Breathtaking

It’s hard to imagine the current positive energy surrounding the U.S. equity markets. Over the last fifty-two weeks, the S&P 500 has increased by 19.24 percent [i].

Last year we were convinced that the markets were poised to rally--not because of Trump but because we were emerging from an earnings recession. You can read our commentary from around this time last year here.

Today, the earnings-recovery is in full swing. In fact, as of Friday, October 27th, 55 percent of S&P 500 companies reported earnings for the third quarter (Q3), and 76 percent of those companies reported positive EPS above analyst expectations [ii].

In addition to earnings, so far, 67 percent of companies that have reported have reported positive revenue above analyst expectations as well [ii].

The current macroeconomic environment in the United States supports these strong Q3 data points. On Friday, we learned that the U.S. economy grew by 3 percent in Q3, which is the second consecutive quarter of more than 3 percent growth since the second and third quarters of 2014 [iii].

U.S. consumers also did their part in adding 1.6 percentage points to the most recent 3.0 percent GDP growth in Q3 [iv].

What helped was consumers’ willingness to spend down their savings, as evidenced by a decline in the Personal Savings Rate to 3.1 percent, the lowest levels we’ve seen since just before the financial crisis in 2008 [v].

Finally, many businesses have recently beefed up their inventories. Certainly, this demonstrates companies’ confidence as they head into this year’s all-important holiday shopping season. Growing inventories added 0.73 percentage points, a nice reversal of recent trends [vi].

All of this positive economic activity may help Q4 earnings grow post double-digits. In fact, estimates are calling for Q4 EPS growth of 10.7 percent [ii].

2018 doesn’t look too shabby either. Full-year 2018 EPS growth is expected to grow double-digits at 11.4 percent as well [ii].

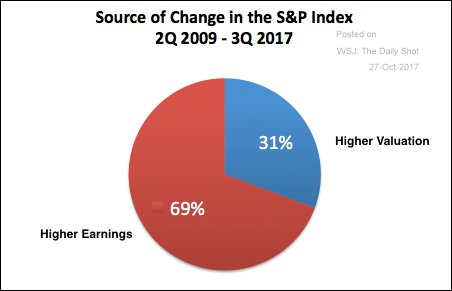

We hear a considerable amount of concern from investors who are “handwringing” over valuations, but the fact of the matter is that many of the recent valuation increases are supported by higher earnings [ii].

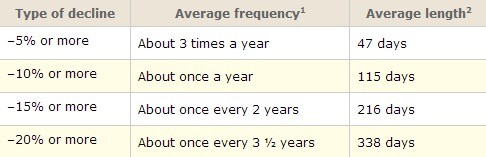

So, when will the correction many investors are expecting arrive? Historically, we are long overdue.

We have not had a 5 percent correction since June 2016 [i].

We have not had a 10 percent correction since August 2015 [i].

We have not had a 20 percent correction since October 2011 [i].

In fact, if you look at the last time we had a 5 and 10 percent correction, the markets recovered in approximately eight and forty-nine days, respectively [i].

Looking at recoveries with associated market corrections further justifies our point.

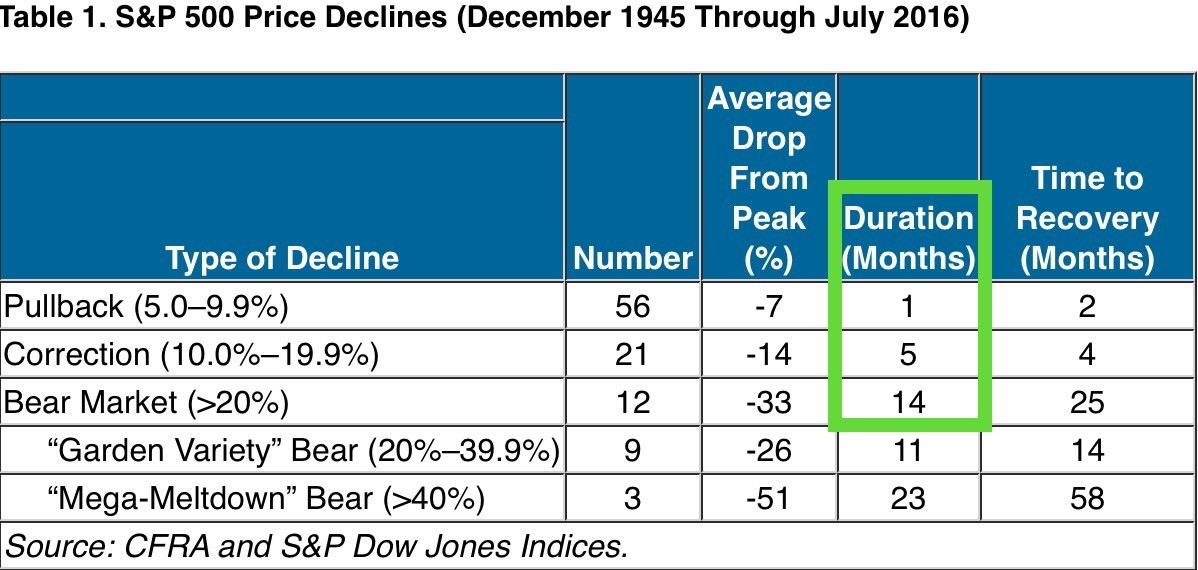

It’s hardly worth trying to avoid a typical correction of 5 or 10 percent. The recovery is a matter of months based on data from 1945 through 2016 [vii]. More recently, however, the recovery has been a matter of days [i] --Not to mention any tax implications you may face for taking profits in the short run.

We would never shortchange a correction; that’s par for the course. However, it’s harder to see a traditional bear market occurring in such a strong macroeconomic environment that is supported by strong corporate earnings. It’s breathtaking, but anything can--and usually does--happen when it comes to investing.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. Bloomberg L.P.

iv. https://fred.stlouisfed.org/series/CPILFESL#0

v. https://fred.stlouisfed.org/series/PSAVERT

vii. http://www.aaii.com/journal/article/stock-market-retreats-and-recoveries.touch