Back to Growth

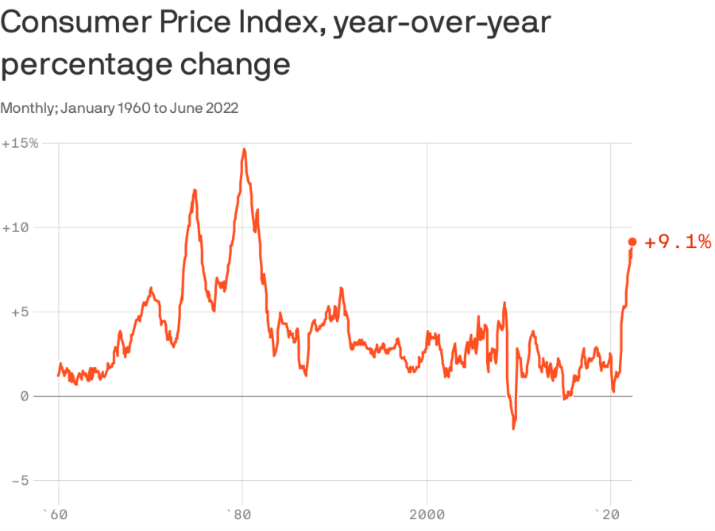

This week the Federal Reserve will put its’ next installment in place to fight inflation that it mostly can’t impact. They will raise the Fed Funds rate by 75 bps and much of that is to diminish consumer demand in hopes of cooling inflationary pressures.

The Fed readily admits it cannot influence supply. Fed Chair Powell addressed this directly back in May, stating: 1

“What [the Fed] can control is demand, we can’t really affect supply with our policies…”

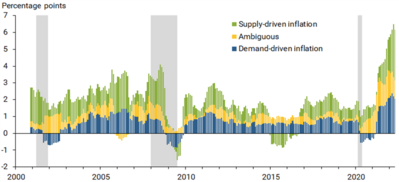

And we know from a recent study by the San Francisco Federal Reserve- almost 66% of current inflation is being driven by supply constraints. 2

The Fed is giving new meaning to the old saying, “don’t just stand there, do something.”

The good news regarding the intentional infliction of demand destruction by the Fed is the consumer is in great shape. Beyond the jobs that are plentiful, the low levels of credit the consumer is holding, and healthy savings; wages are incredibly strong.

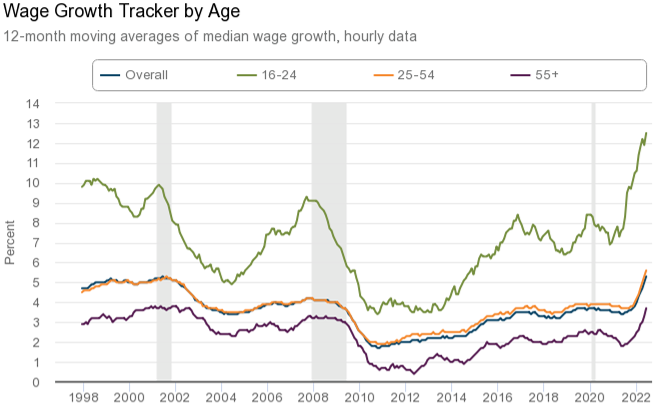

Whichever way you want to cut the data, wages for those that consume the most are growing at a healthy clip. Younger workers are seeing wage growth of 12%. 3

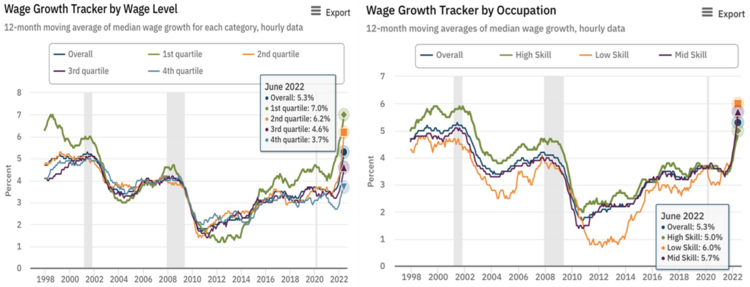

Wages for the lowest quartile earners are growing at 7% and the lowest skilled workers are seeing their wages grow by 6%. 3

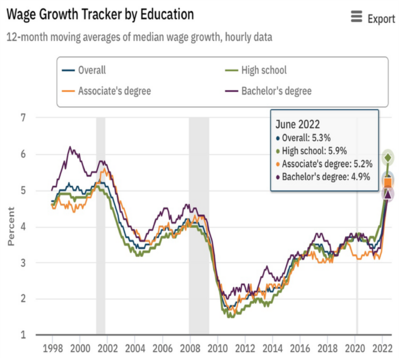

Even wages for those with the least education are growing at rates we have not seen in decades. 3

With inflation averaging 8.3% in 2022, those that consume are keeping reasonable pace with the 2022 average inflation rate. 4

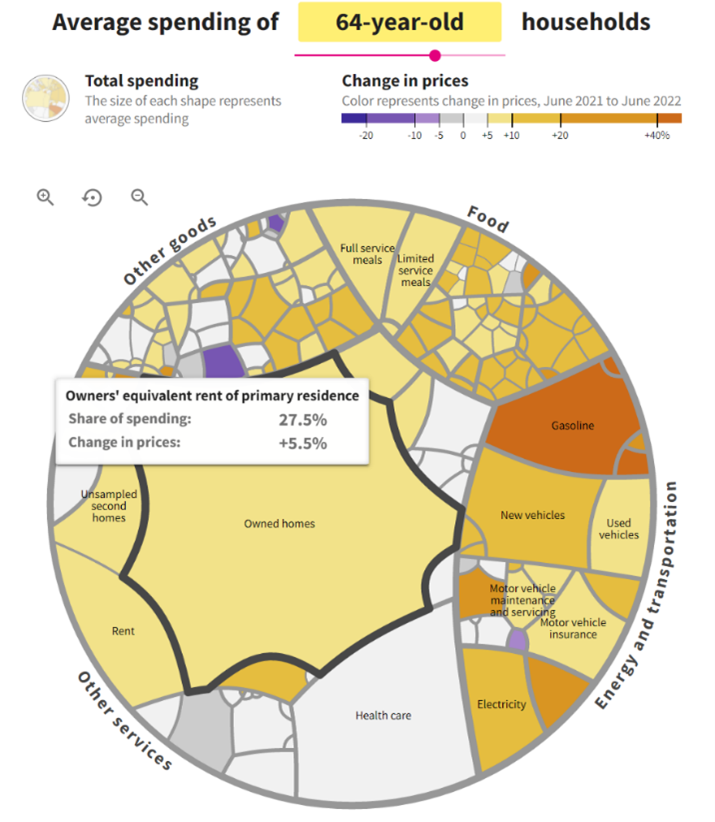

Even if you’re older, your personal inflation index may not look as bad as the headlines. USAFacts published a fascinating tool to help you determine your own personal inflation pain points. I hope you get a chance to play with tool. For example, a 64-year-old spends about 27% of their income on owned homes. That change in price is only 5.5%. 5

However, I’m willing to bet your mortgage didn’t go up at all, as most people have some form of a fixed mortgage or a fixed-to-variable.

While headline inflation is terrible, depending on your age and personal circumstances, your inflation index is likely much lower for your overall spending. Even younger, less experienced, less educated workers are beating the war on inflation.

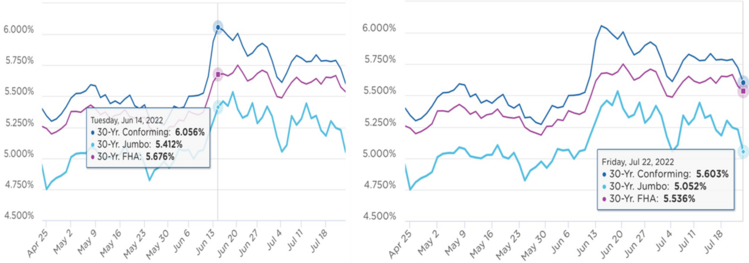

It is going to be very hard for the fed to kill this consumer. I also suspect supply-driven inflation will moderate in the months to come and put a lid on the Fed’s rate hike cycle. Even mortgage rates suggest as much and have dropped by 7.5% from peak in mid-June. 6

None of this means we won’t fall into or are not in a mild recession. What I’m suggesting is; with the position the consumer is in, its likely going to be mild. The Fed rate increase cycle will pause sooner than most anticipated and we will get off this growth detour. Equity investors should then benefit from some large reallocations back to growth.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220504.pdf

- https://www.frbsf.org/economic-research/indicators-data/supply-and-demand-driven-pce-inflation/

- https://www.atlantafed.org/chcs/wage-growth-tracker

- https://www.axios.com/2022/07/13/june-cpi-report-inflation-fed-biden

- https://usafacts.org/projects/cpi/inflation-parts

- https://www2.optimalblue.com/obmmi/