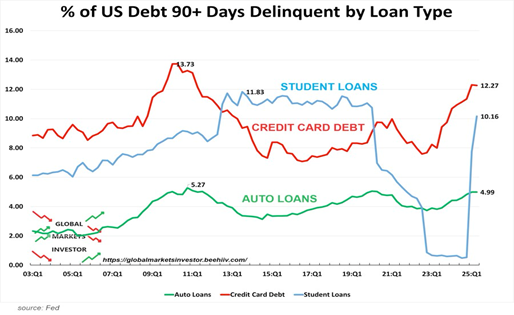

Defaults – Will They Matter?

Defaults are climbing in consumer credit, especially credit cards and auto loans. For those on the edge, higher borrowing costs already hurt. This is troubling, and a rate cut may help, but not fast enough. In GDP terms, these defaults don’t derail the system.

Final Thoughts

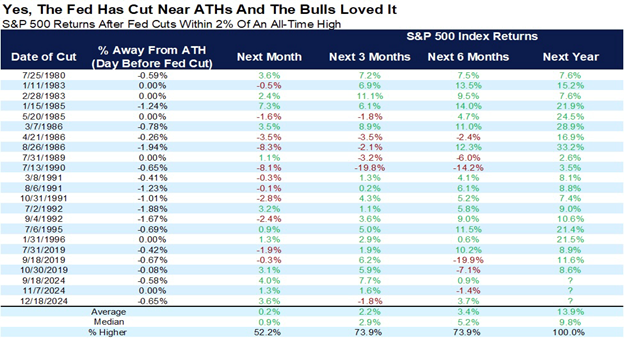

History is clear: when the Fed cuts rates near all-time highs, the market almost always cheers. The data shows that in the months and year after a cut, equity markets have delivered strong returns far more often than not.

That’s the essence of the asset holder advantage. Asset owners don’t just get stability—they often get acceleration. Rate cuts lower borrowing costs, lift valuations, and funnel cash into equities and real assets. Even when households struggle with defaults or wage stagnation, history tells us markets trend higher after policy eases.

This week’s cut, then, is not just about cushioning the economy. It’s about adjusting the scorecard:

- Earnings and assets rise as capital gets cheaper.

- Wages lag because labor doesn’t get the same leverage.

- Defaults climb, but they don’t derail growth.

- Liquidity flows back into risk assets, rewarding those already invested.

The scorecard hasn’t changed—it’s just being marked up again. Corrections may come and go, but when the Fed cuts, asset holders almost always win.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.