“Blah, Blah, Blah” – Mel Bochner

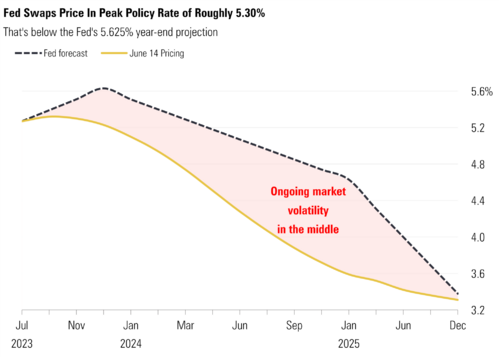

During the earnings quiet period investors tend to focus their attention on a host of other issues. The most recent focal point is the Fed’s interest rate pause/skip decision last week. For the sake of simplicity and brevity they signaled another 50 basis points of rate increases in the coming months after a brief pause. 1

Overlay the Fed’s suggested signaling against what investors believe and you see the gap. That gap will dictate market activity until we work our way back to Q2 earnings season. 2

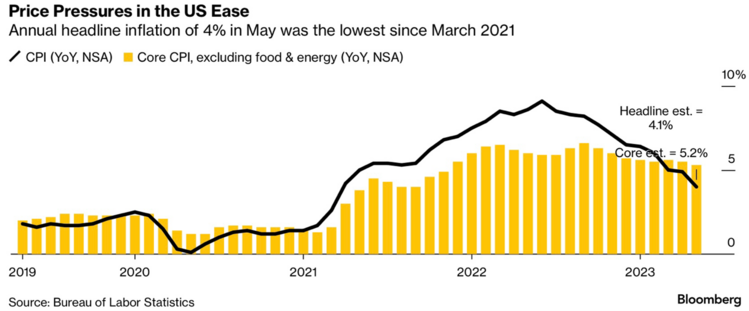

Juxtapose this gap against the reality of various inflation measures. 3

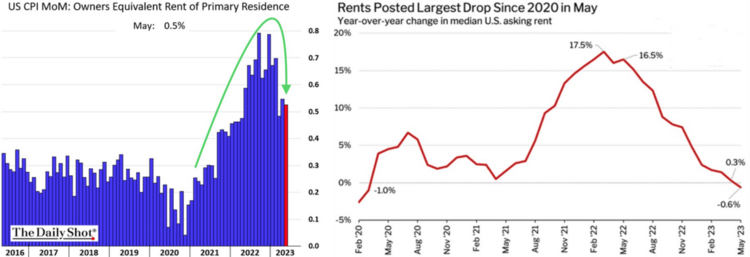

Headline and Core consumer prices have been moderating at a fairly rapid pace. Add to this rent inflation (representing almost 40% of headline CPI), which is also expected to moderate further. 4 5

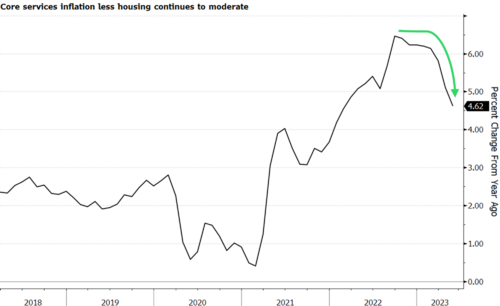

When you take out housing and just look at core services, the signaling is consistent; inflation is transitioning.6

By almost all measures inflation is moderating and will likely continue to do so during the Fed’s “skip/pause.”

A lot of what the Fed has just done is jawboning investors into believing what’s not really happening. As the famous artist, Mel Bochner, might say to the Fed, “Blah, Blah, Blah.” 7

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://apnews.com/article/interest-rates-inflation-federal-reserve-economy-f6318be5023f6e50afc115778c9ec174

- https://www.bloomberg.com/news/articles/2023-06-14/traders-pull-wagers-on-a-fed-interest-rate-cut-this-year

- https://www.bloomberg.com/news/articles/2023-06-13/us-cpi-report-s-details-suggest-fed-pause-will-become-full-stop

- https://dailyshotbrief.com/

- https://www.redfin.com/news/redfin-rental-report-may-2023/

- https://www.bloomberg.com/news/articles/2023-06-13/core-services-inflation-cools-in-key-puzzle-piece-for-fed-pause

- https://en.wikipedia.org/wiki/Blah!_Blah!_Blah!