Being Dumb in America

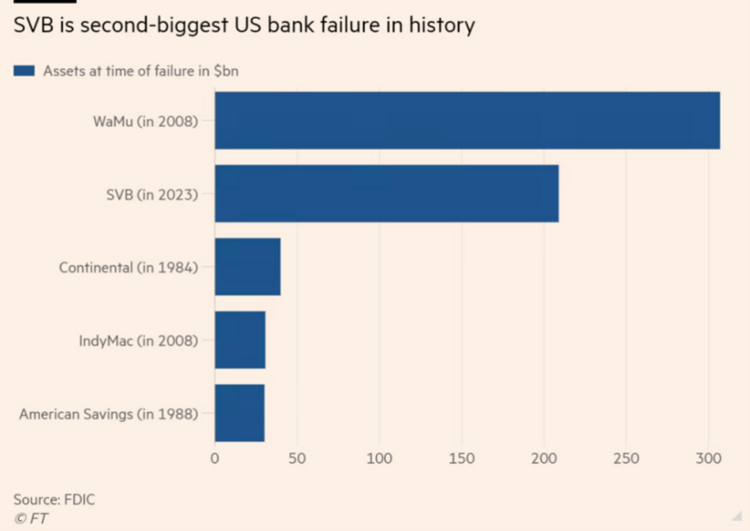

By the time we publish this post the fallout from the failure of the 16th largest bank in America will certainly come into focus. Silicon Valley Bank (SIVB) is going to be the second largest bank to fail in American history. 1

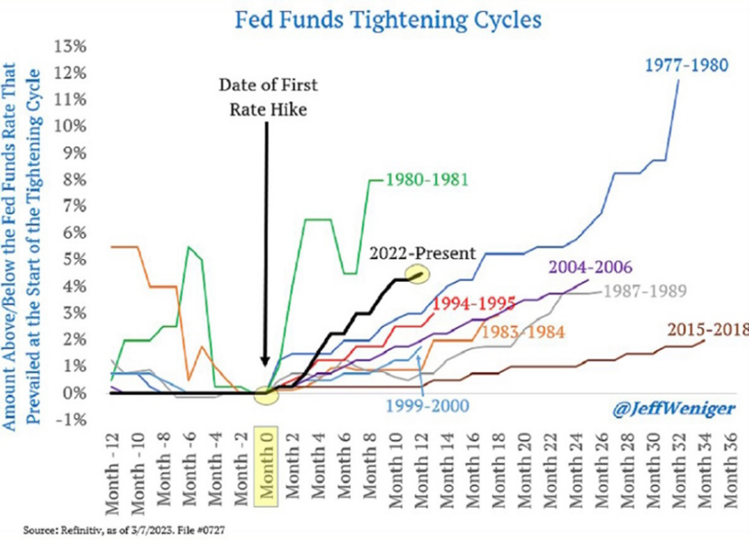

While we have all been watching the “shiny object” called inflation; the rapid rise in interest rates claimed a very large victim – SVB. It’s always in hindsight that the consequences of monetary and fiscal policy interventions come into focus. We are on course for one of the most aggressive interest rate increase periods in decades and that is at the core of the bank failure. 2

I will keep this simple, as the U.S. fractional banking system can be extremely complex.

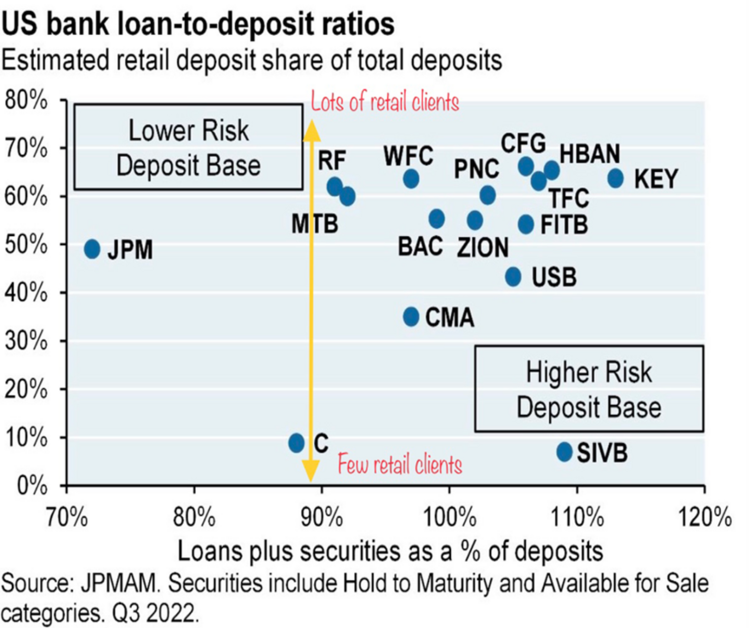

SVB was not a consumer bank in the traditional sense. They banked managers that bought start-ups or venture capital funded companies (think SpaceX or AirBnB during their startup phase). 3

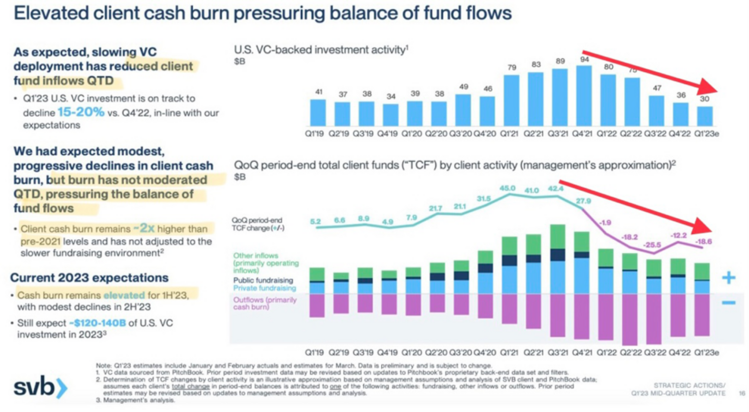

SVB had experienced rapid growth over many years as venture capital investing was booming. VC managers used the bank to help them manage the banking needs of their funds and the companies they invested in.

Two things occurred during the rapid rate increase cycle in 2022. One, VC investing fell out of favor due to higher rates, causing investors to pull back on speculative bets. In turn bank deposits at SVB collapsed. (This from a report from SVB recently) 4

Second, their massive stockpile of cash was invested by the bank managers in U.S. Treasury securities. Historically, this was a very conservative thing to do. They are guaranteed by the full faith and credit of the U.S. government after all.

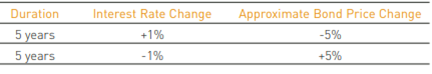

Here’s the dumbest part of the failure. The so-called expert bank investment managers invested the deposits in longer duration treasuries when interest rates were on the rise. For every 1% rise in rates, you experience an equivalent drop in the value of a bond per year of duration. 5

Keep in mind the fractional banking system allows bank managers to loan or invest almost 10x the amount of deposits into certain investments. It’s a form of leverage that leaves banks with little in the way of customer deposits if they all want their money back at the same time.

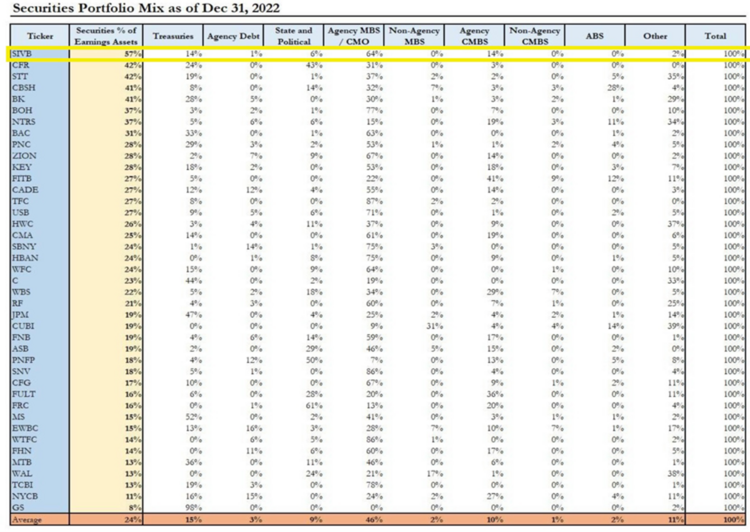

In the case of SVB they had massive amounts of deposits by managers and startup companies and lived off those deposits as a percent of their assets. In fact, more than any bank. 6

The folks at SVB invested in those long duration treasuries and experienced some massive losses, and that is at the heart of their demise. There are some possibilities for more risk in the banking system driven by the rapid rise in rates. SVB is not the only bank that invested in Treasuries. Many banks followed suit.

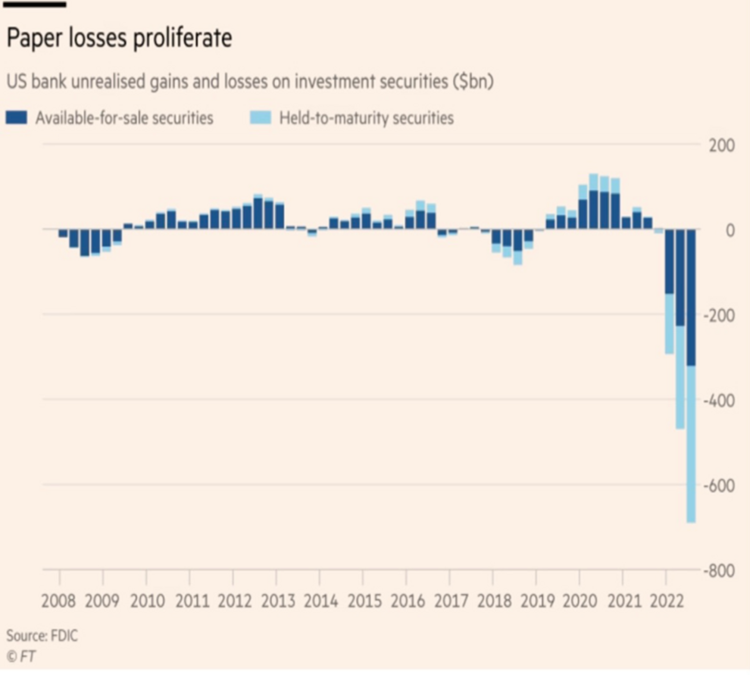

The paper losses on banks holding bonds to maturity and available for sale at any time, are now over $600 billion. The U.S. banking system has $18 trillion, so we should be in better position to withstand some repricing of their assets. 7

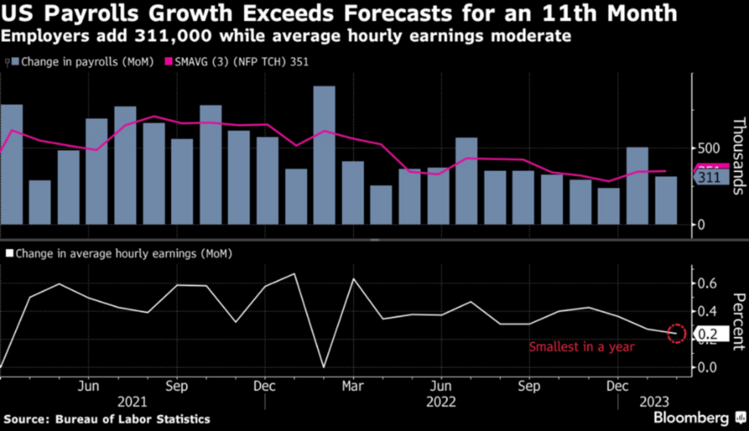

In the spirit of not losing sight of the inflation and rate increase picture we should address the most recent jobs report. It was stronger than expected. The U.S. economy added 311k jobs and it was certainly a green light for the Fed to raise rates by 50bp at the upcoming April meeting. 8

Not so fast…

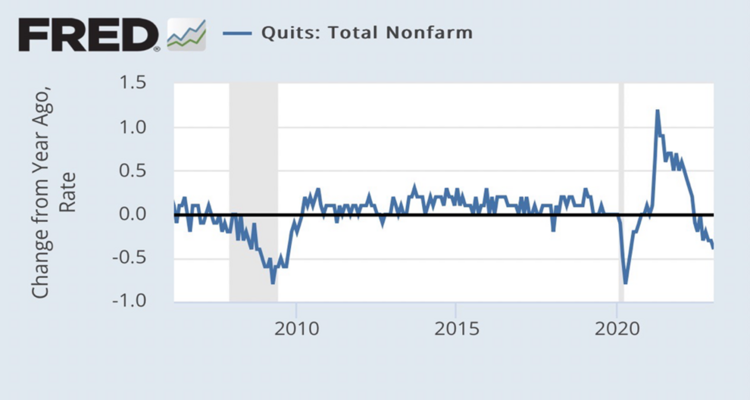

Wage growth was very muted, with the smallest gain in a year. A contributing factor is fewer people quitting their jobs and trying to trade up for higher wages. 9

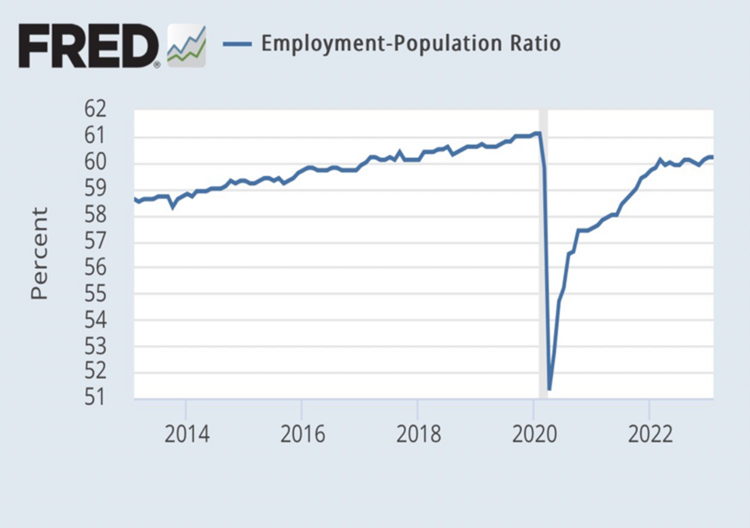

Further, more people are entering the workforce as reported in the Employment to Population Ratio. It’s finally creeping up to pre-pandemic levels. This too is a moderating factor on wages. 10

While jobs are being added at an astonishing rate, the real issue is wages when it comes to inflation. By all measures it looks like wages are moderating and that might allow the Fed to be more mindful on the path of rate increases in the future.

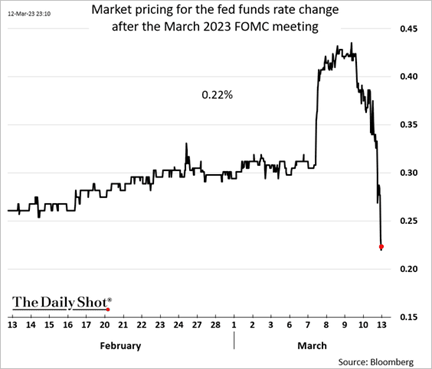

Combine the muted wage data with the uncertainty of bank investments and perhaps we see a quicker end to the rate increase cycle. Bank failures are the pinnacle of unsettling. Fed funds futures now anticipate a less than 25bp rate increase in March. 3

While the bank managers at SVB bet on longer-duration bonds while rates were rising, we, along with many, were positioning very short-duration bonds in most of our portfolios.

Being dumb at SVB is not a crime in America, but it does have massive consequences.

Takeaways:

- Don’t fight the Fed on rate increases and stay shorter duration for safe money. Do the opposite of what SVB did.

- Now you know when you have a checking or savings account as opposed to a brokerage/investment account you are actually lending your money to bank managers to invest. Put excess cash into a brokerage account.

- The Fed will do almost everything to reassure the public their bank deposits are safe.

- We at Phillips and Company, along with your accounts at Pershing/Bank of New York, are not treated like savings or checking. They are 100% guaranteed for default because there is no fractional banking with investment accounts*. Further, your accounts are insured up to $1 billion per client by Lloyd’s of London.

*This coverage does not protect against loss due to market fluctuation.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.ft.com/content/6943e05b-6b0d-4f67-9a35-9664fb456504

- https://twitter.com/JeffWeniger/status/1633138688355078147?s=20

- https://dailyshotbrief.com/

- https://ir.svb.com/events-and-presentations/default.aspx

- https://www.blackrock.com/fp/documents/understanding_duration.pdf

- https://marketgauge.com/wp-content/uploads/2023/03/Securities-Portfolio-Mix-031223.png

- https://www.ft.com/content/6943e05b-6b0d-4f67-9a35-9664fb456504

- https://www.bloomberg.com/news/articles/2023-03-10/us-payrolls-top-estimates-while-jobless-rate-rises-wages-cool

- https://fred.stlouisfed.org/graph/?g=118L9

- https://fred.stlouisfed.org/graph/?g=118Le