Buckle Up – An Early Look at Some MAGA Economic Outcomes

This week isn’t just busy—it’s defining. From the Federal Reserve’s rate decision to a crush of earnings from the most influential names in the S&P 500, markets are heading into what could be the most consequential stretch of the summer. With economic data, earnings, and policy colliding, the signals we get could set the tone for Q3 and beyond.

Federal Reserve: July 30 Meeting Could Be a Turning Point

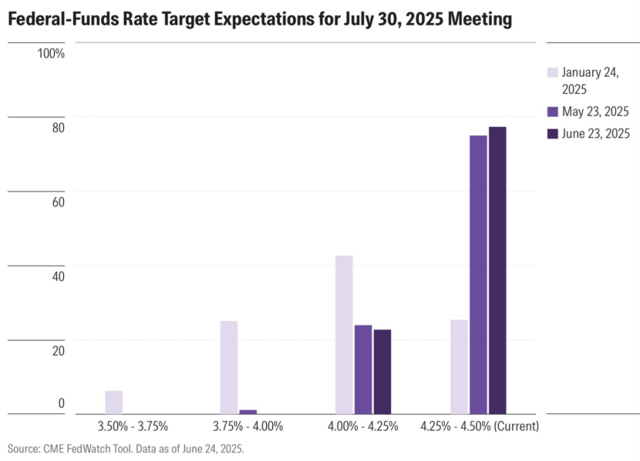

The Fed is widely expected to hold rates steady at 4.25–4.50%, as reflected in the CME FedWatch probabilities. But the real story is in the messaging. Chair Powell’s tone, especially in light of Thursday’s PCE inflation data, will be scrutinized for any shift in stance heading into fall.

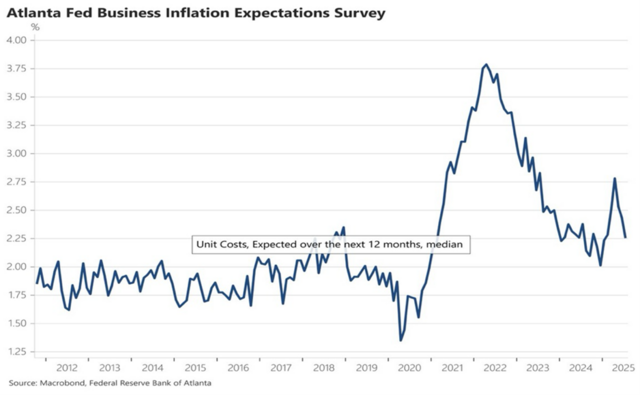

Why does this matter now? Because tariffs are back in the conversation as the August 1st Trump deadline approaches. Like last night’s European Union announcement, we should expect many more deals this week. If enacted or expanded, tariffs could raise input costs and muddy the inflation outlook. This, in turn, may delay cuts and could influence Fed commentary this week. As the Atlanta Fed inflation expectations chart shows, unit cost pressures—have moderated. Let’s not see those costs rise.

Earnings: Trillions on the Line, and Tariff Exposure in Focus

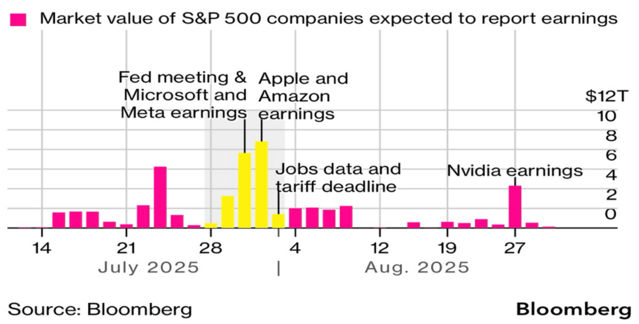

The real fireworks come midweek. As the Bloomberg market cap chart shows, nearly $10 trillion worth of S&P 500 companies report between Wednesday and Friday.

Green (Magnificent 7)

- Meta, Microsoft, Apple, Amazon, all report this week.

- These giants are critical for index performance and market sentiment and also offer a read-through on consumer strength, cloud demand, and AI monetization.

- Watch Apple and Amazon especially for supply chain commentary—any signs of cost inflation or geopolitical reshuffling will be dissected for early tariff impacts.

Blue (Tariff-Exposed Companies)

- Companies like Ford, Harley-Davidson, Whirlpool, Nucor, and UPS are leveraged to global trade and could be early reporters of tariff-related headwinds.

- These names serve as economic canaries: are materials, shipping, and finished goods getting more expensive?

√ Red Check (AI-Related Follow-Through)

- Lam Research, Qualcomm, Meta, Microsoft, and Nvidia (next week) represent the picks-and-shovels and infrastructure layer of AI buildout.

- While Q2 saw AI hype drive valuations, this week is about operational validation: Are cloud capex budgets holding up? Are customers expanding AI workloads beyond pilots?

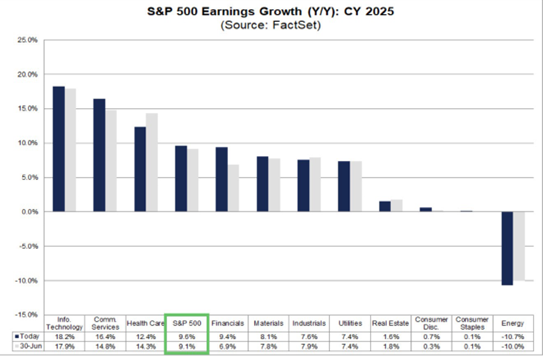

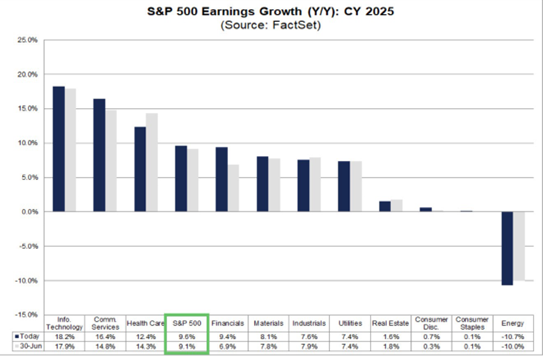

So far, Q2 S&P 500 earnings have been led by Communication Services and Information Technology, with strong showings from the Mag 7 names. In contrast, tariff-sensitive sectors—Industrials, Materials, and Consumer Discretionary—are lagging, showing year-over-year contractions. This bifurcation could widen if policy risk re-emerges. Overall, earnings are beating expectations handily, as we anticipated, and we expect that trend to continue this week.

In fact, the full year expectations for earnings are inching up nicely as well.

Macro Check-In: GDP & Jobs Deliver the Backdrop

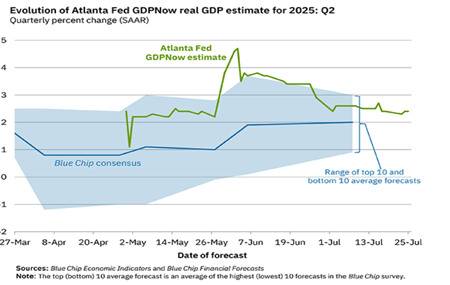

- The Atlanta Fed’s GDPNow forecast has moderated to ~2.6% after peaking near 4%, but still sits above the broader consensus.

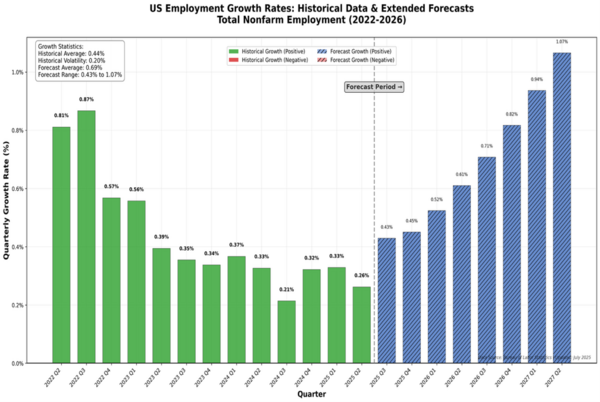

- Employment growth is rebounding, with robust nonfarm hiring projected for the second half of 2025, according to Labor Analytics.

- Friday’s jobs report will be pivotal: it could reinforce the “soft landing” narrative—or raise concerns about overheating if wage growth surprises to the upside.

Your Takeaways

This is not a normal week. The convergence of AI optimism, tariff uncertainty, Fed policy, and labor market health makes this an ideal time to reassess the economic underpinnings of the “Make America Great” strategy.

Watch for:

- AI names validating their capex cycles

- Trade-exposed firms hinting at cost acceleration

- Fed commentary on “persistent pressures”

- PCE inflation and jobs data aligning—or diverging

So, buckle up—this week could set the tone for the rest of the year and shape next year’s policy responses to the MAGA agenda.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.