Bubble Time?

With the S&P 500 up 43.61% off the low set in 2022 and trading at all-time highs, the question I get asked the most is are we in a bubble? 1

The straight answer is I don’t know, and no one else does either. Sure, there will be a pundit who jumps on TV and declares “I called this.” I suspect you’re going to hear about bubbles soon from the pundit class.

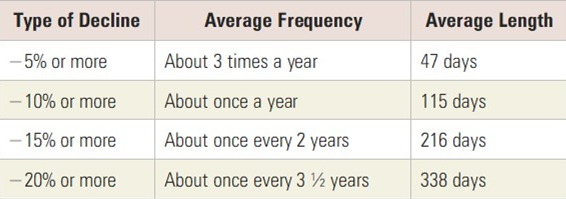

Here are some things to help you sleep better at night. First, and I know I repeat myself often (according to my spouse), corrections happen. They actually happen quite often and will continue to happen. That’s part of the reality when investing in equities. 1

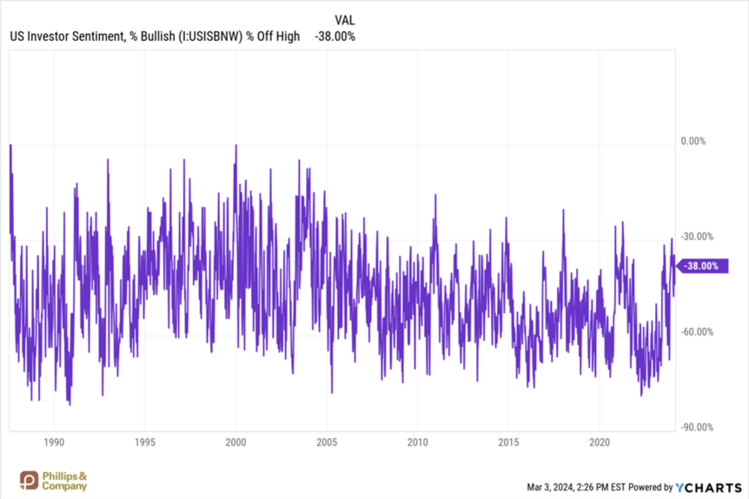

Investor euphoria is just not at peak levels compared to past bubbles. I like to look at a survey by the American Association of Individual Investors as a contrarian view. While investors are optimistic, they are still not as bullish as they have been in the past. In fact, their bullish sentiment is 38% below peak. 2

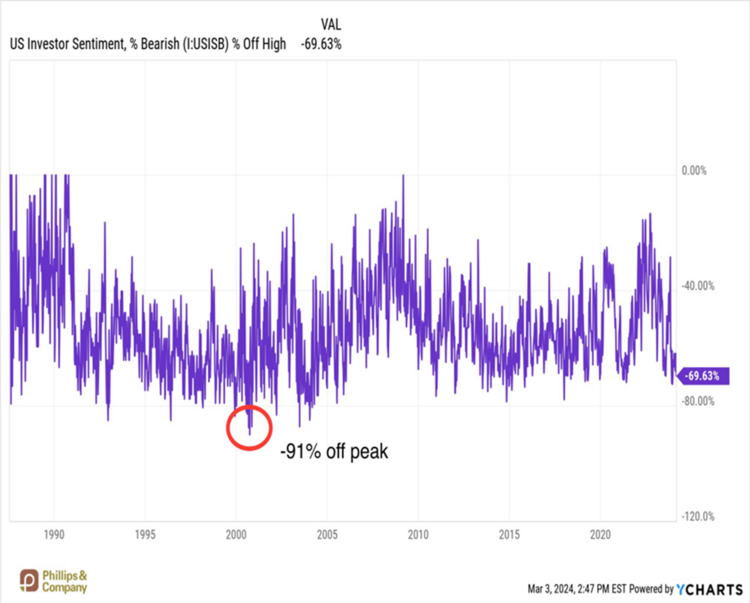

On the bearish side, investors are certainly optimistic as there is reduced negative sentiment. However, their negativity off the peak has a way to go. Remember, I use this as a contrarian indicator, so the more negative individual investors get, the more positive I get, and vice versa. 2

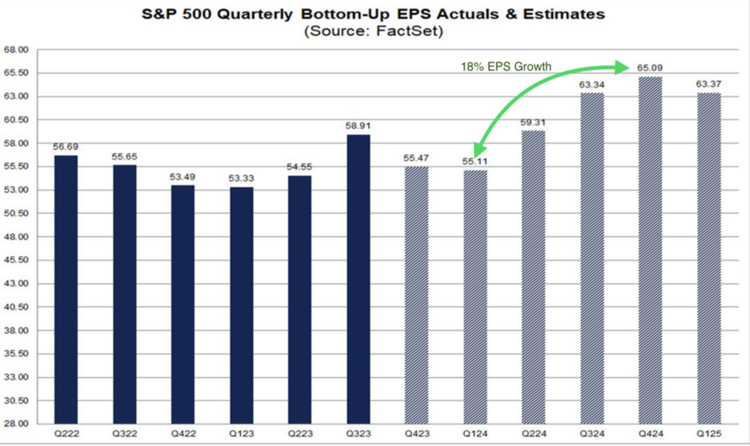

Another indicator I look at is forward earnings growth, and that looks promising. Earnings growth matters and always will. 18% EPS growth from Q1 2024 to Q4 2024 is significant. 3

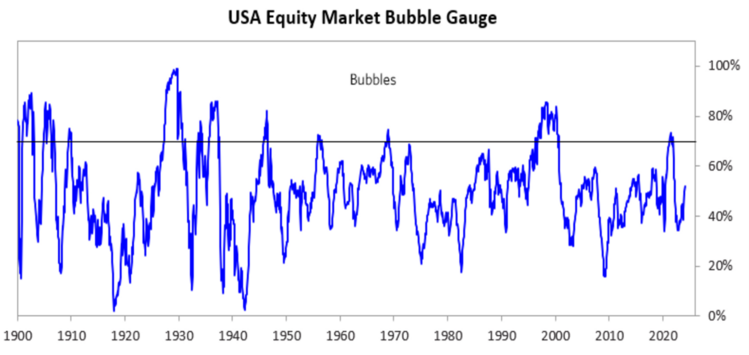

Even famed investor Ray Dalio’s (founder of Bridgewater Associates) bubble gauge is not suggesting a bubble. It measures a host of things like sentiment, leverage, and earnings growth. 4 Here is a link to his article on LinkedIn.

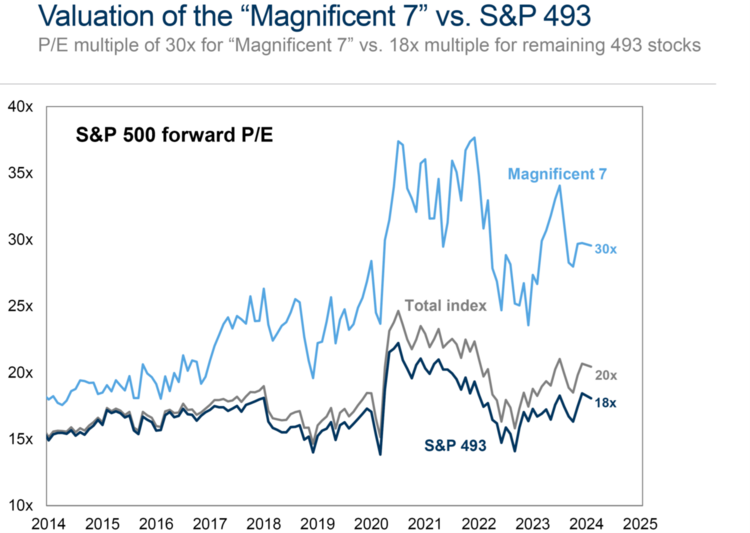

One final data point to consider. The S&P 500 ex-Technology looks closer to fairly valued. While technology is extended, let’s consider the innovations occurring with AI in technology. It’s saving time at Phillips & Company and allowing us to be even more client focused. If other companies apply the tools, a sea change in productivity is underway. Tech might not actually be as stretched as one would think. 5

Not everything is a bubble, even though it sometimes feels that way. I prepare for bubbles by increasing my operating liquidity to survive a drawdown and rebalancing back to portfolio targets. What I don’t do is guess at bubble timing.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: